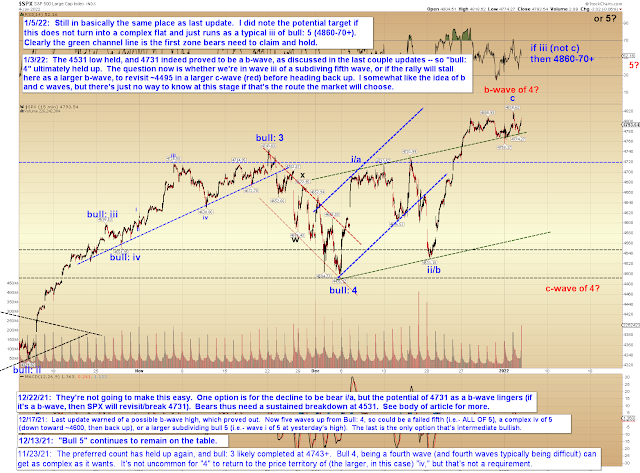

As I noted on the chart, I somewhat like the idea of a complex flat (red b/c), but there's just no way to "predict" that at this stage. If the market instead wants to keep running higher in wave iii of blue bull 5, it certainly can do that.

So no real change there, but I have added a bit to the chart:

I also thought there might be value in sharing the chart that caught my eye prior to last update -- the chart that led me to "like the idea" of a complex b-wave/c-wave (below):

Big picture, SPX is still right up against the upper boundary of the very long-term trend channel:

On another note, it's crazy to consider that SPX is now up seven-fold from the 2009 lows, and triple what it was at the 2007 high. Is the economy three times as strong as it was in 2007? Of course it isn't. But $7 trillion in QE buys a lot of feel-good, I suppose. At least for a while. Kinda reminds me of something my father liked to quote:

"Sin is fun for a season."

In other words: Short-term fun, long-term mess. The problems always come later, when we have to stare down the consequences.

Beyond that, no material change since last update. Trade safe.

No comments:

Post a Comment