Pretzel Logic's Market Charts and Analysis

Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Thursday, May 9, 2024

SPX Update: Patients with Patience

Wednesday, May 8, 2024

SPX Update: MacArthur Park in the Driving Snow

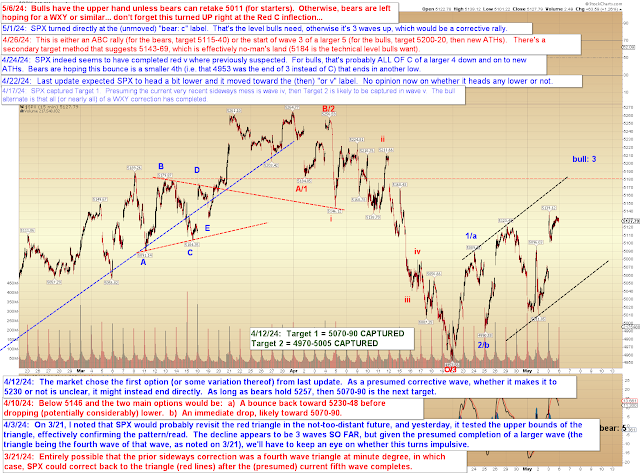

Last update expected bulls would follow through, and they have, so far, since capturing their first "Bull: 3" target from April 26 (5200-20). Again, I didn't need to even move the label, which is nice, since it saves me approximately 6.39 seconds of work, which really adds up over time and -- if I can amass enough of these -- may ultimately allow me enough extra time for one last leisurely cup of coffee at the end of my life. Hard to put a price on that.

As the chart above discusses, the most likely (not guaranteed, of course) pattern is still the bull pattern, which suggests we're in a small fourth wave correction now, but that SPX will go on to form an impulsive rally wave that ultimately targets 5290-5340 (okay, that target isn't on the chart because I ran out of space). As also noted, bears are not completely without options here at the infamous, if minor, Bull: 3 Inflection, so we'll stay on our toes just in case any declines start to appear impulsive. Trade safe.

Monday, May 6, 2024

SPX and COMPQ: The Ballad of Spiro Agnew

Friday, May 3, 2024

SPX Update: Right Said Fed

So, this is a do-or-die moment for bulls and bears. If bulls could turn it back up over this week's high, then they could have a bull nest underway and launch a strong rally. If bears can keep pushing lower and break 4953, then they will be getting into the ballpark of a possible impulsive decline, which could signal a larger trend change. The upcoming sessions could thus be important for setting the intermediate tone of the market.

Wednesday, May 1, 2024

SPX Update: But Who's Counting

Since last update, SPX rallied up into its first target/inflection zone, then the inflection zone did its job and SPX topped right at the "bear: c" label that I'd placed on the chart on April 26. I didn't even need to move it for today's update:

So, this is a do-or-die moment for bulls and bears. If bulls could turn it back up over this week's high, then they could have a bull nest underway and launch a strong rally. If bears can keep pushing lower and break 4953, then they will be getting into the ballpark of a possible impulsive decline, which could signal a larger trend change. The upcoming sessions could thus be important for setting the intermediate tone of the market. Trade safe.

Monday, April 29, 2024

SPX Update: Second Verse, Same as the First

Friday, April 26, 2024

SPX Update: One Chart to Rule Them All

In conclusion, bulls have so far turned the market back up where it was expected and where they needed to. Bigger picture, bulls probably continue to have the advantage unless bears can reverse this and form at least one more new low, to give the decline a more impulsive appearance.

And there's really nothing else to add since then, other than to note that we'll probably enter the ABC inflection zone either today or Monday. Again, though, as I also wrote last update, "bears should be ready in the event the market elects to disappoint them." Trade safe.