On a side note, to my recollection, every single nonfarm payroll of 2023 has ended up being revised downward. In fact, last month's report was the same as this month's (187k) upon release, but now sits at 157k as of its most recent downward revision. June was originally reported at 209k but was ultimately cut in half (to 105k) by its final revision. Are the folks running this show really that bad at this? Or is there a reason the revisions only go one direction (with the initial number being overinflated in the direction that helps the headlines)? I mean, you'd think if it was just random "bad guesses," then they'd guess too low roughly half the time and occasionally have to revise a number higher instead of always "guessing" way too high for the headline. But that doesn't seem to be happening in 2023.

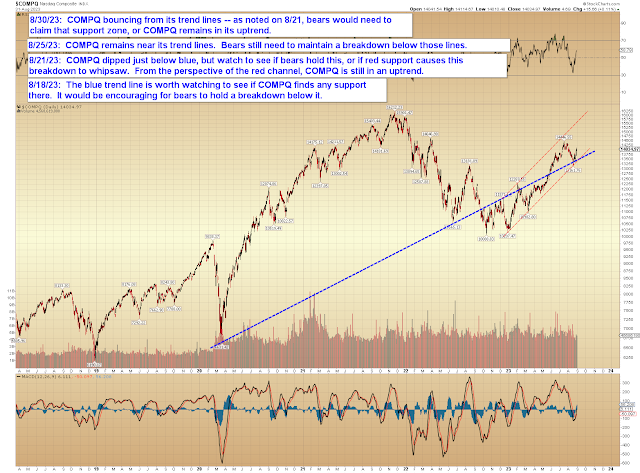

COMPQ is, for now, comfortably back into the middle of its uptrend channel:

In conclusion, SPX appears likely to capture its next upside target zone. Trade safe.

No comments:

Post a Comment