Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, March 20, 2020

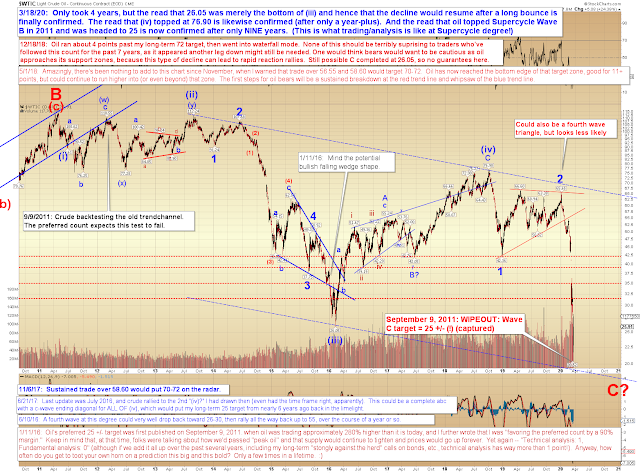

SPX, INDU, OIL: Oil Finally Captures Nine-Year-Old Standing Target

Last update discussed that new lows looked likely, but warned of the possibility of a complex correction, as follows:

In the forums, I noted that the low appeared that it might be a b-wave, and b-wave lows imply further lows to follow. If we make a new low tomorrow, that b-wave call will be confirmed.

That said, we should at least be alert to the potential of (as I also wrote in the forum) an increasingly complex correction -- which could take the form of a "slight" (which could be 70+ SPX points, in this crazy market) new low, then a run back up toward yesterday's high, followed by yet another new low. That's definitely an option here, given the past couple days of chop.

The b-wave low was indeed confirmed, and -- in futures, anyway, the complex correction may have played out (or may still be playing out). The question now is where the market wants this apparent ongoing b-wave low to begin: It could begin near ~2553 -- or it could begin near ~2710. Rallies slightly beyond either of those zones MIGHT thus suggest new lows STILL NEEDED. We'll see how it develops from here. Because...

Yesterday, the market tested a significant triple resistance zone -- and so far, it has failed to get back above:

Bigger picture, there is obvious support causing this chop zone. INDU reached the red "stealth" trend line I had noted previously:

While at the same time reaching a horizontal support level I'd previously noted. Together with the above, that qualifies as a confluence of support:

Finally... oil now qualifies as one of my longest running strings of hits (in terms of time, with my original call dating back to 2011), and gives equities traders a glimpse at what it's like trading a decline at Supercycle degree. In 2016, oil tagged 26, which was AWFULLY close to my standing 25 target, and the pressure was on to call that a wrap -- but instead, I predicted a fourth wave bounce that would last a year or longer (it lasted almost 2 years), which would then be followed by a fifth wave decline to finally, once and for all, truly capture the standing 25 target.

This week, that target was officially captured.

After a nine-year wait (!).

In conclusion, the first zone for equities bulls to beat appears reasonably clear; if they want to get even a short-term rally going, they will need to sustain trade back into the blue base channel. Even if we rally all the way back up north of 2745 from here, at present, it is difficult to reconcile the low as a clean pattern, which thus still implies a b-wave, and thus still implies that new lows remain on the horizon -- either directly (if resistance continues to hold), or after a larger bounce. Trade safe.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment