This looks like distribution to me: ramp the heavily-leveraged futures at night for a fraction of the cost of the cash market, then sell your inventory when the market opens. In this vein, there are two interesting fundamental factors at work right now:

1) There have been huge inflows of cash into the U.S. from foreign investors who are fleeing the European system, and some of that money is finding its way into stocks. This is bullish as long as it continues, and it seems to be primarily what has driven the current rally.

2) There are large outflows from domestic mutual funds. This is bearish as long as it continues.

I have an interesting speculation that perhaps the U.S. fund managers are ramping the futures each night and, effectively, distributing to the Europeans. Who knows. But it's a strange pattern nonetheless. One would think that, at some point, most of the money that's going to flee Europe will have done so already and the well will start to run dry. When that will happen is far beyond my ability to anticipate: it may have happened already (data in this regard lags the market), or it may be at some future date.

My friend Lee Adler at the Wall Street Examiner does a great job tracking market liquidity, and most of my data in this regard is garnered from his Professional Report subscription service. Here are two charts from his service, which illustrate the situation.

My friend Lee Adler at the Wall Street Examiner does a great job tracking market liquidity, and most of my data in this regard is garnered from his Professional Report subscription service. Here are two charts from his service, which illustrate the situation. The first (on right) shows deposits into U.S. trading accounts -- based on supporting data, these are presumably coming from Europe. As Lee states in his report: "This remains a bullish influence for U.S. markets; a.k.a.- the last Ponzi game." The data is from the week ending January 4, so it lags by a couple weeks.

The second chart (right) shows domestic mutual fund outflows. The most recent data here is also from the week ending 1/4/11. Weekly outflows have reached the highest levels since August. Lee states, "This continues a bearish signal on the charts... a continuation of heavy outflows could eventually take a toll on stock prices."

The second chart (right) shows domestic mutual fund outflows. The most recent data here is also from the week ending 1/4/11. Weekly outflows have reached the highest levels since August. Lee states, "This continues a bearish signal on the charts... a continuation of heavy outflows could eventually take a toll on stock prices."So as of the week of January 4, the market was in a bit of a battle of liquidity inflows and outflows. Whichever source wins that battle heading forward is going to determine future market direction. I believe the European inflows simply can't last forever; and that seems to be the only thing keeping the U.S. markets afloat right now. As I stated earlier, since this data lags, a victor to this battle may have emerged already. This is why I generally use stock price charts first, and data second -- because the price charts are real-time, and should theoretically contain everything the market "knows."

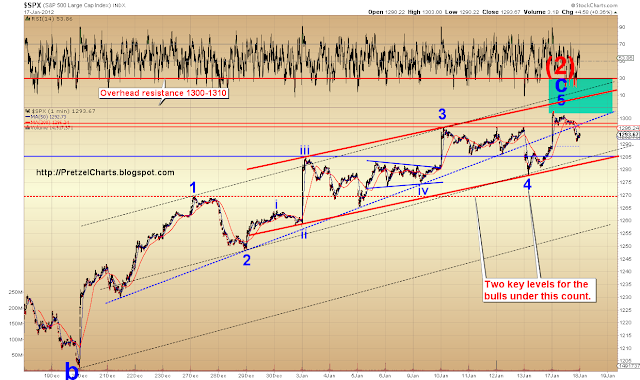

The short-term wave pattern could now be viewed as complete, meaning the top may be in -- however there has been nothing to confirm any sort of trend change yet. What I would really like to see is a full daily candle beneath the lower trendline to confirm a top, but the market is still a ways from that.

The first chart I'd like to share is good old classical technical analysis; after that we'll look at the wave structures. The chart below highlights three factors which suggest a turn may be at hand, all noted on the chart.

So there is continued evidence for a top, as there has been for roughly a week... but the market is still hovering. Some might take that as a bullish sign. Personally, unless the SPX breaks through 1300-1310 and holds it, I'm not going to get overly excited. But I've been wrong before; and the money flowing in from Europe is certainly an x-factor that bears watching at this stage.

The next chart is the second chart from yesterday, which shows a potentially-complete five wave structure to a top. If this count is correct, the top is now in. It's also possible that wave five of 5 is still unfolding, with yesterday's low being four of 5.

The next chart is an alternate short-term count. This count has a few things going for it, such as it effectively explains the bizarre structure of the recent rally (which looks like a series of a-b-c's). I'm keeping this count as the alternate for the time being, but market action could shift this count into the preferred role.

