My personal theory is that the Fed won't bail out the market until it's too late and too much damage has already been done. I base this speculation largely on the charts, but even if I had no charts, I would probably speculate the same thing, because the Fed always overshoots, in both directions. Thus, I suspect that by the time the Fed tries to reverse course, it will be too late to stop several large entities from collapsing under the pressure (the market is not ready for this environment, and most humans do not adapt to change quickly enough to make the adjustments they will need to make to save their organizations).

SVB collapsed because it did not adapt to the changing conditions quickly enough and was caught wrong-footed on Treasuries. Which crashed because the Fed had to hike rates quickly, which it had to do because inflation was (/is) out of control, which in turn happened because the Fed and the US Government both printed way too much free and easy money for way too long.

Remember that when these same entities who have completely mismanaged our economy try to shift the blame elsewhere by insisting that they (yes, the very same government that caused the problems!) could have stopped this (and the rest of what's coming) if only they'd had even more control/"regulation."

This is akin to an arsonist insisting that he could have saved a building that he himself lit on fire -- if only he'd been allowed to light even more fires.

So ultimately, this is yet another collapse that can be laid at the doorstep of the core Keynesian philosophy (top-down central "management" of the economy) that has long captivated and motivated the leaders of our institutions. As the trouble snowballs, you'd better believe they will not want to take the blame for any of it -- so the history-rewrites and propaganda will start any minute, if they haven't already. After all, if the masses ever figured out the game, voters might wake up and start demanding the government relinquish some of its control, and we can't have that.

If you can't tell, I get a bit upset when I think about what they've done to our country, and I get even more upset when they obfuscate it. If the public continues to be misdirected into blaming the wrong things, nothing will ever get better. It will only get worse... and unfortunately, that's the path we seem to be on.

Let's get to the charts. Last Wednesday, I wrote:

Bear v, were it to materialize directly, only needs to break the low at 3928, but if it can sustain a breakdown there, then 3820-45 would certainly be within the range of possibility for bear v.

SPX came within a point of that target on Friday, and should reach it at the open today:

Big picture, blue 2 is, of course, still very much on the table:

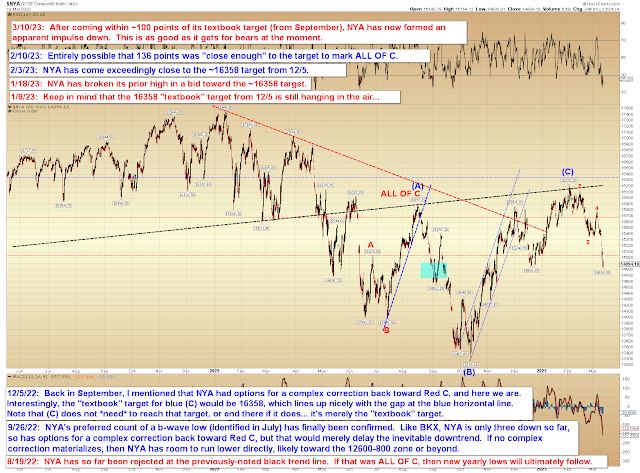

NYA remains in lockstep with SPX:

In conclusion, it's finally starting to feel like the market is waking up to the realities that we've been discussing here for over a year now. There are still options for complex second waves here (variations on Red 2 on the second chart), but for now, the trend is our friend, and we won't discuss those in more detail until the market gives us reason to. Do keep in mind that SPX will reach its first downside target zone, so a bounce soon is not out of the question. Trade safe.

No comments:

Post a Comment