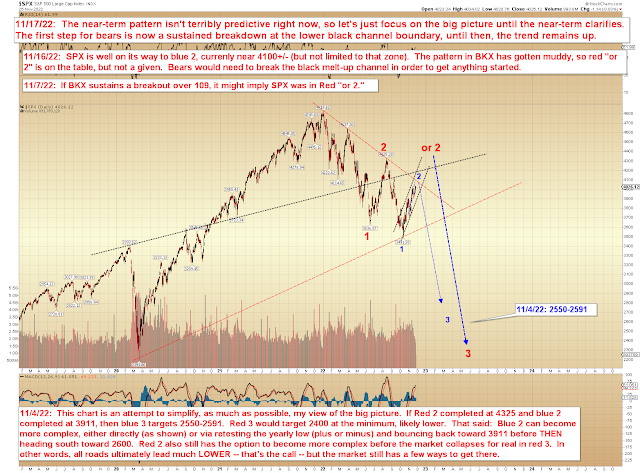

It would probably still look better with higher prices, but we're now into territory where we have to at least consider the option that it's "done enough" fourth waves and reverses more significantly. In other words, I'm not calling the top yet, but it's at least on the table finally and I can't rule it out anymore. However, I'd still like to see an impulsive decline before considering that option in more detail, so the big picture chart remains unchanged for now.

TLT has rallied ever since my warning (which turned out to be the exact bottom), but is now testing an area that could potentially offer resistance, and is thus worth watching more closely again:

In conclusion, if SPX rolls over here, the first zone to watch is 3865-98 (which would be one area a complex fourth wave could bottom), but it is into a zone where I can no longer promise continued upside. I think it would probably look a bit better with more upside, but it doesn't appear to be "guaranteed" the way it did over the recent past -- thus we'll be watching closely in the event it forms an impulsive decline. Trade safe.

No comments:

Post a Comment