NOTE: CHART ANNOTATION ERROR -- THERE IS NO INVALIDATION FOR THIS COUNT. That's what I get for doing too many things at once some nights. :)

In conclusion, unless the market breaks the key levels of 1300-1310 on the upside, and holds that break, I continue to believe that a top is close at hand, and that the market has given no real signals to become long-term bullish. At the same time, it's not yet given any concrete price signals to be short-term bearish either. There continues to be a great deal of evidence for the bear case, as outlined today and over the last week or two, but the bears need to start taking back some key levels to validate that evidence. The first level for bears to capture would be 1285 -- and then 1277 and 1270 below that. If the first count is correct, then perhaps this is the week the bears finally get 'er done. I believe the influx of European cash which has been supporting this market is (clearly) a finite source, and likely to be tracing out some type of bell curve. When that liquidity clears the apex and hits the slope, the market is going to run out of juice. Trade safe.

The original article, and many more, can be found at http://PretzelCharts.blogspot.com

Morning everyone. :)

ReplyDeleteGood morning :)

ReplyDeleteExcellent post PL. European cash propping. Ppl lookin for the holy grail need not look when any complex top or bottom is being formed. It aint there (timewise). You can only see a top or bottom well after it is in. Give me a V move (and a beer) any time.

ReplyDeletety :)

ReplyDeleteI generally do really well at calling important bottoms -- I assume that's because the secular trend is down, so the waves are cleaner... as opposed to the corrective waves forming rallies. My top calls, while less precise, have been solid enough that one should have made money (if they protected profits during the declines). Hopefully, that track record will continue here!

Morning all...

ReplyDeleteWell, now I'm glad I held those shorts. That was a nice little oooof-aa by the market.

ReplyDeletePRetz- with the buy spike at 5am on ES... how would characterize it? Was that a last ditch parabolic on a short time frame?

ReplyDeleteLooked like a C-wave to me... and that was how I played it.

ReplyDeleteES levels ~ first break should determine direction and get us out of oscillation.

ReplyDeleteUP

1296

DOWN

1286

Yes to your two comments below PL. Discuss will not let me REPLY. And about the drop,

ReplyDeleteYeah, nice and unexpected. Must have been news related.

PL:

ReplyDeleteSector rotation can also explain the drop and pop. Furthermore, the European banks are sitting on a ginormous pile of Euro's that Super Mario printed for them. They are not about to jump into the sovereign bond market until they have some assurance that they have a backstop. That is a lot of dry powder.

Looks like long term TIC flows confirm your analysis this morning. Up 59.8 Billion.

ReplyDeletemorning guys. lets see what the market has for us today.

ReplyDeleteps pretz, i saw you mentioned on another blog i read. nice!

I was thinking below 1288 and we are headed to 1265 to close the gap from the 3rd. Below 1286 will just give me more confidence. I appreciate that you post your intraday targets Katz! It gives me something to check my own ideas against.

ReplyDeleteCovered at 1287.50 ES. That was a nice short-cover, short-cover tonight for double-points. :)

ReplyDeleteWill consider going short again if the triple-bottom falls apart, or shorting again higher.

Gotta get this article packaged for Minyanville, be back in a few...

ReplyDeleteCapacity utilization rose to near 80%. US manufacturing rose 0.9%. Surely but slowly, US manufacturing is coming back. Housing is the key rocket fuel, however.

ReplyDeleteIn an interview, Atlanta's Fed president said that he and his colleagues had no reservation about authorizing the Fed Chairman to hit the QE 3 button. He added that it might be housing targeted.

So far, the earning season is new.

ReplyDeleteBut only 40% beat, compare to 50% last season. It is not clear, however, how much of earning disappointment is already priced in. :)

Euro popped on larger than expected IMF war chest.

ReplyDeleteWhy do people even listen to this Synthetic QE3 chatter anymore? The Fed has been threatening QE3 for months. If they didn't do it when the market was much lower, and the news was much worse, why on earth would you think they would do it now? They don't want $150/bbl oil, believe me. That will kill whatever recovery is going. Besides that, there's just NO reason for it here. They need to save this bullet for something serious -- not waste it when the market's in an uptrend and the data looks nothing like a "crisis."

ReplyDeleteSPX so far ahead of Euro now, I don't think those pops will matter for a while.

ReplyDeleteSo according to you this situation is specal! But I have find out a similariry with the other TOP of SP history, let me check still a couple of days if this similarity is confirmed and then we eventually can decleare that tis is a TOP

ReplyDeleteDamn, bounced right of my ES 1286.

ReplyDeleteyeah...my first ever currency trade was working...until more intervention ran my stop.

ReplyDeleteEXCELLENT POST PL!!! I don't know how you pull it off everyday. Especially with BSers like me haranguing you in the middle of the night. You are a really extraordinary person. I'm starting to get it now (I just wish my Prechter book would arrive.)....And Katzy...you're the bomb too, as well as all of the other seasoned vets...way better than any college course I ever had. Thanks to all.

