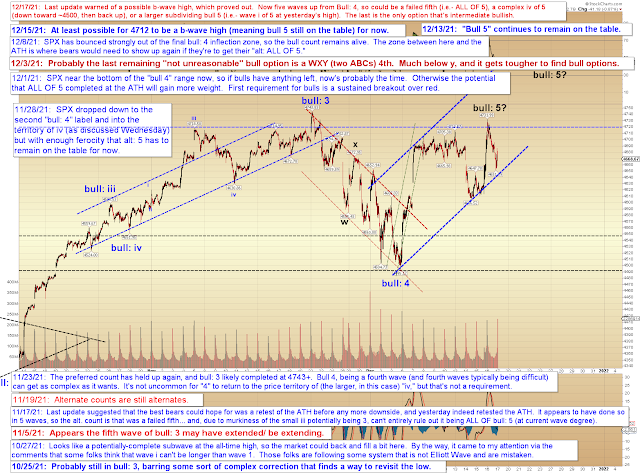

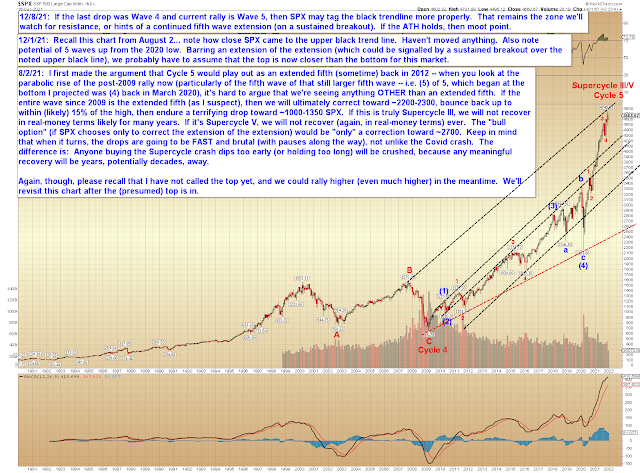

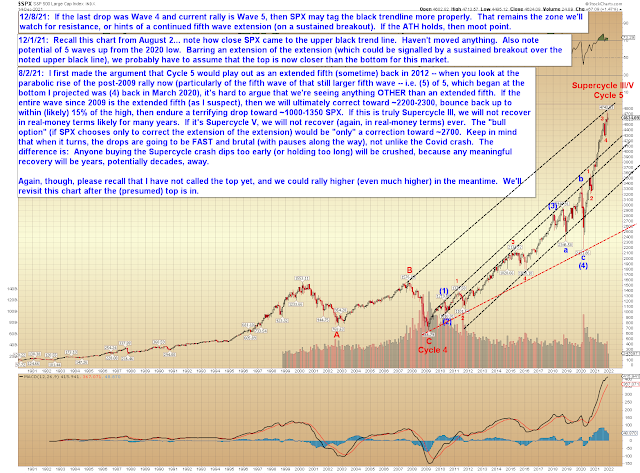

- A complex b-wave high (slight new high, then back below the blue "bull: 4" label, then back above the ATH).

- A subdividing fifth wave (leading to a solid rally)

- An ending diagonal (with the current rally being iii of said diagonal)

Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

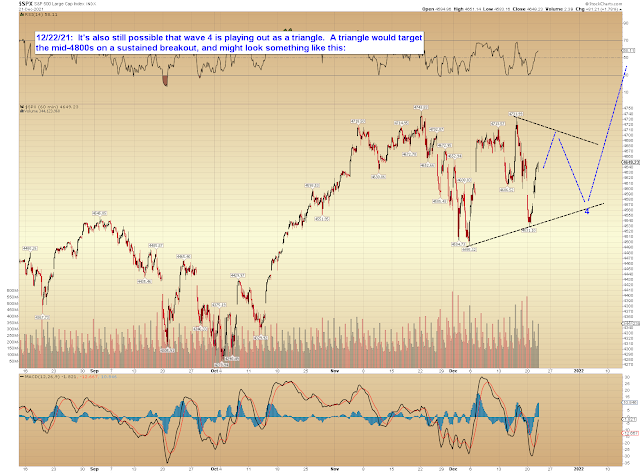

Wednesday, December 22, 2021

SPX Update

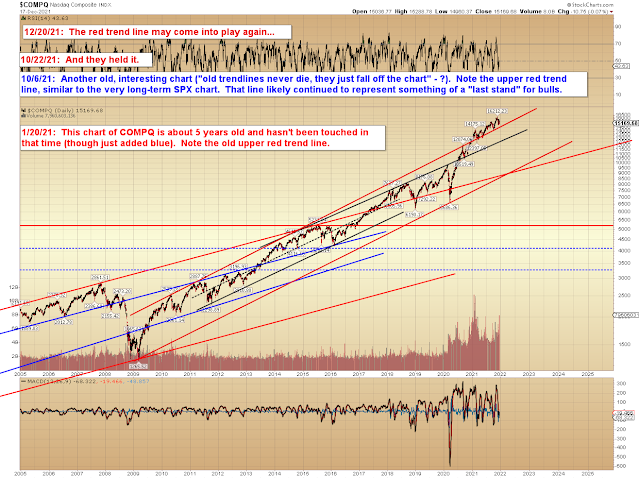

Monday, December 20, 2021

SPX and COMPQ Updates

[W]hile I've been leaning toward a fifth of bull: 5, we now have enough structure in place that we have to more seriously consider the possibility that it completed as a failed fifth. We'll see how the market reacts to the zone near and/or a bit south of 4600 (assuming we get there), and if it can't find support, then we'll take it from there.

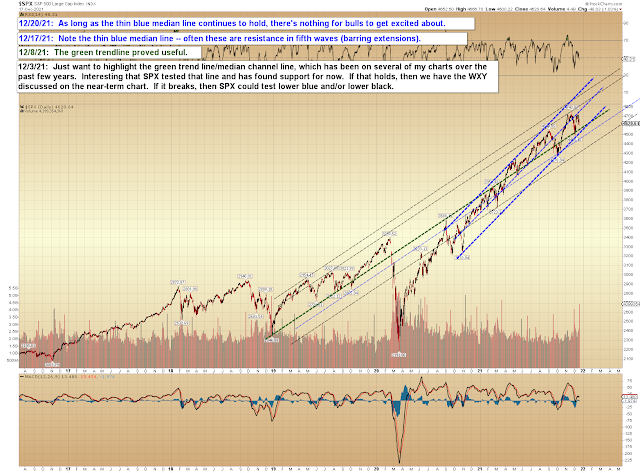

Friday, December 17, 2021

SPX Update

In other news, inflation is picking up a pretty solid head of steam, which will be interesting, inasmuch as the Fed really hasn't had to deal with any inflation since the beginning of Quantitative Easing in 2009. It's obviously easier to print money in a deflation, since liquidity is being destroyed faster than it's being created, leaving you lots of wiggle room. When inflation begins to take hold, then printing money no longer leads to "pretend wealth," it leads directly to wealth destruction, as you dilute the value of each dollar that's already in circulation. When inflation is underway, printing money becomes a silent tax on the working class, because you are essentially stealing the value of their wages and savings and putting that value into your freshly-minted currency. Of course, years of deflation have led naïve politicians to believe there are no consequences to money printing, so, as so often happens, the current generation is ill-prepared for what seems to be developing.

Young people often believe that "old-fashioned" wisdom is outdated, when it should instead be viewed as the collective lessons that humanity has learned through thousands of years of trial and error.

“Tradition is a set of solutions for which we have forgotten the problems. Throw away the solution and you get the problem back. Sometimes the problem has mutated or disappeared. Often it is still there as strong as it ever was.” ― Donald Kingsbury

Despite what proponents of MMT seem to think, a government can only print so much money before inflation rears its ugly head, and all the money printing turns out to be zero-sum, punishing savers and wage earners in the process.

Back to the market. Last update warned:[T]here is at least a chance that the "?" high is a b-wave, which would mean we're headed back up there.

That proved out -- and the most recent rally leg did the minimum structure needed for a fifth wave, so now we have a few possibilities:

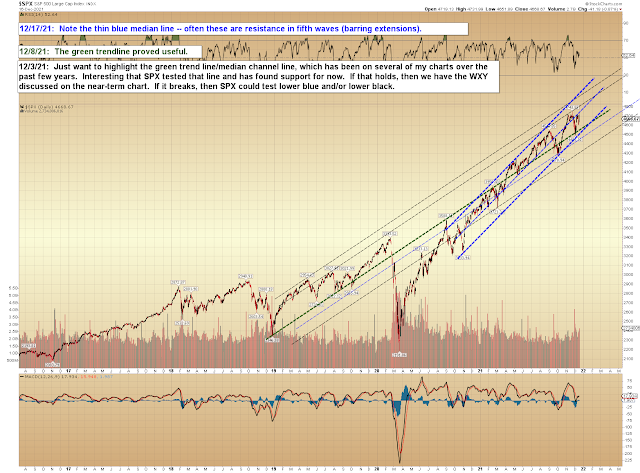

Intermediate-term, interesting how SPX stalled at the median channel line. If this is a complex iv of 5, then it will tag it again... if that was a failed fifth, then it's done what it needed to:

No change to the big picture:

In conclusion, while I've been leaning toward a fifth of bull: 5, we now have enough structure in place that we have to more seriously consider the possibility that it completed as a failed fifth. We'll see how the market reacts to the zone near and/or a bit south of 4600 (assuming we get there), and if it can't find support, then we'll take it from there. Trade safe.