Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, April 3, 2023

NYA and SPX: Back in the USSR

Friday, March 31, 2023

SPX and NYA Updates

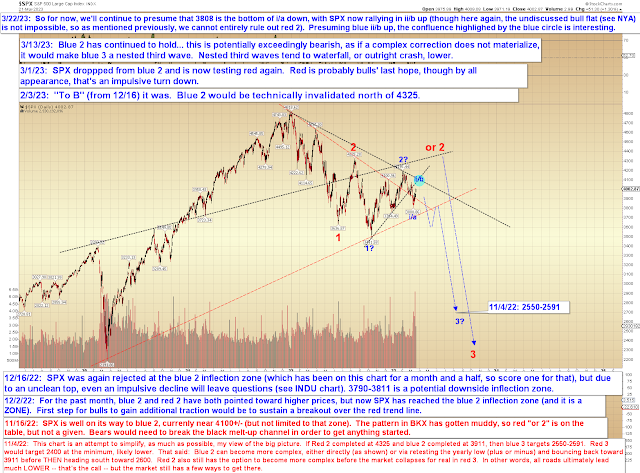

Since last update, SPX has made the previously-favored b-wave low count seem less likely:

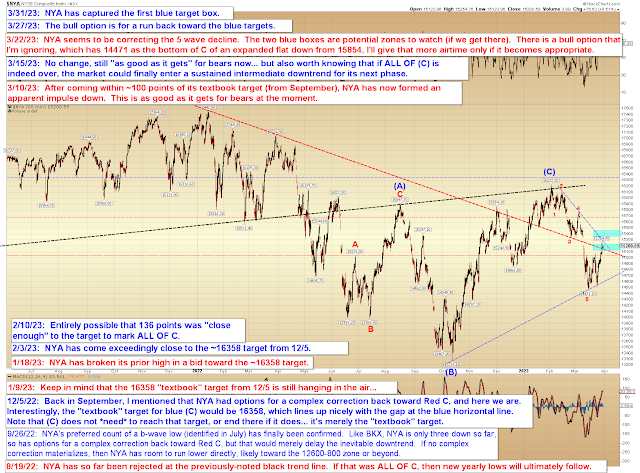

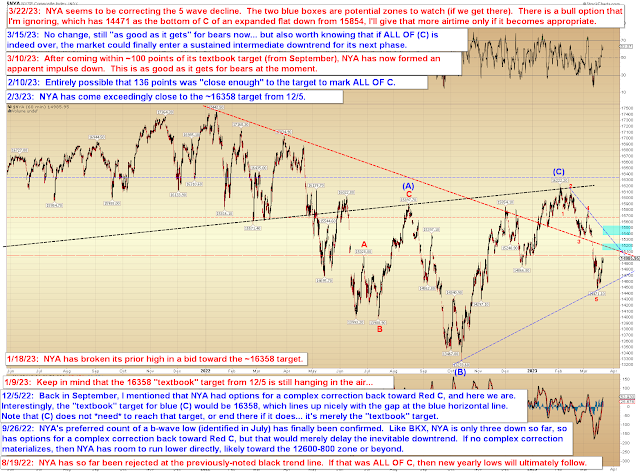

NYA has captured its first upside target zone:

If NYA reaches 15400-15800, then that is a very significant inflection zone, so I would be interested to see how the market reacts to it.

In conclusion, the near-term bear count in SPX hasn't quite been invalidated, but it's on the ropes. NYA is now in the process of forming three waves up, and recall that three waves can be an ABC correction. The current wave can run higher, but be aware that this can become a very significant inflection and reverse. I'd like to see a bit more from the market before calling for a reversal, but just putting that option out there for now. Trade safe.

Wednesday, March 29, 2023

SPX, NYA, OIL Updates

Monday, March 27, 2023

SPX and NYA: Near-term Potentials

Friday, March 24, 2023

SPX, NYA, TLT Updates

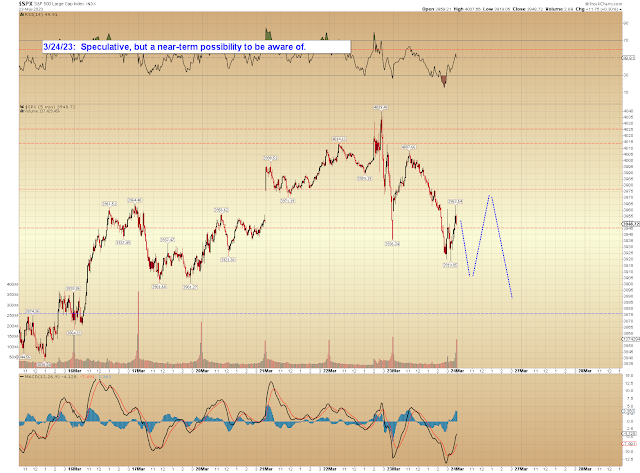

Last update noted, regarding the SPX chart:

In a perfect world for bears, though, SPX stops at or before the highlighted confluence

[W]e do have five clear waves down (an impulse) in NYA, which means that unless that impulse is wave C of the noted expanded flat, it will be followed by another impulse down that is equal to or greater in length than the first. We cannot entirely rule out all bull options, but if this is the start of blue 3, that next impulse down will be a nested third wave and thus fairly brutal.