ReplyDeleteI do think that I'll sign up for Lee's pro service...Gawd he guilts me everytime I go over to look at his work..."If you haven't signed up yet...You know who you are."...He's smooth. LOL

I was thinking about you when he posted that.

ReplyDeletePL, they have dual mandates. With unemployment at historic high, and inflation tame. They are now one-track minded. :)

ReplyDeleteMany of the unemployed are long-term, the Fed Chairman had said many times that it was an American crisis.

Well, I only looked at the last 2,700 trading days -- not all of history. And I was looking for a specific thing, as stated. And I wasn't just looking at tops! I was looking at the whole market -- tops/bottoms/in-betweens. But regarding what I was looking for, I didn't see anything exactly like it.

ReplyDeletety, jbg! I don't know how I do it some nights either, to be honest. :D

ReplyDeletebtw, if you sign up w/ Lee, if you would, do it through my link so he knows I'm sending him some bidness. I owe him for the intro to some people, so I'd like him to see I'm trying to pay him back by sending him some bidness. It's a damn good service, and he really should be charging WAY more than he does, IMO.

Demise of the Retail Trader

ReplyDeleteBy Alan Farley

| Jan 18, 2012

| 9:28 AM EST

Schwab (SCHW) is reporting a 66% quarterly decline in new

customer accounts, year over year. This looks like equal parts

disgusted investor and

vanishing trader. More unsettling evidence about one cause for January's limp volume.

Retesting 1300 ....

ReplyDelete66%? Holy gazoombas.

ReplyDeleteIn a good way, I hope. :o

ReplyDeleteDunno bout news. Just reading what the chart fairy brung me. :)

ReplyDeleteThnx for the compliment jbg. Feel free to ask questions, I had an excellent teacher and finished my education with Atilla. And I am continuing to learn from Pretzel. Basically I am just an EW and TA chartist, do not watch the news or any thing else. Still think it is all in the charts first (as I know Pretzel does).

ReplyDeleteBack into shorts at ES 1294. Tight stops. Just a tester... we'll see...

ReplyDeletegot in too early, cold be a problem today with the imf news

ReplyDeleteI will definitely send him bidness through your link...He is completely driven, thorough, and competent. Both your and his work would never be available to any of the little guys like me without the internet...I was gonna give a shout out to Algore, but didn't want erasers thrown at me. Thanks again.

ReplyDeletePL - excellent post again. i am regular follower of your blog and completely agree with the bearish count as we (who trade in Indian stock market) are also waiting for so called Wave '2' end (you all might be surprised NIFTY also having similar pattern of a-b-c where wave 'c' is ending diagnol. Sure you might be surprised why i follow your blog when i dont trade in US market, the reason once it confirms in SPX then it is confirmed that other markets will follow the same. :)

ReplyDeleteRecently i come across about OEW (Objective Elliott wave), one of the OEW blogger suggesting SPX is in long term Bull trend. Bit confused, appreciate if any one your throw light on this OEW and how this trend is so different to all...

CORRECTION on down below: this is the third test of the 1286 ES level. This steep rise (look at a 5 min. chart) and this test fact does not prove me much confidence for an immediate continued down.

ReplyDeleteHi, KKS, welcome. Elliott wave is like any other analysis and is open to interpretation. The folks you refer to are simply choosing the bullish interpretation of this market. It's as simple as that. Elliotticians *rarely* agree on much of anything. ;)

ReplyDeletestraight up, looks like an algo kicked in

ReplyDeleteplease look at april may closinig and other top. When an important top is in you have a top in the closing 1364 end of april followed by a new high 1371 may the second not confirmed in the dalily closing. So we had 1296 closing of january the 12th followed by bew high 1303 of yesterday not confirmed in the closing 1294 which is lower than 1296 of course. This happens also in other important tops

ReplyDeletelol.

ReplyDeleteBut you may have your facts wrong: I'm pretty sure Anon20 invented the internet. Algore stole it from him!

Right. That top is totally different than what I was looking at. I don't mean to say it's different in ALL aspects -- it's just different than what I was looking at. Look at all the gaps up followed by black candlesticks and reversal candlesticks... followed by more gaps up and black or reversal candlesticks -- that's what I was looking for. A series like this one -- and there wasn't any, going back to 2000 or so.

ReplyDeleteThank *You*. As soon as I snuggle up with a book or two, then I'll know which questions to ask. In the meantime, I'm just thoroughly enjoying your chartporn. It's awesome.

ReplyDeleteRight, back to 2000 or so. For the moment we can say that we are in a minor TOP compared to April and that is similar to September 2000 compared to March 2000. For the rest we have to check as usual

ReplyDeleteBe that as it may ....

