The last couple of weeks in the market have formed a complex pattern, but we've stayed one step ahead of it the whole time, so it's been relatively easy to predict -- but things may be about to grow much less predictable. Because the market is complex enough on its own, I don't like to present too many options (even though such options often exist in reality), since then things get too confusing for readers, so today we're just going to focus on the two most straightforward options, then we'll see what the next session or two bring.

First up, let's look at BKX again, to confirm that it does indeed appear to be three waves into the last swing low:

I always study other charts to see if I can find the broader pattern stretching across multiple markets -- and as it happens, NYA seems to share the appearance of a three-wave low with BKX:

So, while nothing's perfect, two major markets have the appearance of three-wave lows, which argues that the low is most likely a b-wave and thus ultimately destined to fail.

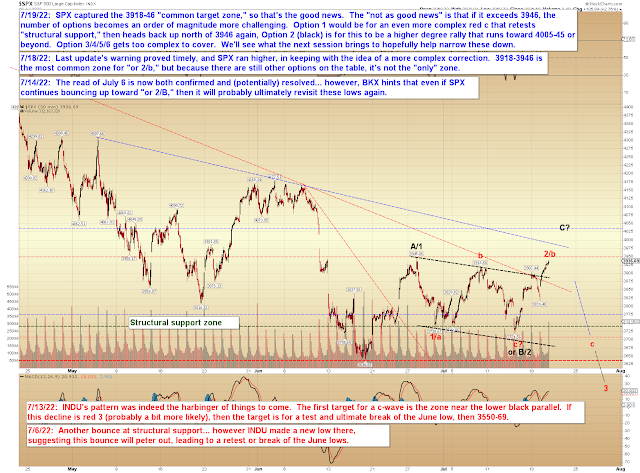

Where it gets tricky is, as I alluded to at the start, that there are multiple paths the market can take between here and there. The two most straightforward are discussed on the SPX chart below, but I want to stress that these are far from being the only interim options -- thus, "stay nimble" (the theme a few updates back) continues to apply:

In conclusion, we seem to see more than one market adhering to the theme of an imperfect low that will ultimately need to be revisited for resolution, but by no means does this need to occur immediately. It could occur immediately, if SPX takes the super-simple red 2/b path and stalls directly -- but if it doesn't, then we'll examine more potential paths in the next update. The simple takeaway is: Any way we slice it, SPX will most likely revisit the "structural support zone" at least one more time. Trade safe.

No comments:

Post a Comment