The market initially decided this was bullish, because, hey! only a 0.50 rate increase. Then the market realized that nothing about this environment is bullish and gave it all back on Thursday.

Or it was just blue 4 in action. You decide:

In other news, TLT reached its next downside target yesterday, testing the lower blue trend line before coming up off the day's lows:

An interesting scenario here might be for the stock market to continue dropping in blue 5, which could maybe give TLT a little boost to retest the broken black lines, as originally suggested on April 19. Assuming any kind of correlation between stocks and bonds still exists over even short time horizons.

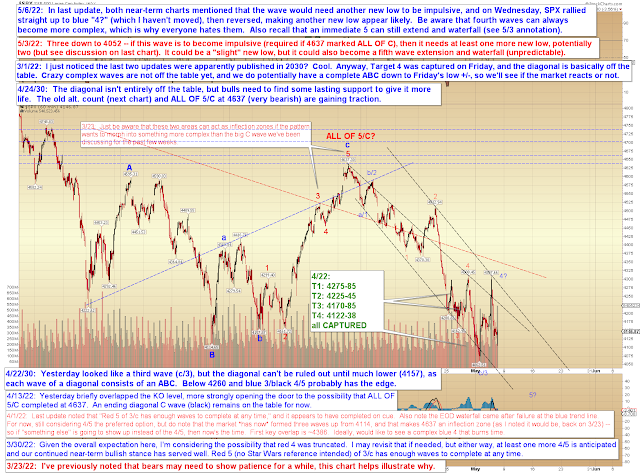

SPX does still have the option for a super complex flat, but as noted Tuesday/Wednesday on the chart below, even this option would look better with another new low:

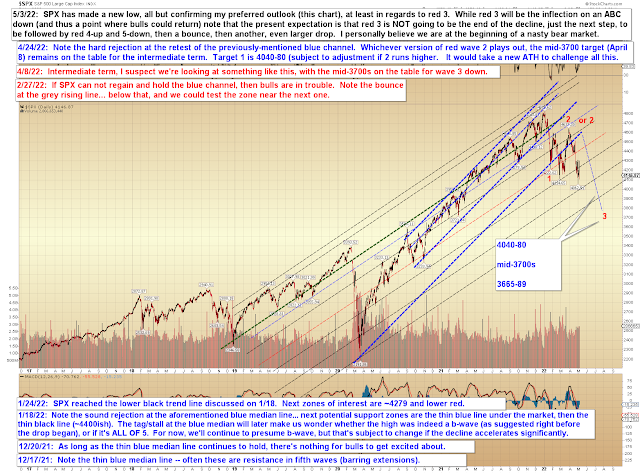

Big picture, still no change:

In conclusion, Wednesday and Thursday performed right in line with the expectations of blue 4; soon we'll find out if bulls have it in them to make that wave more complex, or if that was all she wrote and we're straight on to 5. Also, I feel like I should mention again that this would be a perfectly normal place for a fifth wave extension -- and if that were to happen, then later today or Monday could see a waterfall. Trade safe.

No comments:

Post a Comment