ReplyDeleteWith Euroland in recession and China losing steam, the threat of deflation is high in the minds of those ladies and gentlemen in the Fed. So I'd not be surprise if they hit the button. But targets it towards the housing sector which is the low hanging fruit for employment. As to crisis down the road, I am quite sure that they have QE 4, 5, ... , n lined up. :)

A disclaimer:

I am neither for nor against QE's. As long as they work. So far, they seemed to be, protests of QE jihadists notwithstanding. :)

PL - I hear hedge funds are under-invested and could be the sideline cash that's keeping the market hovering

ReplyDeleteI'm convinced (when wearing my criminal cap) that the MMs really want this puppy closer to 1310 and then short the poop out of it. That would be chartable within reason. Their main enemy is time and they're running out of it (purely gut on this).

ReplyDeleteIt is now testing my upper limit of ES 1296.

ReplyDeleteOnce again...ROFLMAO...This is getting to be almost as fun as being an ER nurse....oops...peezed myself again.

ReplyDeleteI am not a believer in "cash on the sidelines." Every transaction has both a buyer and a seller, therefore, it's a zero sum game. If a hedgefund takes $20 million and buys stocks with it, now the guy who sold it to them has $20 million of "cash on the sidelines." When he spends it, same thing happens. Rinse and repeat. So, IMO, "cash on the sidelines" is a big myth. U.S. market money is just changing hands.

ReplyDeleteWhat keeps the market hovering is the influx of *new* money, i.e.- fresh liquidity that hasn't been circulated before... such as money flowing out of European markets and into U.S. markets. Or money printed in QE. Then it becomes a different game. Just MHO.

Yeah true, agree, but question is when? As they say one can get the levels right or the timing correct but not both (rarely).

ReplyDeleteits true. i was there!

ReplyDeletedont forget about the wheel and sliced bread too.

ahh Tesla, Einstein and Anon20. hallowed names in invention

lol

ReplyDeletewow bears just got trampled... someones on a mission

ReplyDelete1297, out of those shorts?

ReplyDeletehow tight do you normally set stops?

Haven't even been looking at the market. Got booted out of this position for -2. Oh well, it's been a good night, so I'm happy to sit in cash here for a bit.

ReplyDeleteUsually pretty tight. 1--3 points... just depends on how it's acting. Occasionally, I'll give a trade more room. But not when I'm just taking a stab.

ReplyDeleteHi Pretzel, I wonder if this almost "highlander style" immortal rally has anything to do with the Chinese Lunar New Year coming up next Monday and Tuesday.

ReplyDeleteIt so happens that the New Year is "the year of the dragon". Chinese believe that Dragon years are the best/mightiest years in the 12 year zodiac cycle.

This came to mind when my colleague casually commented "that we are going to get a recession in the Dragon year" late in December.

Just my 2 cents of thought

Hi Pretz,

ReplyDeleteAny thoughts on PCLN?

Interesting point, never thought of it that way. New cash (scukers) coming in from Europe as you stated?

ReplyDeleteBest guess would be that it puts in *some* type of top between here and 520. Much above 520 and something else going on. Honestly waiting for the market to turn before I worry too much about stocks like PCLN again, so I haven't been watching it religiously lately.

ReplyDeleteHi, and welcome! :)

ReplyDeleteThat's my thinking at present.

ReplyDeleteThis is one heck of a show to watch right now, the alternate count got within 1/2 point of being put into play so far.

ReplyDeleteHaving watched my father put together deals together with the Arabs, Chinese, and an occasional European nation I made a few distinct observations. The two most important being 1) Don't believe ANY of their reported statistics, 2) The appearance of control and understanding of their economic situation is an illusion for your entertainment (see 1)). The unfortunate thing is the U.S. has dumbed down to that level, because now that the U.S. is just another player in the game there is little advantage to being right/accurate/competent. We're not trying to compete anymore, just coalesce. The CPI as the prime example of that, with other reports being questionable at best. It has just become a ridiculous race to the bottom to remain competitive...total paradigm shift...In conclusion...WTF...I digress :)

ReplyDeletethanks -- guess it will turn with the market --- might take a nibble today

ReplyDeleteThey "work" like everything else the Fed does. QE's work like lowering interest rates "worked" to stimulate the housing bubble. The Fed is incapable of solving anything, they just move problems a few months or years down the road... and create unintended consequences to add to the mess when it finally crashes down. ;)

ReplyDeleteThere is no question that America shot herself in the foot. The US style of capitalism aided and abetted the hollowing out of America. At this point, I am urging my children to learn Chinese and Arabic.

ReplyDeleteHopefully, they will be able to get even. :)

Now ya went and did it!

