Which, of course, is the gold standard of quality that long-time readers have come to expect from this publication. And which isn't as easy as it looks -- after all, you don't see Morgan Stanley dreaming up new ways to insult Fed Chairmen, do you? And they have entire teams of people working on this stuff -- yet all they can manage to do is occasionally guess the general direction of the market while maybe offering some vague policy critique.

Anyway, I digress. The point was, the insults aimed at the Federal Reserve the rising wedge turned out to be true -- or at least, that's what futures are strongly suggesting as of the time of this writing.

There are still some remaining hurdles for bears, though (particularly in the cash market charts), so we'll take a closer look at those in this update.

First up is NYA. We can see NYA fell out of the wedge, but so far, it simply tested the blue line, which is the first bear hurdle. Of course, if the big drop in futures holds, then NYA is likely to open below that line -- but there are still ~4 hours until the open, so lots can happen in that time.

Presuming NYA does open below the blue line, then bears will need to defend that line and turn it into resistance.

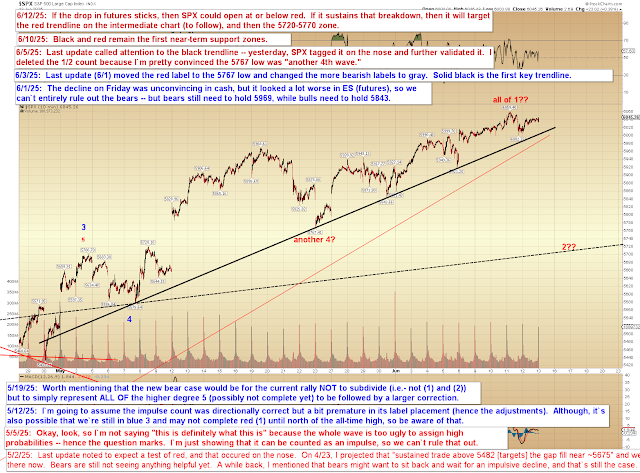

Next up is the SPX near-term chart -- which also references the chart that follows after this one:

Here's the intermediate chart:

In conclusion, bears have done the first step, but there's still more to accomplish in the form of cracking support before we get too excited. That said, be aware that IF the highly speculative 1?? and 2?? on the near-term SPX chart happen to be unfolding, then these early downside targets might be VERY conservative. Because if this is a second wave decline, then its job would be to convince everyone that the bear market is resuming -- which implies a deep and scary decline, potentially of 500 points or more.

And it also bears mention that SPX did not reclaim its all-time high -- which means that if the decline gets teeth, then it's not outside the realm of possibilities that the bear market IS resuming, so we should be aware of that, as well. But before we even consider going there, let's see how bears handle these potential support zones first. Trade safe.

No comments:

Post a Comment