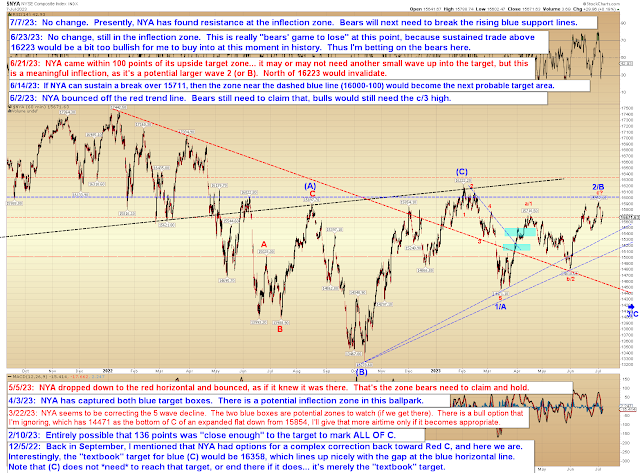

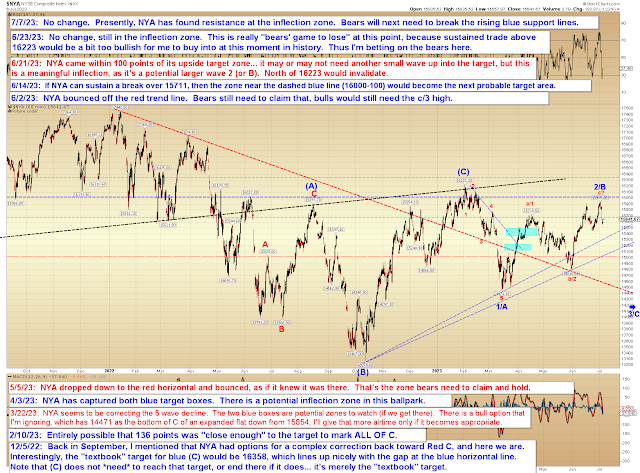

The market continues to defy bears (and reality) and head higher. Bears haven't run out of real estate just yet, but NYA is getting close, and bears need to show up soon if they want to prevent a breakout:

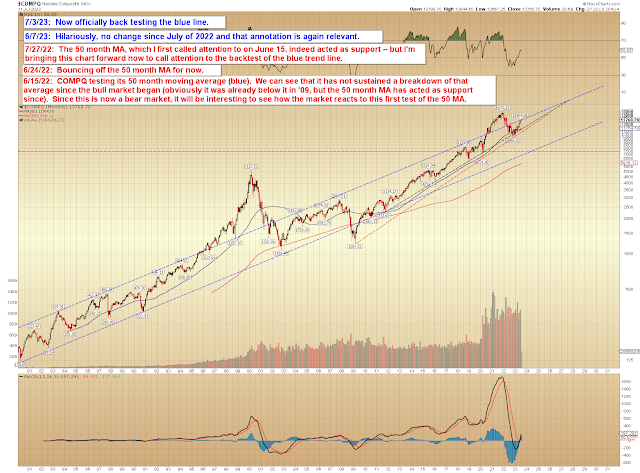

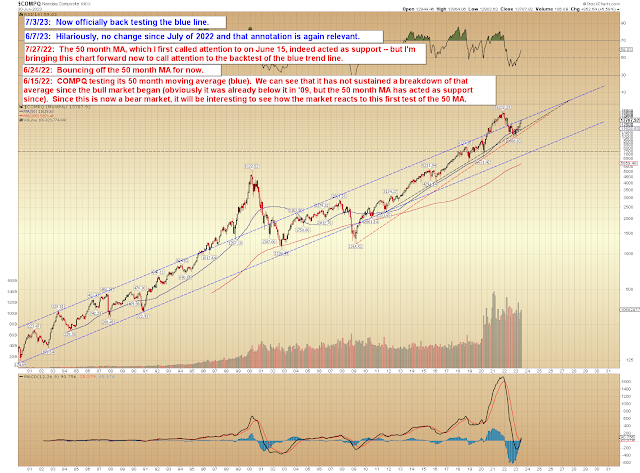

I haven't updated BKX in a few months, and this seems like a good time to do so:

