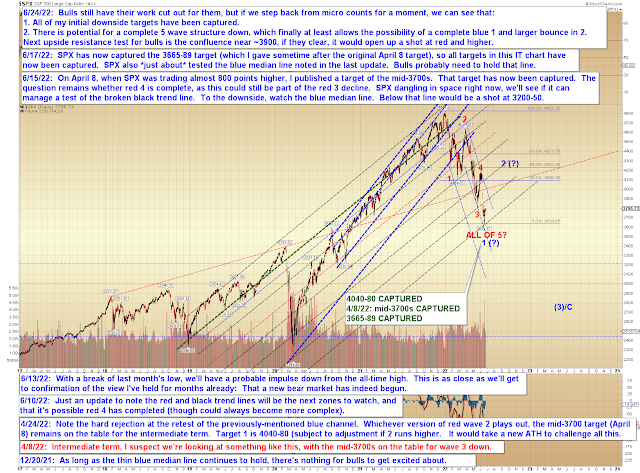

Let's start with SPX:

BKX helps put the chart above into more perspective -- we can presume either BKX/SPX are working on micro red (iv), or are trying to mount a larger bounce in 2 (or a more complex larger 4 -- not functionally much different at this stage):

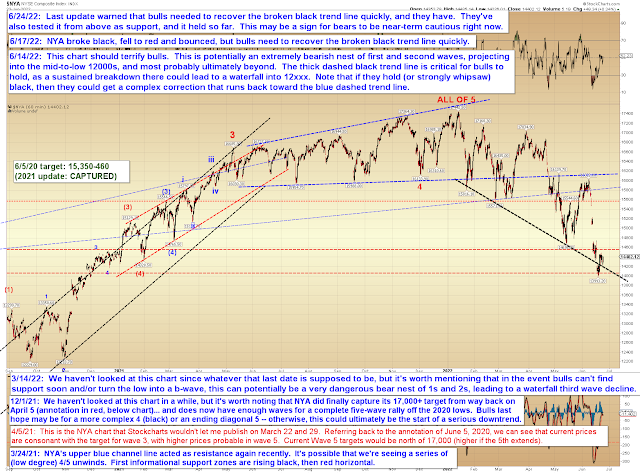

NYA has whipsawed its breakdown:

COMPQ is bouncing from its 50 month MA, a possibility we were alert to earlier:

A different look at COMPQ:

In conclusion, the ingredients are finally at least present for a larger bounce if bulls can clear the next upside resistance zones. We're into the "picking nits" part of Elliott Wave analysis, where the easy money for the move (at least, for this leg of it) has already been made. At this point, the structure could "possibly" support one more micro fifth wave lower -- but zoomed out at the larger time frames, it already has enough waves to call it "five down." Which means this is certainly an area where bears might finally want to show some caution. The next zone we'll be watching is the 3900+ area on SPX. Trade safe.

No comments:

Post a Comment