Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, February 6, 2017

SPX Update, and How Our Brains Block Us from New Information

One of the reasons so many scientists struggle to produce decent science is that our brains, left to their own devices, work in a fashion that prevents it. Once we pass childhood, our brains automatically attempt to fit all new knowledge and experience into preexisting paradigms (which has led to expressions like: "You can't teach an old dog new tricks!"). This tendency can be overcome, but we must consciously and intentionally work to counteract it. Unfortunately, most people are simply unaware of how their own minds work, and don't know how to counteract this tendency -- or even that they should be working to do so.

This is why scientists repeatedly try to fit new (sometimes contradictory) evidence into existing and known frameworks, instead of seeing that the new evidence might disprove an existing theory (or at least call it into question). This leads to scientists essentially ignoring new evidence -- well, they don't exactly ignore the new evidence, what they do is shoehorn it into the existing framework via speculation that there must be some random, heretofore undiscovered, "thing" missing that will allow the new evidence to fit comfortably into the existing theory.

In other words, when a piece of contradictory evidence shows up, many scientists indulge in flights of fancy and imagine additional evidence that doesn't exist, in order to reconcile the old theory with the new evidence. This imaginary new evidence then, paradoxically, actually causes contradictory new evidence to strengthen their belief in whatever popular theory they favor -- instead of doing what it should do, which is cause them to question the entire theory and framework.

You see, that's just how our brains work: They first attempt to understand anything new in terms with which they are already familiar. So if one doesn't ever move past that knee-jerk first effort, then new evidence is not seen for what it truly is, and is instead seen as supporting evidence for the familiar. This is why physicist Richard Feynman said, "The first principle is that you must not fool yourself -- and you are the easiest person to fool."

Our brains tend to work this way because, in some situations, they have no choice. We are constantly attempting to cram an infinite amount of information, from an infinite universe, into a finite vessel (our brains) -- which is impossible. Some of that information invariably ends up cast asunder and lost. It's like trying to fit the Pacific Ocean into a Dixie cup. You simply can't do it. The key is to understand and remember, at all times, that all you really have is a cupful of saltwater, and not confuse yourself into believing that you actually have the entire ocean in there.

Even on subjects we can comprehend and fit inside our finite brains, it's important that we do not confuse our models of reality with reality itself. Reality will virtually always be "bigger" (will contain more information) than our models.

These are some of the reasons why humility is such an important trait in a good scientist... but it's such a rare trait in humanity in general, that we instead end up with a lot of egos who prefer to have "the answer all figured out."

So we end up with few truly new discoveries. Instead we get a whole bunch of people working to cram every piece of new, possibly revelationary, evidence into supporting the existing paradigms.

I mention this because it's something I was discussing with my teenage daughter (who wants to be an astrophysicist) over the weekend -- and as I was pointing out some of our weaknesses as humans, it got me thinking about how we engage in this same sort of thinking with the market. So, I thought that bit might be worth sharing, as another warning about how our biases can cause us to inaccurately reframe, or to entirely miss seeing, new information.

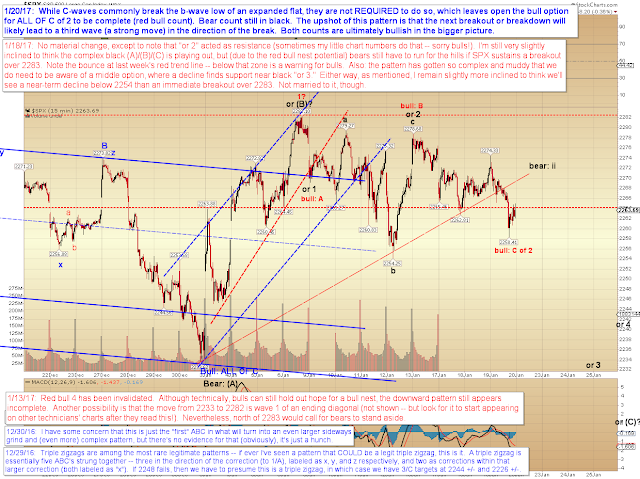

Moving onto the charts, the near-term bear case for SPX is shown below:

No change to the bigger picture:

In conclusion, if bears can hold the all-time high, they have a shot at a decent near-term correction. Do keep in mind that this is not expected to be anything other than a correction, though, and that the longer term outlook still remains bullish. Trade safe.

Friday, February 3, 2017

SPX Update

No material change from the prior update. SPX was rejected on its first attempt at the 88-92 zone, but will likely make another run at it.

In conclusion, normally we'd still expect to see another leg down, but bears have no choice but to get nervous if SPX sustains a breakout over the all-time high. In the meantime, I would stay alert to the potential for a very choppy market over the next few sessions. Trade safe.

Wednesday, February 1, 2017

SPX and RUT: Washing Cars in the Rain

In the prior update, I attempted to utilize the same power I have to make it rain after I wash my car, by going tongue-in-cheek overboard on the SPX chart about the bear case being darn-near silly. (I'm only half joking here.) Sometimes this works, and I've often noted previously that one way for me to do my part (however small) in creating reversals is to spend time charting an alternate count that goes against whatever count I'm favoring -- and the market will often reverse into my preferred count on that very session.

So we'll see if this attempt to goad the market worked, although the noted red trend line is still holding. Despite that, though, the decline from 2300 does appear reasonably impulsive -- so if they're trying to bait bears again, then they're doing a darn convincing job of making it look like there will be at least one more leg down over the near-term. Normally, we'd expect that leg to be of equal or greater length as the decline from 2300 to 2267 -- and in this case, if we do get another leg down, it isn't too hard to imagine it reaching at least 2233.

