Accordingly, near term options remain on the table as recently discussed. Bulls are hoping for a C-wave relief rally, while bears are probably hoping for the same.

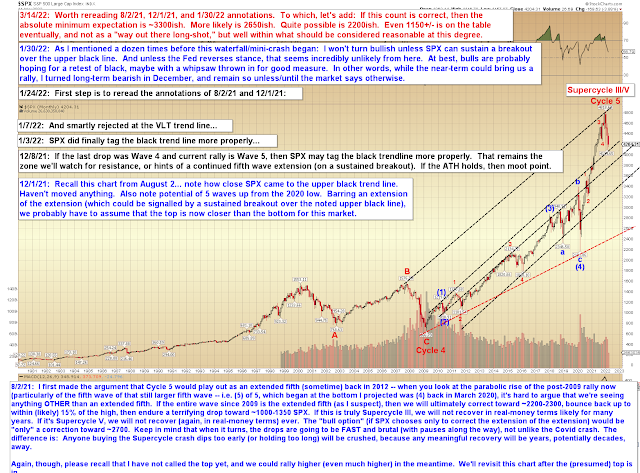

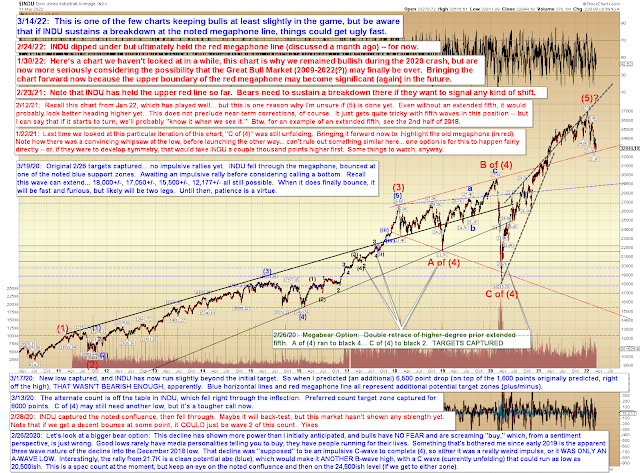

Since everyone is probably hoping for the same outcome here, we should not ignore the possibility that it may not materialize. On the chart above, it shows wave "5?" -- but be aware that said wave would probably be wave 5 of a larger wave 3, and that sometimes means an extended fifth wave. As the chart below shows, any sustained breakdowns should be taken very seriously:

Bigger picture, the bear case hasn't changed, though I have included some ballpark numbers on the chart below. The question I always ask myself in parallel with such numbers is, "What would have to happen to take SPX to [for example] 2200? What is going on in the world as the market falls?" Because we have to remember, especially when dealing with Supercycles, that these things do not occur in a vacuum. If the market crashes, there are things going on outside the market that will be "causing" the crash.

And when it comes to Supercycles, those events can be truly dramatic, as I've often discussed in the forum. During a Supercycle crash, the door is open to events such as major natural disasters ("big one" earthquakes, Cascasdia Subduction Zone tsunamis, etc.), world wars (or even something at a smaller scale but still massively devastating, such as a "backpack nuke" brought up through our less-than-secure borders and detonated downtown in a major US city), comet impacts -- things of that nature. Things that we tend to blindly assume can't happen in modern times, but most assuredly still do.

Those types of events can, and usually do, run in close proximity to Supercycle crashes.

Anyway, I don't mean to sound melodramatic, but when we start asking ourselves the question ("What could be happening in the world to cause the market to react so negatively?"), we probably won't like the possible answers. As I've always said: Charts lead the news.

And finally, a chart that still contains at least a sliver of hope for the bulls:

In conclusion, bulls and bears are still hoping for a C-wave bounce off the low here, and there's still a reasonable chance we'll get one. But if we don't, then be very cautious if the market sustains breakdowns at the noted levels. In the meantime, we'll see if the market keeps waiting until the Fed does its thing. Trade safe.

No comments:

Post a Comment