So the big news to hit since last update is, of course, the downgrade of the USA's credit rating, only the second time in history this has occurred (the first was in 2011). The downgrade comes from Fitch, and my favorite snip from their report is this:

In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years

Yeah, no kidding. Government has gotten so bad that I went from having a rule to never bring up anything political (which I succeeded in doing for years) to feeling forced to mention certain issues (usually obliquely, but occasionally directly) in these updates on and off for the past 4 years or so. Of course, it doesn't help that our country is now more polarized than ever and therefore EVERYTHING is perceived as political, even things that shouldn't be (in my view, issues such as free speech and creeping totalitarianism are not "political" issues, they are human rights issues, and thus we'd do better to stop viewing them through the lens of our political affiliations and instead fight for/against them with the same vigor on whichever side of the aisle we find them. A politician who's trying to sell us totalitarian policies is no longer on "our" side, even if they still claim to be.).

Fitch also underscored the rising general government deficit, which Fitch expects will rise from 3.7% in 2022 to 6.3% of gross domestic product in 2023.

With a heavy heart, Fitch ultimately decided to downgrade the USA from AAA credit to a more appropriate rating of D. I'm kidding of course. They generously downgraded us to AA+.

While the market reaction to the downgrade in 2011 was short-lived, this still does come at an interesting time.

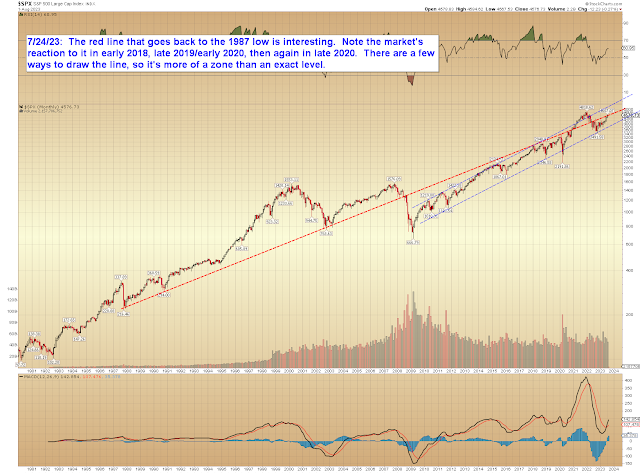

SPX, so far, still remains below its next relevant long-term trend line:

NYA remains below its intermediate line:

BKX has tagged the "90ish" target zone several times, but has so far been unable to clear it:

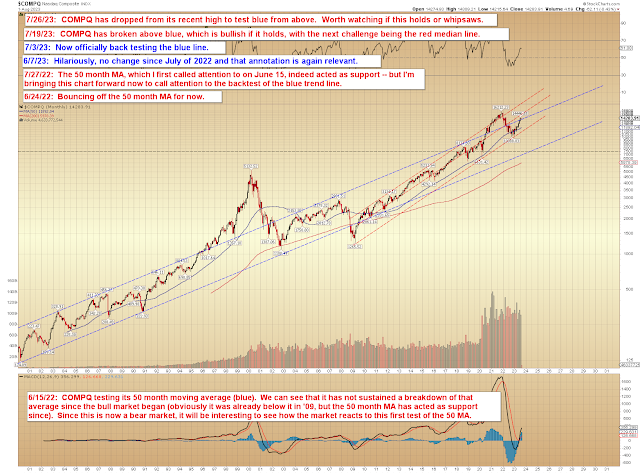

And COMPQ is still lingering near its relevant long-term trend line:

In conclusion, if the market was looking for a catalyst to react to these resistance lines, then maybe the credit downgrade will provide one. Or if it was looking for a "gotcha" rally (i.e.- negative news generates a positive market reaction), then the same thing applies. On the downside, 4527 SPX is the first level bears need to claim and hold, on the upside, the trend lines serve the same function. Trade safe.

No comments:

Post a Comment