ReplyDeleteMrkt is involved in an ST or IT oscillation. Stochastics work very well when mrkt is in oscillation mode. What I do is to search for a time frame that shows the full extent of an oscillation move , or stochastics moving smoothly (somewhat) from top to bottom and up again. The 10 ES does this.

ReplyDelete"This will work until the last cycle, then it will screw you...."

ReplyDeleteNot even a kiss afterwards...been there, done that.

It will not phone you the next day. lol

ReplyDeleteLol- where were you guys on this one? I get to doing too many things at once sometimes. There's no invalidation level for the second count. Wave (iii) is already longer than wave (i). I was looking at another count before that one, and I mistakingly transposed by numbers onto the new count.

ReplyDeleteI need an editor, and/or about 10 more hours in the day... :/

How about ADX. It seems to work better than stochastics in that it is more absolute. No?

ReplyDeleteThis is interesting, too -- because with where the bounce started, this could still be wave 5 of 5 on the first count.

ReplyDeletewhy not just break resistance? They moved the market all the way up here in a hurry, and now they stall...

ReplyDeleteGoing long on Mandarin :) The Arabs, not so much. Maybe that will change.

ReplyDeleteThis is where I seriously just run out of time. I literally worked non-stop on this update for about 11 hours -- but I can kick back now and can do the "editor" thing. I need a team of Elliotticians and an editor. Then I can just bark orders at them and have them bring me Lattes.

ReplyDeleteYa need to use more colors, or different characters to keep you straight...Definitely more colors, even though it bring down StockChart servers.

ReplyDeletedo tops occur while walking resistance lines like this or is it more common to tag and drop?

ReplyDeletehmmm, yes, watching that count closely - in the zone astro-wise....

ReplyDeleteAll I really expect is a snuggle LOL

ReplyDeleteTops are very rarely inverted v's. Usually, they look like this market. Several stabs at a new high that fail, then a last retest of the final failure... then a drop.

ReplyDeletefull scream ahead...

ReplyDeleteI have all you characters, but none of you help set me straight! There was like one night when Bob helped edit after the update was posted. :D

ReplyDelete"How will playing cards help?"

I am there for you. Wait, are you male or female? lol

ReplyDeleteLet me look into that, if I have it.

ReplyDeleteI see it now, it is a megaphone on the 10 min ES chart. Very interesting. Megaphones shake out the weak players by stripping them of cash before the next major move.

ReplyDeletePL hasn't gone to bed yet. I think that's a bearish indicator: He thinks the top is near and he's here to watch as it happens!

ReplyDelete. sold shorts or whatever the term is, sqeezed. just played big longto bail me out i need 1320 and will sell her there. this trend is up so that the play i thinks.

ReplyDeleteArabic is for job security. :)

ReplyDeleteWe'll be fighting turban-heads till the chicken come home to roost. If they speak fluent Arabic, they'll be able to hang out in FBI, CIA, NSA, State Department and the Pentagon - for life. :)

Absolutely male nurse or as we like to call ourselves...Nurse With Prostate (NWP)....

ReplyDeleteCOMMENNNNNNNNNNNCE.....Focher Jokes........NOW

Hey Furr, I was thinking of you this morning and your prediction from last week:

ReplyDelete"With Sun square Saturn next week on 1/19, I fully expect a reversal +/- a day or so from Wed-Thurs."

Anything more to add from the stars?

Yep, don't know where you would be if I hadn't noticed that one typo. Probably sleeping under a bridge somewhere I reckon.

ReplyDeleteI read the article quick this morning and before coffee, so wasn't terribly sharp. I'll try harder next time. :)

Akwfung, from what you've heard, would QE3 expand the Fed's balance sheet? Or just remix assets?

ReplyDeleterotf.....

ReplyDeleteBillabuster, what are you playing and where is your entry. Trying to help you out. What charting do you use? TIA.

ReplyDeleteUt oh.......!

ReplyDeleteVery hard to learn the language well enough to pick up the multiple entendres. Would have to be a native speaker for the agencies to have a real interest in you, imo.

ReplyDeleteIt's correcting now...

ReplyDeleteGood morning all.

ReplyDeleteWhat is the significance of the fact the NASDAQ Composite finally made a new record high since last October. The NASDAQ has been lagging in that regard compared to DOW and SPX.

Egan Jones downgrades Germany to AA- from AA

ReplyDeletedidnt hit yesterdays high... yet?

ReplyDeletethanks, will keep an eye out for it. also thanks for all the great work- if we can get a move im sure a donation will find its way to you :)

ReplyDeleteI have not heard about, and am totally clueless on, what those brilliant minds in the Fed will cook up. :)

ReplyDeleteIt's there. Play it, PL.

