Anyway, yes, we're still in the inflection zone and apparently always will be. Best I can determine, this is some type of trading Purgatory we've all been sentenced to, probably for making fun of Ben Bernanke's beard all those years ago.

No! Of course, I'm only kidding! Obviously, Ben Bernanke's beard was truly an object worthy of scorn, so no just Deity would punish us for that.

Must have been something else.

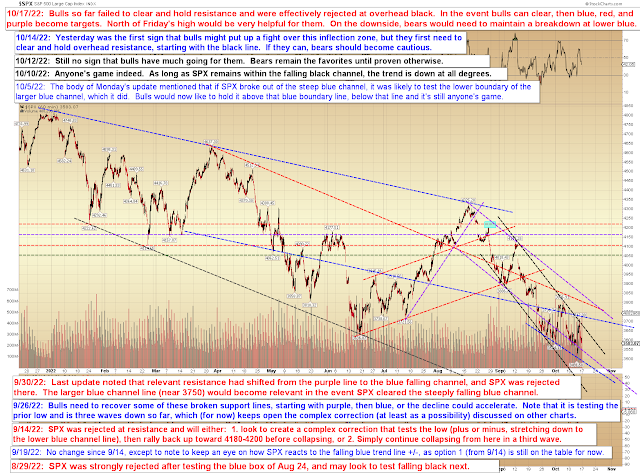

Big picture can be summed up as, shockingly, "no material change":

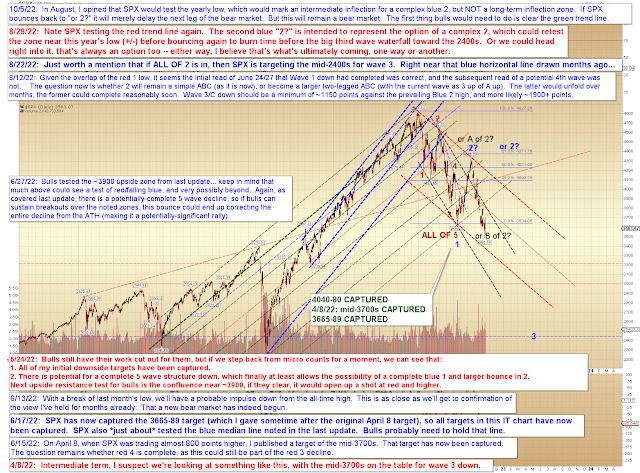

Near-term, I have drawn up some potential targets in the event the market can break out (i.e.- up) of Purgatory:

Finally, just the simple trend line chart:

In conclusion, I still believe bears need to be cautious if SPX can sustain a breakout over resistance, potentially very cautious -- but so far, it has not done so, though as of this exact instant, I'm slightly leaning toward the idea that it will (just a lean, though, and I might reassess that if we head much below 3540 SPX). On the downside, bulls should be very cautious if SPX were to sustain trade below the thick blue lower trend line. Trade safe.

No comments:

Post a Comment