Last update predicted:

the SPX 24 hour chart (ES+SPX) appears to be three waves up into its high, which suggests that either the rally since 3941 (on that chart) is incomplete to the upside, or that the larger wave (going back to the start of the rally) is incomplete to the upside. In other words, this chart seems to suggest more upside either now or later.

And then later underscored:

let's not get too far ahead of the market yet, as the SPX24 chart (second chart) seems to suggest we're not quite to the bigger B/2 just yet

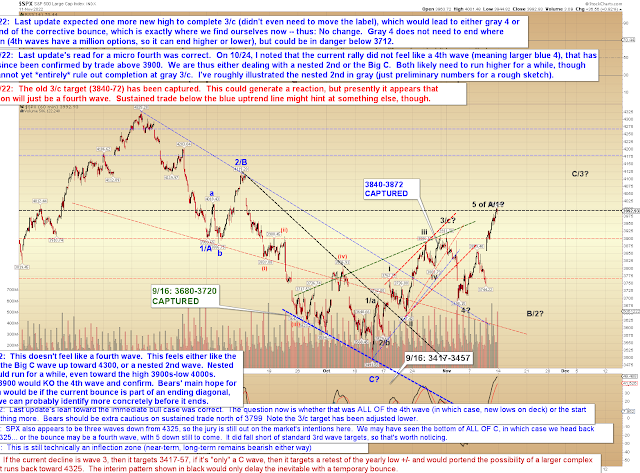

This read was quickly vindicated by the market, which made new highs later that session. This implies that the correction discussed above was a fourth wave (at micro degree) and that the new high was a fifth wave, with another fourth seeming to play out in the latter part of the session on the 14th, with the fifth to pair with that second fourth ("second fourth" is fun language) showing up in the gap up yesterday. We may have then seen yet another fourth wave (a "third fourth"!) manifest in the remainder of the session yesterday.

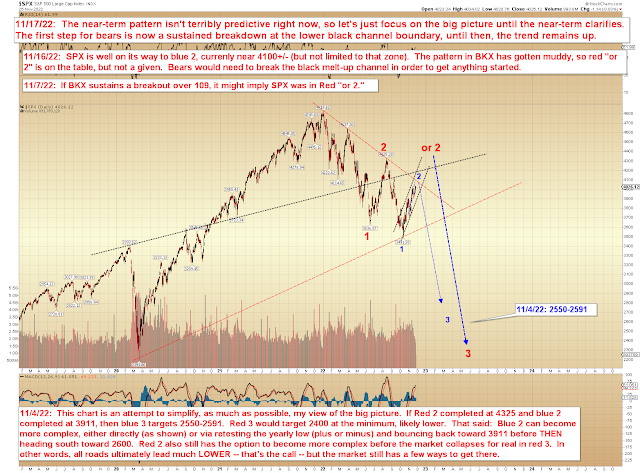

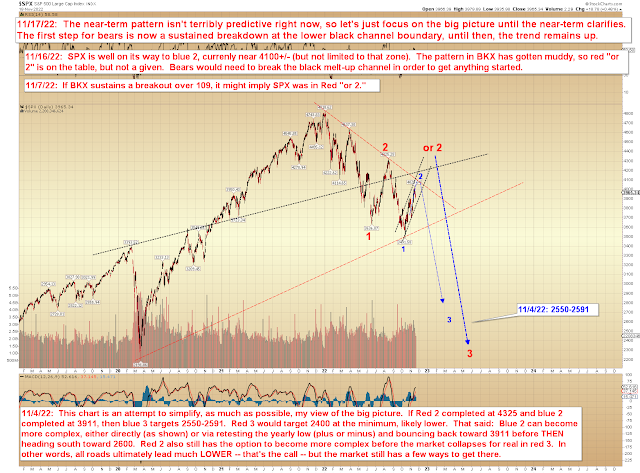

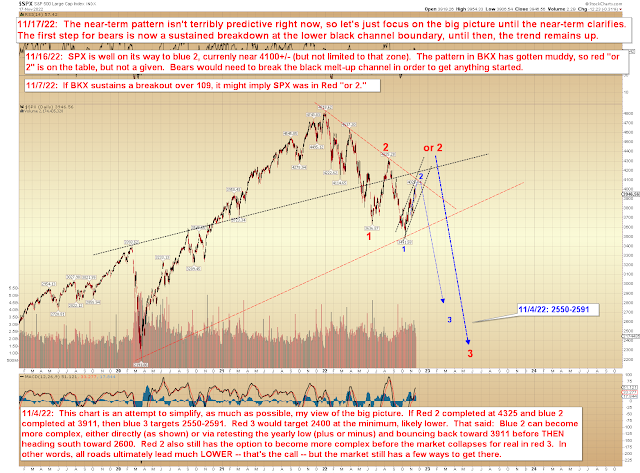

All this implies that the market might be unwinding its upward momentum, meaning the rally might be getting a little tired. I say "might be" because this is the type of market that can easily find a second wind and burn bears who get too aggressive too early, so I'm not inclined to get too far ahead of it... but it's interesting to note that we are approaching the blue 2 zone (chart below).

That said, it's quite possible that if there is a reversal, it will just be a correction on the way to red "or 2," so I'm awaiting an impulsive decline before actually changing footing. As of this exact instant, this is more of a "time to be cautious" moment for bulls, as opposed to a "bet the farm short" moment for bears. It could always turn into one, but we don't have an impulsive decline yet.

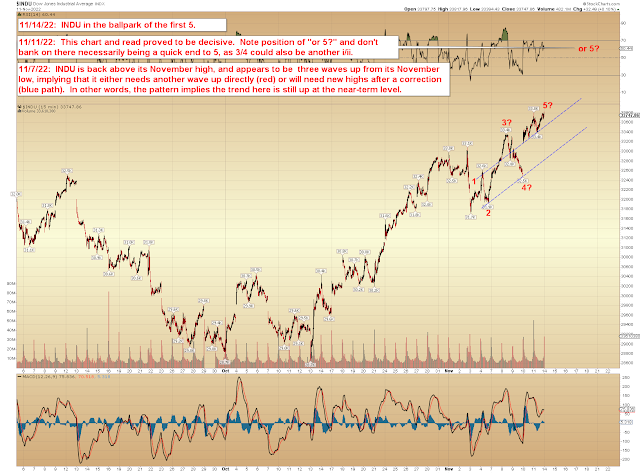

BKX, of course, decided to get cute and goofy and whipsaw its breakout, so it's not unreasonable to think it's still headed higher, and we can definitely say that "or 4" isn't a given yet:

In conclusion, SPX has spent the last few sessions lunging briefly higher, but then failing to find additional buyers, so while there's nothing yet to suggest a reversal, bulls may want to at least lean forward in their chairs a bit and watch things closely over the next couple sessions. Trade safe.