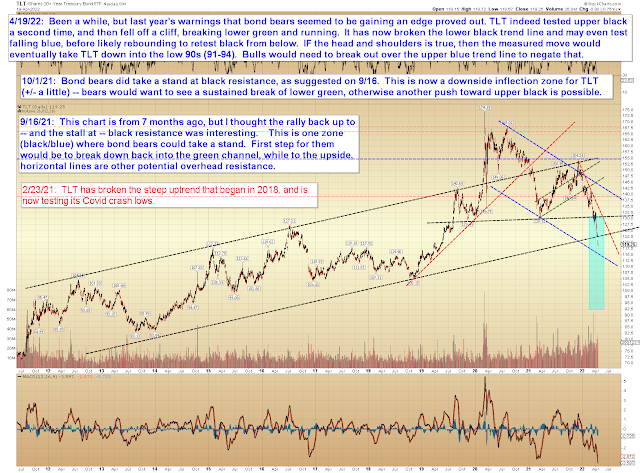

First up is TLT. Note that the potential head and shoulders target is long-term, not something we're likely to reach tomorrow; as noted on the chart, we'll probably backtest some broken levels first:

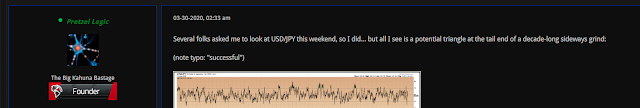

Next is USD/JPY, which took two years to confirm the read I made in March 2020 (published only in our forums, I think).

Interesting to note that the series of three wave structures was instrumental in making this read -- many, many similar experiences over the years are why I remain a proponent of Elliott Wave Theory:

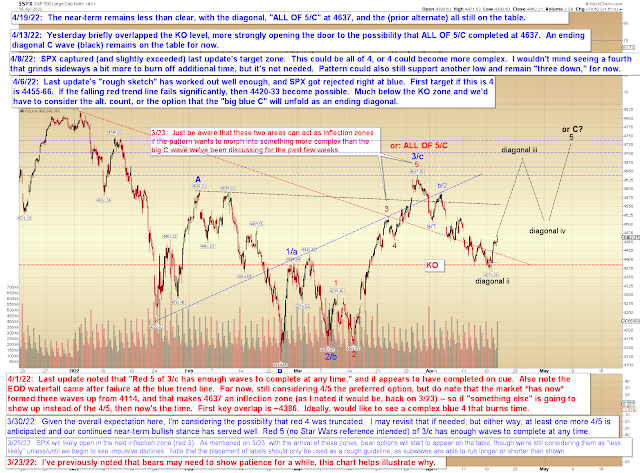

Next, we'll look at the options in SPX:

And the "alternate" count, which remains one of the options for now. Even though SPX did overlap the KO level, it hasn't done much else to add any confidence to this count so far. Perhaps that will change soon:

In conclusion, the near-term pattern has been choppy and is not a clear impulse or a clear corrective wave so far, keeping the near-term options open in SPX for now. First thing bears would like to see is a sustained break of yesterday's low. Trade safe.

No comments:

Post a Comment