ReplyDeleteI fully expect a reversal here by Friday- question is, is it short term - (meaning a few days) or long term.

ReplyDeleteFor all of you that are day trading these moves, be aware that the moon moves into Sagittarius at 2:29 EST and may provide energy for a boost up toward the close.

I do think the top is near... but the reality is more like this: I want to "relax" before bed. After working straight through most nights, by the time I'm done I'm exhausted... but if I go right to bed, I basically have to start working again when I wake up. So I stay up for a bit to sorta unwind and answer questions. Trading alone was so much easier than trading and blogging -- at least, easier than trying to do both right, anyway. :)

ReplyDeleteBTW - both France and Spain have bond auctions tomorrow. The Spanish bonds will be most interesting since they are 5 yr and 10 yr.

ReplyDeleteHere is a visual of the megaphone and some entry/exit points marked in yellow on the stochs. Candle action will extend from one line to the other usually. That is, until it does not work anymore and a true direction appears, which will screw anyone who did not read the mrkt correctly. This is a megaphone or expanded triangle. I always try to follow up on previous charts & commentary. See the red TL from this morn?

ReplyDeletehttp://www.screencast.com/users/katzo7/folders/Jing/media/acd49a61-e6c9-4830-90fd-34b96c3f5fcf

Eagan Jones downgraded Germany to AA- from AA.

ReplyDeleteThe market said, "Germany? Where is Germany?" :)

Alright, on that note, I'm going to stumble off to bed and try to get some rest. Got a few orders entered, so maybe the market will bring me a late Christmas present. Night all! :)

ReplyDeleteIf this megaphone plays out, not a bad time to enter shorts as we've completed three ascending peaks and have some RSI divergence

ReplyDeleteThanks for the update.

ReplyDeleteLOL! Or the market said: Eagan Jones? Who is Eagan Jones? :-)

ReplyDeleteI dated a lot of nurses, married/divorced one, became one (after dropping out of law school)...Life and death are about as real as it gets. It's like being a teacher, a cop, a priest, and a psychologist all at once....Good times and horrible times (keeps ya grounded)...

ReplyDeleteSo be nice, or I'll stick a tube in ya.... :D

Hello board. I have the NDX breaking thru 2412 and now it appears 2438 is the next stop this week. I have tried to post a chart of my count but I am all thumbs apparently. This is a rare month for the NDX. An open after the last OPEX of 2215 and now a trading range of 200 straight up since Dec 20. It appears something will give in a big way soon. Just not sure it is this week. Any ideas on this index? I will try to post a chart again.

ReplyDeletenever mind lol

ReplyDeletetrading journal, day 15:

ReplyDeletebulls win. again.

shorted ES @ 1299.5 w stop at 1301.25.

ReplyDeleteIf you saw at my post below you'd have won at least 3.5 pts on this current move. Just be on the right side... Wait a bit for there may be a pull back then there may be more to come but be focus and make your decision.

ReplyDeletebah humbug

ReplyDeleteMYSELF, I am starting to think that the great economist Irving Fisher had it right back oct. 1929, 3 days before the GSC3 crash, when he proudly said publicly: "stock prices have reached what looks like a permanently high plateau."

ReplyDeleteThis market is a zombie dracula, for no matter how many wood stakes I drive in it, it stumbles back up, every day.

Dollar index backed up a little bit once again to around 81, gold and silver want to die but still refuse to. whatever.

but this is a fundamentally zombie market, of that I am CERTAIN, and it is already DEAD, but does not know it yet.

because, central banker dr. caligari's give this usa spx golem a european virgin's blood every night, keeps him hard.

So, how many young european virgins are still left, and, whose naive blood can matter more than the old euro hags,

that country by country, have overspent multiples of what they earned? How long, before eu runs out of virgins?

Few eu virgins left to sacrifice, IMO, for the eu hags' 50yr. of excesses.

And I also read an article yesterday, of record market withdrawals.

Thus, I continue to believe, that what is coming, very very soon,

is a MAJOR gap down, overnight, and NOT a slow trickle down.

I see a +/-50 point spx drop overnight, back to MY trendline,

where battle will then again be staged, for at least a few days.

MY overnight target: spx1245 area, where trendline is now,

and I predict nearly NONE of you will be aboard, to ride it.

interesting, what are the implications for this? retrace back to 1285, but which way is it suppose to breakout?

ReplyDeletedle:

ReplyDeleteWhat's your count? TIA

Anon20, thanks for this take on the situation. I'll be there. I'm massively short, from two weeks too early, and hurting, but waiting for revenge, a dish best served cold.

ReplyDeleteAnybody counting the waves?

ReplyDeleteI am with you as well. I too shorted way too early and have been holding and waiting for the top and drop. Thanks for the posts Annon20. Please keep them coming.

