With Thursday's solid decline, it's likely that wave (ii) ended at 1363.46, about a point and a half shy of my target zone. In my defense, it appears that the final fifth wave up most likely failed, which accounts for the target short-fall. There is one last short-term hope remaining for bulls, but it's lower probability at this stage -- I'll cover that option in a few moments, but first, let's take a look at how my Elliott Wave analysis is doing overall for the intermediate picture.

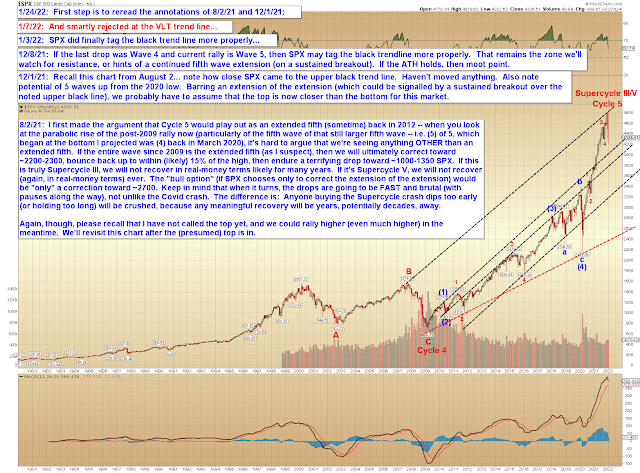

Below is the preferred count I published on June 1. The decline fell 6 points shy of my target zone (and the red wave (ii) illustration here was never meant to be anything other than a rough guideline) -- but overall, it's probably safe to say, "not too shabby." This is one reason I stick with Elliott Wave as my go-to analytical tool: I simply know of nothing else that can call two intermediate turns this accurately

before the first turn has even happened.

Let's update that hourly chart, add in some more clutter, and see where we are now in the intermediate picture. My wave (iii) targets have been slightly adjusted from the June 1 chart. Bear in mind that the market is a living, breathing, dynamic environment -- so further adjustments will likely need to be made on the fly.

Next, let's zoom in a bit to the 15-minute chart. I am uncertain if wave 3 has bottomed or not, so don't bank on that wave 4 bounce -- instead watch the red dashed trendline in the one-minute chart (shown next). My best guess is that 3 has reached a possible very short-term bottom (or nearly so), based on the one-minute chart, but it's not entirely clear. Yesterday's 18 point bearish trade trigger target (which I've removed from the chart) was easily reached during the session.

Below is the one minute chart. These can be extremely tricky to interpret and my confidence in this particular instance is only medium. The chart does note the invalidation level for the bearish wave (4) interpretation (1347.39).

Again, don't necessarily bank on that wave 4 bounce here. As long as the market stays below the dashed red trendline, bears have no reason to fear anything; breaking that trendline is the first step for bulls to get something going.

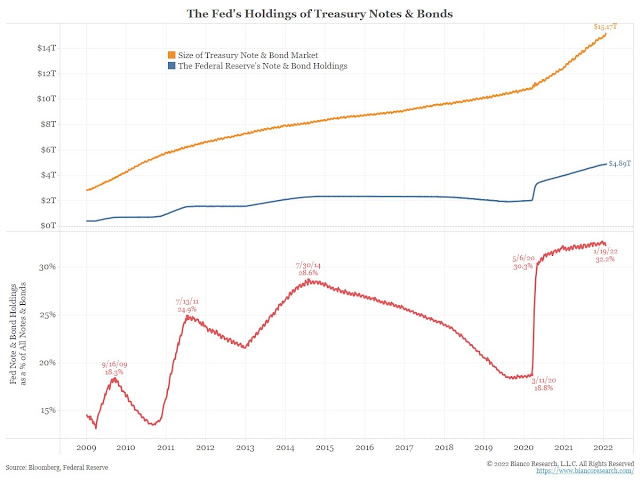

Next is an indicator chart I haven't had the opportunity to share since late last year. This indicator combines the readings of TRIN (a breadth indicator) with the down volume to up volume ratio (which indicates selling pressure), and shows that when the two indicators reach the signal line in concert, it becomes extremely high probability that there will be lower lows made in the near future. This fits with my interpretation of the wave structure, but it's always nice to have some additional confirmation.

By the way, the last time I referenced this indicator (December 2012), it failed to work! I don't think that will be the case this time, though -- the odds are definitely against a second failure here, so there should be lower lows in the market's near-term future.

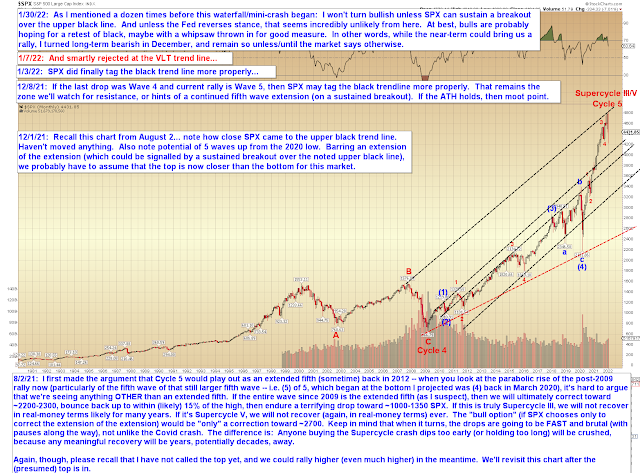

Finally, I do want to outline an alternate intermediate possibility. This potential is lower probability, but there's no way to rule it out yet. The strength of the decline was fully appropriate to kick off the assumed third wave, so there's currently no reason to to think a double-zigzag will develop here -- but we'll stay alert to this going forward.

The main purpose of the chart is actually to outline the very bearish 190 point sell trigger which will be activated with a breach of the lower dashed blue trendline, but I figured I'd save space and annotate the alternate count onto this chart too. The bearish sell trigger also jives with the idea of a third wave down. My preliminary target zone for the larger third wave is 1120-1130, but that would not mark the entire wave down -- there would still be a fourth and fifth wave, which, if correct, should allow the market to reach the trigger target in the high 1000's.

In conclusion, it appears reasonably likely that the market has begun the expected third wave decline. Third waves represent a "point of recognition" for the masses, and they tend to be strong and unrelenting. Discounting the alternate potential for a moment: if this is indeed now wave (iii) down, then bounces will often come late; upside targets for bounces will frequently fail; oversold indicators will reach deeply oversold conditions and stay pegged there; and declines will run deeper and faster than most think they should. Trade safe.