We'll start with the updated short-term chart, then discuss things in more detail:

So the chart only covers "bear: i/a" and the "bull: 5" options in broad strokes, but were the market to continue directly to new all-time highs, THEN (and only then), the following additional options might apply:

- A complex b-wave high (slight new high, then back below the blue "bull: 4" label, then back above the ATH).

- A subdividing fifth wave (leading to a solid rally)

- An ending diagonal (with the current rally being iii of said diagonal)

I'll cover those options in more detail if it becomes appropriate.

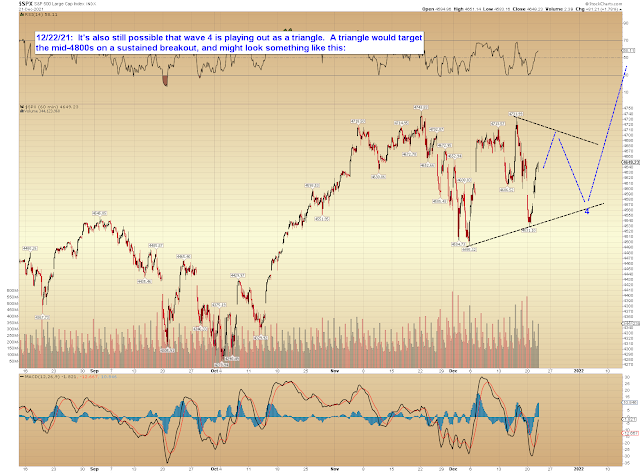

Another near-term option is outlined on the chart below:

In conclusion, the trading range, combined with the ambiguous nature of the pattern, is making the market's near-term intentions a bit foggy, but there isn't much to be done about that other than to await more clarity.

Also, since this is the last update before Christmas, it's tradition to post the link to A Christmas Story -- Reflections on What Matters. Trade safe, have a great holiday, and Merry Christmas!

No comments:

Post a Comment