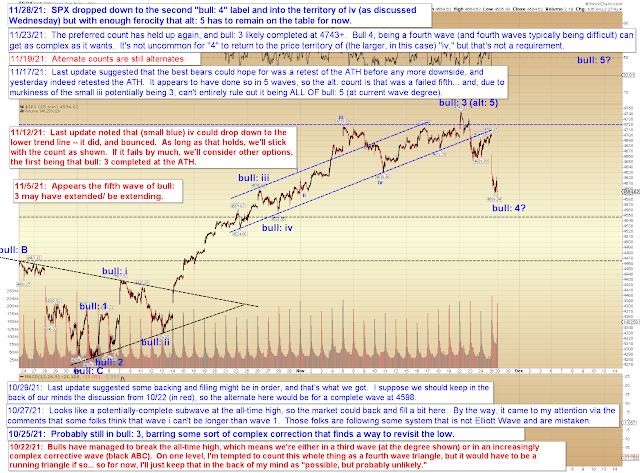

On Monday, we talked about the "market almanac" for Thanksgiving week traditionally being bullish (not this year!), but the market is dynamic, and by Wednesday, we had this warning:

Bigger picture, SPX came within spitting distance of the standing 4750 target: And that, likewise, contributes to the "easy money may be over" sentiment, as that's close enough to the target zone that an alternate count of ALL OF 5 as complete at least should be kept in mind.

Then on cue, Friday turned into a complete rout, with VIX spiking more than 50%, the 4th largest one-day gain since 1990:

This is obviously an extreme reading from VIX, and normally extreme readings lead to snap-backs, temporary or otherwise.

NYUD is also interesting here -- we can see that similar readings in the past tend to be followed by a bounce. Now, the bounce that follows the extreme is not always the "final" low (see: Sept. 2020), but it has led directly to new highs several times:

So, beyond the swiftness of Friday's drop, there wasn't anything particularly surprising about it, and I didn't even need to move the second "bull: 4?" label. That said, again, as noted Wednesday, we are into trickier territory with this market now, and ALL OF 5 complete at the all-time-high still can't be ruled out.

INDU (next chart) contributes its own warning to the mix:

Finally, the long-term SPX chart:

In conclusion, the fourth wave for SPX is still on the table, but as I mentioned on Wednesday, things are a little trickier now, and we can't rule out ALL OF 5 having already completed. Even if SPX manages to make a new high, that will probably be the fifth wave, and (barring an extension) is thus reasonably likely to be followed by a correction (or worse) anyway. If INDU makes a new high too, then things might get more bullish again, and (were that to happen) then we could consider fifth wave extensions and ending diagonals -- but for now, we appear to be in territory where a healthy dose of bull caution remains in order. Trade safe.

No comments:

Post a Comment