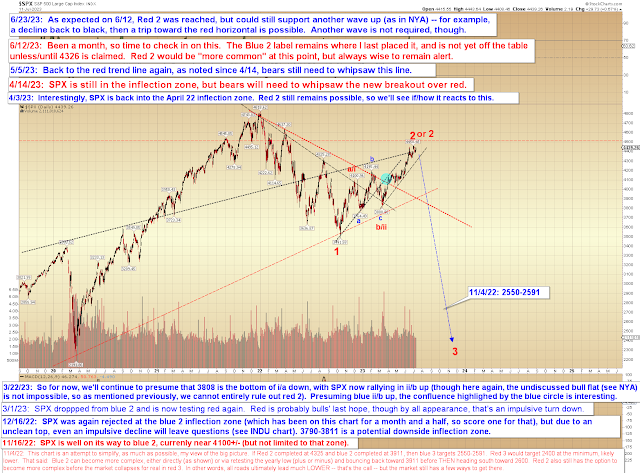

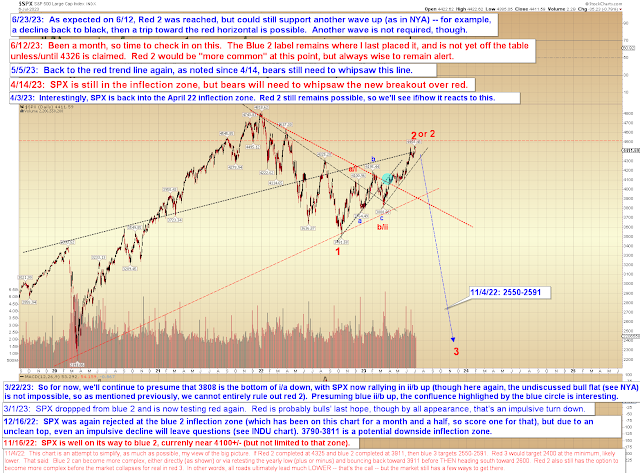

The SPX "immediate" bear count will come under fire if NYA breaks out:

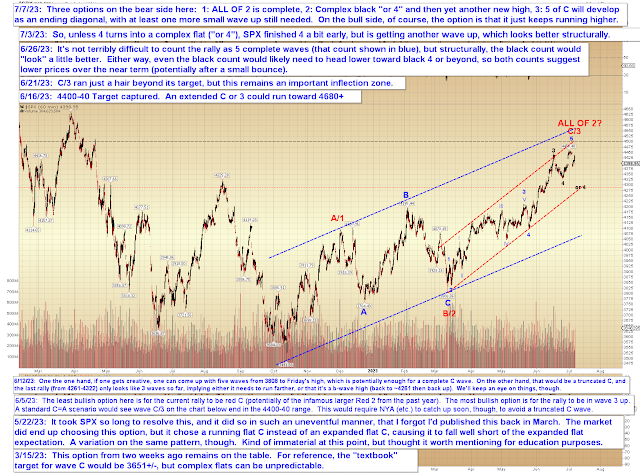

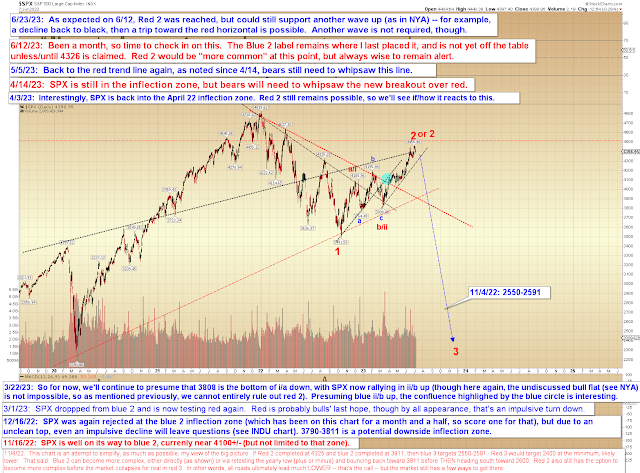

And the SPX bull count, which would also function as another version of the bear count (with both the bull and bear options being in agreement for a time; see annotation):

In conclusion, still waiting on NYA to either reverse or break out in order to clear the air. Trade safe.