ReplyDeletedle7319, do you trade futures or the cash market or individual stocks?

ReplyDeleteall this emotion is making me nervous as a bear... the top could come another 40 points higher.... just saying

ReplyDeleteThanks Anon...My top for RUT is 780. Then I will likely short this creature.

ReplyDeleteI say we are now on (v) of iii in PL's Alt Count chart of today. Seconds?

ReplyDeleteImplications are that it will work its way up and down til it tires and goes the correct direction (down me thinks). It is an exhaustive phase, robbing both sides.

ReplyDeletedont need helpfrom u. thats my problem following ppl . i saw up from 1260 and didnt play what i saw.

ReplyDeleteThat looks like it to upside, trade your low charts tho.

ReplyDelete1305 could of been the end of it. It counted as a 5 of 5 of 5 of c of 2 of c. Slight 5th wave overthrow of the upper wedge trendline, bear exuberance everywhere, in the middle of major resistance, super stretched divergences. I cannot think of a better place to call a top then right here. I do see one other alternative (if this is a wave 2), and that is we just finished 3 up of c. We will get a correction down to the lower wedge trend line around 1260 and another move up for a 5th wave.

ReplyDeleteLOL, don't take my word for it though, I am in pain from bad calls for the last month.

1305 rejected? tbd

ReplyDeleteAs Albert says below, OR, per PL's other SPX chart - Wave 5 yes, but getting ready for a iii of 3 of 5 push up

ReplyDeleteRut ohhh, I faint at needles.

ReplyDeleteand you wont have it either! preparing now for verbal assault ;-)

ReplyDeleteI picked a bad time to become a short and hold trader a few weeks ago.

ReplyDeletebeen lurking and reading PL and others.....thanks much

ReplyDeleteakwfung, I think PL is the best of this stuff... Trust him.

ReplyDeleteSPY/SPX

ReplyDeleteDouble top on the 120/240, that will attempt to shake every short out.

ReplyDeleteCould still be v of 5 of C of (2) on the first chart by my count.

ReplyDeletePossible Agreement

ReplyDeleteBy Graham Shove

| Jan 18, 2012

| 1:54 PM EST

At 12:28 PM heard "Greece To Reach Agreement With Private

Creditors By Week End." Getting the deal with creditors finalized would

be a major milestone in any restructuring....

Since you have been unemotionally correct for a few weeks, I will answer you.

ReplyDeletewhat does 1340spx relate to, in dow industrials, a break above prior 2011 high, right?

well, I will tell you, IF dji breaks above prior 2011 high, even intraday, I will admit bull market.

as you do not appear to respect 2011 h&s neckline in this area, as SUPREMELY inviolate powerful,

so, since you have been correct so far in 2012, I will say, if spx goes to 1340, then, bull market.

I rate odds at less that a 1000 to 1, but hey, I was also sure MY 1255spx trendline would hold.

So, how far can idiots go, how stupid, linear, moronic, imbecilic, can modern empty amerikans be?

you tell ME. you are one of them.

Trust but verify .... :)

ReplyDeleteI just want to double check and get oriented before jumping in.

See this little pop right after I said it was all down, happens often. Exhaustive ending spike if that is what it is I think, will know in an 1/2 hour or so, and is purposeful to reset the stochs back to the top. Let us see. You can tell them as the dont quite come up to the previous high on small time frames. They are really a failed attempt to go higher, or a failed 5.

ReplyDeleteYeah, me too, since October. Over 400 failed trades. But no more, from now on I'm going long and buying the dips!

ReplyDeletei see a major melt up at close, GS is dominating today

ReplyDeleteI will short at 1360. If it doesn't make it I miss the move. This thing is hard wired upward

ReplyDeletei am ready; i placed a march spy put at 130! let's see how much that one will be in the money by then!

ReplyDeletekatz07.....sure do appreciate your grasp on the market....thank you

ReplyDeletefirst mouse gets the squeeze, 2nd gets the cheese!

ReplyDeleteThnx, I try my best....

ReplyDeletecobra says bulls need convincing new high right here or it's failure and we drop

ReplyDeleteI am short ES.

ReplyDeletewho's cobra?

ReplyDeleteThis thing changes per minute and you need to react... Ex. at the close of yesterday, how many people would think it will resume its uptrend today but it does. Do you know if the market was pushed just a little bit lower on its low yesterday then it may be in downtrend today? It's very critical to make a call...

ReplyDeleteim out. gl.

ReplyDeletei see the chart from sept 2010, and it had this exact same channel setup that went on for 4 MONTHS. just steady march upward, almost no spikes.

ReplyDeleteThanks.

