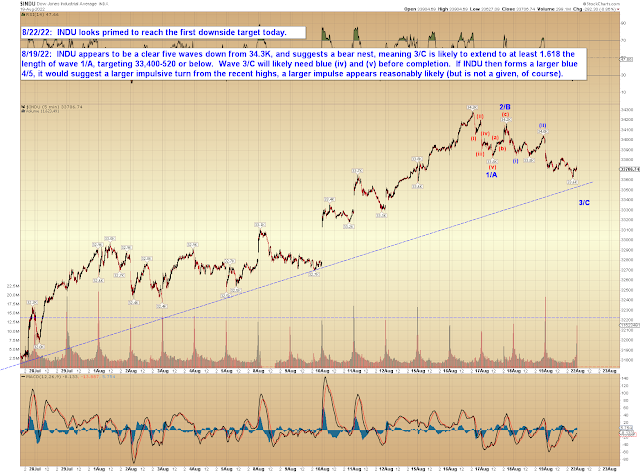

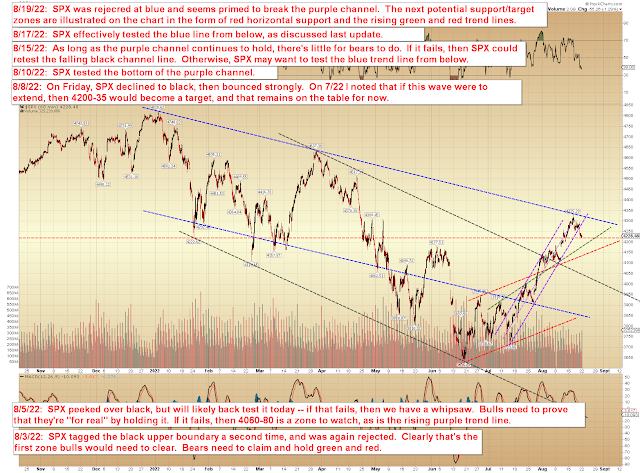

...on the first two charts, we can see that bears have formed a small impulse down (blue 1/A), but still have work to do in order to create a larger impulsive turn, which is what's required in order to suggest a larger trend change. I'm leaning toward the idea that they will (and that we've about seen the end of this bear market rally), but that's just a pure hunch, so take it with a grain of salt -- from an objective scientific standpoint, it's too early to say whether or not this decline will become impulsive.

There is no change to either my lean or the fact that I still can't give you a chart showing why I'm leaning that way, because the market has not yet formed a larger impulsive decline -- so the appropriate caveats still stand.

SPX will capture its target at the open, but has created the possibility (not a guarantee) for a continued decline beyond it:

The basic trend line chart remains useful:

No change to the big picture, except the addition of a calculation:

NYA has broken down from its channel:

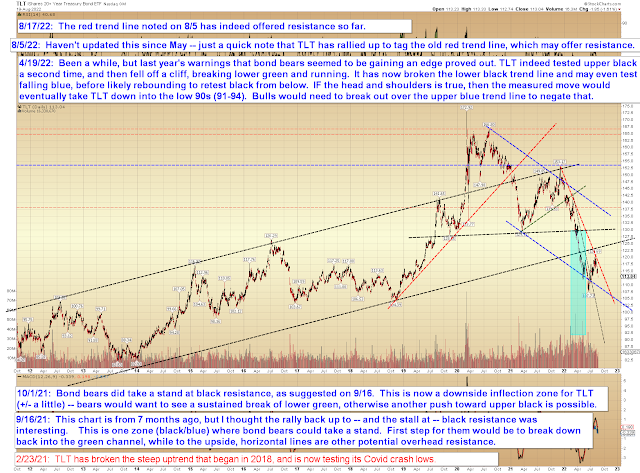

And TLT has continued its decline since hitting the resistance zone mentioned on August 5:

In conclusion, last update is going to prove to be a hit, as SPX and INDU will both capture their target zones. Beyond that, no change from last week's outlook. Trade safe.

No comments:

Post a Comment