RUT did indeed continue within its trading range, as suggested on January 27. The next downside support levels beyond the range, and the upside resistance levels, are both noted.

In conclusion, in most markets, I would say we have an impulsive decline, and thus expect (at least) one more leg down after the current bounce completes. In this market, who knows. Maybe tomorrow Trump will announce that the United States is going to build a wall around China, and the market will rally in anticipation of massive job creation... at least until somebody realizes that China already HAS a wall, which lots of people still think is "great," as evidenced by its name ("The Stupendous Wall of China").

Either way, watch 2288-92 and the zone near the all-time high for potential reversals. If SPX instead powers straight through the all-time high, then of course we had another bear trap, and bears will have to go back into watch and wait mode. Trade safe.

Monday, January 30, 2017

SPX and RUT: Why a Fun-damental Bias Isn't Always "Fun"

I was skimming through some of my old articles this weekend, and I want to share something briefly that might be worth a reread, particularly for bears. The article I'm quoting from was about how our underlying fundamental biases can cost us money. The point I made early in the article was that we are all more forgiving of our errors when they're in the same direction as our fundamental bias. So bulls can forgive themselves more easily for making bullish errors, while bears can forgive themselves more easily for being "short and wrong" than they can for being "long and wrong." As a consequence of this psychology, even when bears know they probably should be long, they will more quickly accept a short entry than they will accept a long entry. This can be pretty devastating in a bull market.

The article I referenced above then attempts to explain the psychology behind those errors:

I'm not sure if I can explain this in a way that makes sense, but I'll try: our beliefs represent what we stand for in this world. And what we stand for in turn represents who we are, in a meaningful sense. At least, it has meaning to us on a personal level. Our beliefs generally represent the core foundations from which we build our enduring life principles -- so beliefs translate into action. As a result, we all associate "who we are" with our beliefs to a greater or lesser extent, depending on the depth and strength of the belief. This is why religion and politics are such heated forums -- people feel criticized on a deeply personal level when those beliefs are challenged. They feel you are attacking not simply their ideology, but actually attacking them as individuals.

Anyway, I think this human tendency is one of the challenges that makes it so incredibly hard to get away from our fundamental bias. It's much easier to forgive ourselves when we err on the side of our fundamental bias, because that error is in line with our self-image -- it's "who we are" to some extent. And we can always forgive ourselves for "just being ourselves" (we do it all day long!). Conversely, that same psychology causes us to criticize ourselves much more harshly when we err against our fundamental bias. Which in turn causes us to make more errors toward the side of our bias.

It's worth examining. We all have a fundamental bias -- and I suspect it costs every one of us money at times.

Moving on to the charts, SPX is still trading within its red channel of the past several months:

RUT has, so far, stalled shy of its recent swing high:

I'm not focusing on the near-term in this update because the near-term has, lately, been filled with very unusual patterns, so I don't trust the "obvious" patterns right now. I'll update the near-term counts when appropriate -- in the meantime, bulls will want to keep an eye on the dashed black trend line on RUT, and the dashed red trend line discussed on the SPX chart. Trade safe.

Friday, January 27, 2017

SPX, RUT, BKX: Back to Back Rare Patterns

Every now and then the market throws in a pattern that is just so rare and unpredictable that all you can do is shake your head. The recent chop zone featured not one, but two such patterns. We discussed the first one (an ultra-rare triple zigzag) back in December. The more recent rare pattern is charted below. These are the types of patterns that are so unusual that many novice Elliotticians can't figure them out even AFTER they've played out. And virtually none of us can anticipate them in real time, because nobody in their right mind anticipates the "1 in a 10,000 odds" pattern.

Bigger picture, there's no change:

Last update's triangle fake-out warning was timely, and the upside breakout target was captured:

(continued, next page)

Monday, January 23, 2017

SPX Update: Day 217... Deep within the Chop Zone

We're now three weeks into a chop zone within a still-larger chop zone... and I haven't had this much fun in a market since that time way back in high school when my then-buddy Dan got chased through the Quakertown Farmer's Market by an angry vendor. (Dan, if you're out there: You deserved it!)

Seriously, this chop zone is more fun than a barrel of rabid fire monkeys with functional chainsaws. (Are "fire monkeys" even a real thing? Well, they should be! Err... maybe not. The world has enough problems.)

Anyway, there's been no real change since December, which is when I first came up with the black (C)-wave count, primarily based on instinct, which has made it hard to have too much conviction about it, especially since I do ultimately expect we're still in a bull market, and the aforementioned C-wave would simply be a bull market correction (if it materializes, of course). Yes, that was one single run-on sentence. At least now it doesn't constitute the entire paragraph.

On the plus side, we may finally be getting close to an actual move.

Below is a more simplistic chart, along with a couple targets:

In conclusion, at this point deep within a chop zone, it just gets tough to keep these updates interesting, and to come up with anything that I haven't already said five times before. The bottom line is that I'm still ever-so-slightly favoring the black C-wave count, but since that's always been just a gut-instinct, I'm not married to it. I do ultimately expect we're still in a bull market, so with or without that black C-wave, higher prices are still expected in the bigger picture. Trade safe.

Friday, January 20, 2017

SPX Update: Next Break Could Finally Be Significant

Ran a bit short on time tonight, but the charts have all the info, so I'll let them do all the talking.

In conclusion, nothing to add beyond the annotations on the charts -- except a quick reminder that everything moves in cycles, including personal wealth advancement. Allow yourself room to breathe within those cycles -- try to slow down when your personal cycle is on a downswing, and run with it when it's on an upswing. And trade safe.

Subscribe to:

Posts (Atom)