ReplyDeleteYesterday, I thought the sucker would go up and may be retest 1300 before coming back down. I though it might be safer to ride it down instead of trying to follow my up call.

ReplyDeleteThis is not a push over. :)

http://www.cobrasmarketview.com/

ReplyDeleteHe is pretty good...TA and intraday swings.

reversal on the breakout needs downside follow through.

I think we are heading for the ultimate pain zone for those holding shorts... like me.

ReplyDeleteLOL. It went down because of a little glich at 1291.25 ES (as I told everyone) but the momentum pull it down lower. Here is another factor - momentum. That's why it's very dynamic.

ReplyDeleteHas PLs preferred count be eliminated yet? Could this not till be a wave 5 of 5?

ReplyDeleteWhat glitch are you talking about?

ReplyDeleteRe-opened small short position at 1301.25 after getting stopped out. Still looks stretched to the upside to me.

ReplyDeleteIt would be nice to have a break out, to the downside, of this 'diagonal' to end the day. But I think any break down will be short lived. I believe that the consequences of money printing and false economic growth need to start showing up in company earnings and lower consumer spending and lower GDP numbers before we see a real break. The central banks and governments have rigged the game and will do whatever it takes to keep the patient alive... even if it means that the final fixes will be that much more painful.

ReplyDeleteIs he currently bullish?

ReplyDeleteA sell order at around 3:00 pm.

ReplyDeletemelt up- hopefully enough of a run up to kill off all short stops. we need capitulation, not a slow drift up.

ReplyDeleteAre you daily trader or short term trader? Don't make a decision like that. It's dangerous. Don't be emotional. It won't work. It can be changed tomorrow. You need to open your mind to perceive what the market telling you and act on it.

ReplyDeletewe got the new high. any updates from cobra?

ReplyDeleteSymmetry on the SPY since 12:30PM indicates a potential fast move could begin around 3:30PM.

ReplyDeleteim thinking 1320.

ReplyDeleteWow... even pushing above diagonal top trend line. Could this be the start of the final leg to the ultimate pain zone?

ReplyDeleteNo, I think he is also expecting a top somewhere in here. Wedge forming, gotta break at some point right?

ReplyDeletewhile we all watch the FIB 78.6 retracement please read:

ReplyDeletehttp://www.businessweek.com/news/2012-01-17/s-p-500-rally-may-stall-as-bears-disappear-technical-analysis.html

I think it closes down from here.

ReplyDeleteso far so good, everyone has 1310 pegged so we need to conclusively break it to scare the bears off

ReplyDeleteToday Christine Lagarde said she will find out the money to save Europe, great and the market goes up! Two observartions 1 to save Europe we need Europe to reduce the debt, financing the debt is a way to loose money. 2 nobody will lend many to FMI to finance losses. Good luch

ReplyDeleteHey... Didn't I read about bullish and bearish sentiment indicating at top was close from someone recently? Some Pretzel or Twisted or something like that :)

ReplyDeletewe have a phrase- drink the cool aid. Everyone knows its all wrong, but everyone keeps on having a party. trends last far longer than they should, look at where we are now- 100 spx points from the december low-

ReplyDeleteWow... not slowing down... accelerating upward... IMF comes out and says, "We want (need) another 500B to 1T to make sure we can backstop everyone." And the market moves up. Everyone is numb to the sound of printing presses... it has become background noise

ReplyDeleteThat's because pronouncements such as these are stated in terms of years. Lagarde doesn't say things like, the banks' credit will freeze next week.

ReplyDeleteread these posts- EVERYONE is STILL short. they ALL have to capitulate before we can turn. MORE CAPS!!!

ReplyDeleteBut there is always the possibility that the push up was to entice the longs and tomorrow we open back down. I think they (you know, them) want to still pull in more longs and squeeze some more shorts so we will still see another week or so of the upward movement.

ReplyDeletewe are almost back where we were before the Europe problem began....

ReplyDeleteFrom a financial view point someone has to lend money to IMF to finance Europe debt and I dout the someone will do it. nobody likes to finance losses that will increase if financed

ReplyDeleteThey may hold these levels or push higher up until right before / after AAPL earnings which are scheduled after next Tuesday's close.

ReplyDeletehope springs eternal. Stops are in, emotions are out.

ReplyDeleteWow. We are pinned right here.

ReplyDeleteassuming we get another upward revision tomorrow-

ReplyDeleteearnings are not bad (gs was up 8% today!), europe crisis is being dealt with, greece won't default, euro rebounded nicely, mortgages are up in US or at least appear to be up- wondering what the catalyst will be other than the market hit a red line on a chart... are we waiting for an event that already occurred in august? that was the time to be short, since then it paid to be solidly long...

just trying to stay critical and neutral...