I say that because, while many folks look primarily at indicators (which are often derivatives of price) -- and I agree those can be useful at times -- my philosophy has always been that price trumps everything. And since the current SPX price is not unexpected (as indicated by the label being there before the market was! In fact, one could say this price was largely "expected"), now we have to see if and how the market reacts to this zone. That will give us further information.

So, while I'm open to larger bull options here, the market is still operating within the tolerances of "bear" price territory.

Next, it's interesting that NYA (representative of the broader market) is still below its high from roughly a week ago, so the broad market is not participating to the same extent so far.

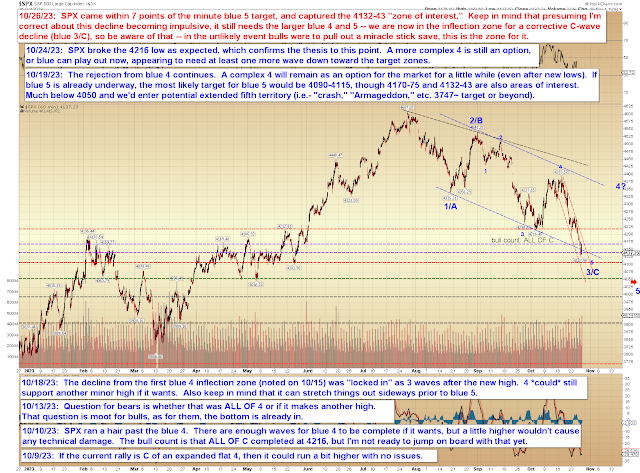

In conclusion, there have thus far been no big surprises for a while -- the market declined to where it was supposed to, then rallied after capturing its target. That was all expected (though the rally did exceed the expectations I had back before we even started rallying, I immediately adjusted those expectations when they were met) -- actually, before we close this, let's take a quick stroll down memory lane:

While we (myself and my readers) were looking lower (big picture -- near term, we had some upside target captures) for a while before September 22, I had mainly been painting that in broad strokes, and I think that was the first day I published the "official" exact target of 4090-4115 SPX. Which was 300 points lower than SPX:

SPX had just about reached that target by late October, so I began warning both verbally and visually. At that point, the visual warning "only" indicated a bounce to ~4340 (~240 points up from the downside target zone -- ~540 points total in both directions now).

Then, as SPX reached that upside target, it became apparent it was heading higher, and I changed the label to "ii?" (added the "/4?" two updates later) and raised it to its current zone:

And that's where we find ourselves today. So maybe I'm "due" to be wrong (because I am still leaning toward bears, though not in a "bet the farm" sort of way at this point -- we don't even have an impulse down yet!) and this rally will smash records and we'll all live happily ever after. But I do want to see how it behaves here first. Trade safe.

No comments:

Post a Comment