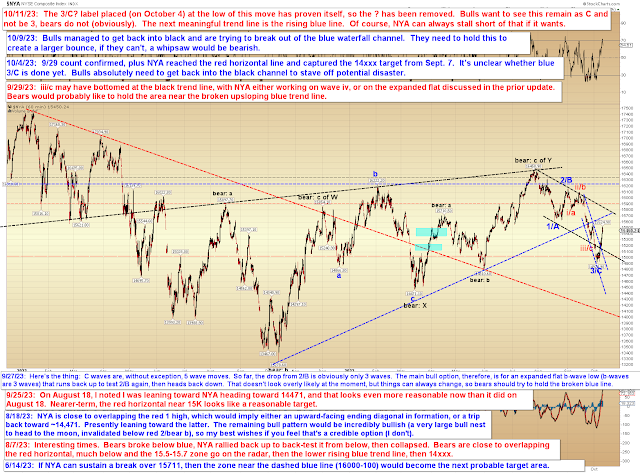

If memory serves, I actually wrote about this inflection zone months ago, predicting at the time that we'd reach the 3/C inflection with no overlap of the prior wave 1 high in SPX, leading to a time where everything was in limbo. (I'd quote it here, but I don't have time to search that deeply at the moment.)

On the rally end, so far SPX did continue higher (as noted was possible last update) and has not overlapped blue 1 (SPX has a slightly different appearance than NYA):

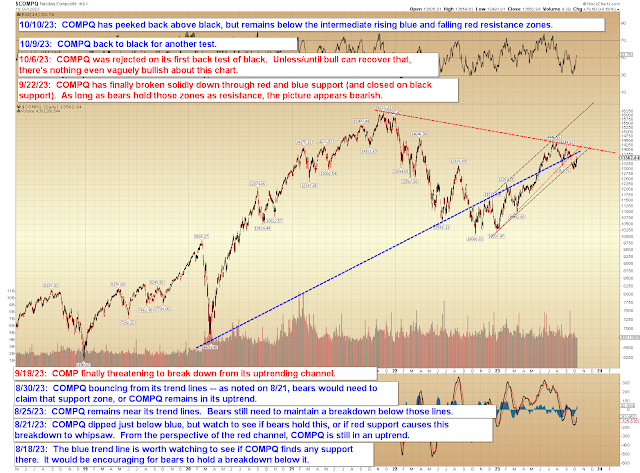

COMPQ is still below blue resistance:

Bulls, of course, are clamoring for "their" count, so here's the most palatable "bull" count I can currently find:

In conclusion, the strength of the bounce has given many bears pause (paws?) and I'd be lying if I didn't say it has at least made me wonder. This type of rally strength can sometimes indicate a meaningful bottom. For the moment, though, there's nothing in the charts to invalidate any of the bear options, so I'm continuing to lean that direction for now. Trade safe.

No comments:

Post a Comment