So there's a lot to cover today via charts. First, everyone wants to know if there's a remaining bull option, so it's important to clarify that while the fourth wave discussed previously in SPX is off the table, a higher degree complex fourth wave is not. Let's start with looking at that -- and even short-term readers should remember this chart, because we looked at a version of this option as recently as last month. The thing about complex fourth waves is that they are, well, as the name implies, "complex," and can keep tacking on runner waves, extending the fractal.

Next, let's look at the chart that had us turn bearish right at the high -- in essence, the chart that "started it all" and got us this far on the right side of the trade immediately before this little mini-crash began:

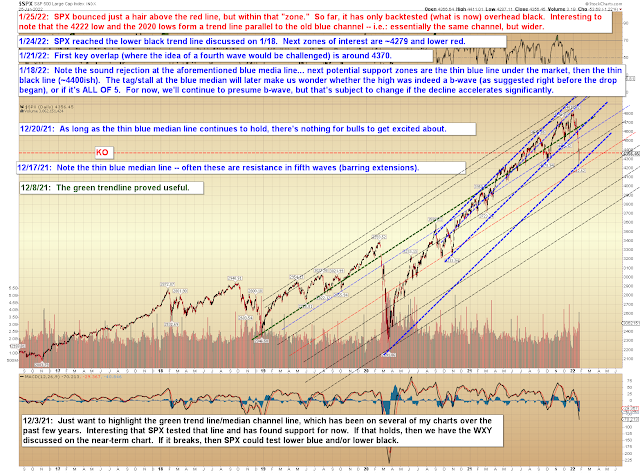

Next, an interesting observation about the recent low, which did come within the red target zone:

Finally, sometimes it's nice to step back and simplify:

In conclusion, the Fed has driven this rally for most of the past 13 years (with the brief exception of 2017-2019, give or take a little, when the Fed eased off the accelerator), so don't underestimate the significance of today's Fed statement. If they don't at least hint at a course reversal or delay, the market will remain under significant pressure. The problem is, the government cannot intervene in a market for a decade without serious unintended (and intended) consequences -- and the Fed has (as many of us have warned) painted the market into an unsustainable corner.

We can see on the charts that the market has found support at an inflection zone while it waits on the Fed. Today could be for all the marbles. Trade safe.

No comments:

Post a Comment