Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, May 22, 2023

SPX Sidedate: (Well, it's not an "up"-date, and it's not a "down"-date, so...)

Friday, May 19, 2023

SPX, NYA, INDU: SPX Finally Does a Thing

Wednesday, May 17, 2023

SPX Update: ...

Monday, May 15, 2023

SPX Update: More Fun than a Mayonnaise Popsicle

Friday, May 12, 2023

SPX: More Exciting Than a Shoe Full of Spiders

The reviews are in! Critics are raving over SPX!

"Annoying and boring." -- Siskel and Ebert

"An insufferable sideways grind." -- The Wall Street Journal

"Is this thing even on?" -- Mike Tyson, just before punching a hole in his screen

The action-devoid sleeper is here! Pre-order your tickets NOW. Don't miss:

SPX: The Revenge of something something whatever zzzzzzzzzz...

Now playing at a theater near you!

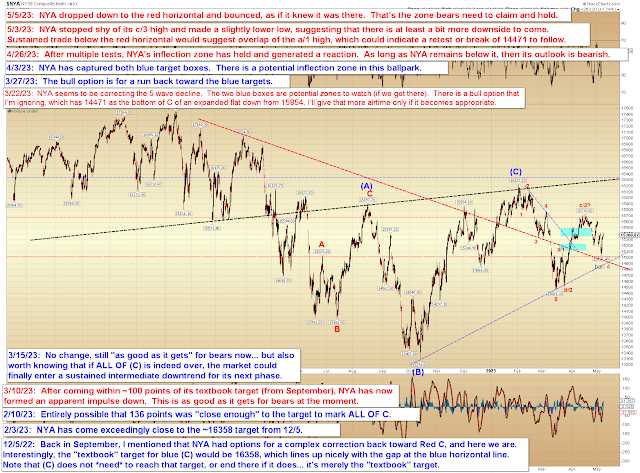

So, yeah. Still not a lot to add here. The market has traded sideways since the last update, and possibly since the dawn of time. Here's the updated SPX chart:

As we can see on the chart above... hang on, that's the wrong time scale. I didn't mean to use an hourly chart.

Okay, here:

And there we have it! In conclusion, there's still nothing to add and, at the market's current pace, there may never be anything to add ever again. Trade safe.

Wednesday, May 10, 2023

SPX Update: Nothing Lasts Forever... or Does It?

Monday, May 8, 2023

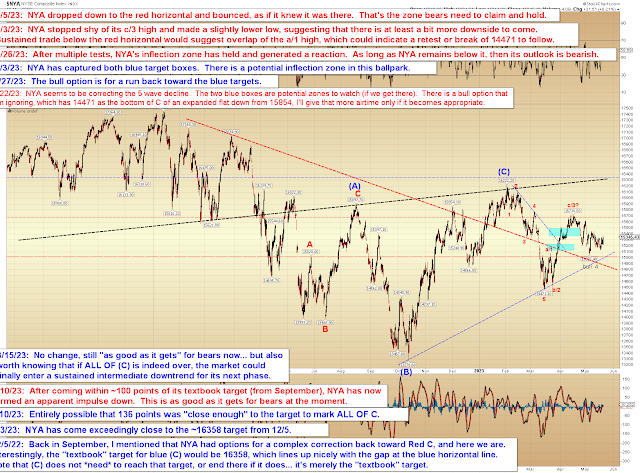

SPX and NYA: Sorry, I Ran Out of Titles Six Months Ago

Last update discussed that SPX and NYA had both reached support, and both markets proceeded to form sizeable bounces from that support. I want to say that puts us in trickier territory, but the reality is, this market has been stuck in a trading range for a year. So it's all tricky territory lately, and don't let any temptation toward complacency (in either direction) convince you otherwise.

Year-long trading ranges are the type of thing that could give Freddy Kruger himself nightmares.

There's no change to either NYA or SPX at the intermediate level.

Near-term, I outlined a bear case (the bull case is obvious and was already discussed last update):

In conclusion, so far, the market has bounced twice at major support. As noted several times previously, bears still need to break that to get anything going. On the flip side, bulls have yet to claim the next key resistance levels, so they can't claim victory yet, either. And on another note, if you've survived this year-long trading range without blowing up your account entirely, pat yourself on the back. When the market treads water, often the best we can hope for is to do the same. Trade safe.