[I]t seems the Fed only reaches its goals by continuing to feed volatility and destroying wealth until the economy is in recession. Thus, the Fed is not going to reverse course when the economy starts to struggle (unless inflation has abated), because they currently view a struggling economy as necessary to tame inflation. And the Fed won't bail the market out as it heads lower, because the Fed wants the market lower.

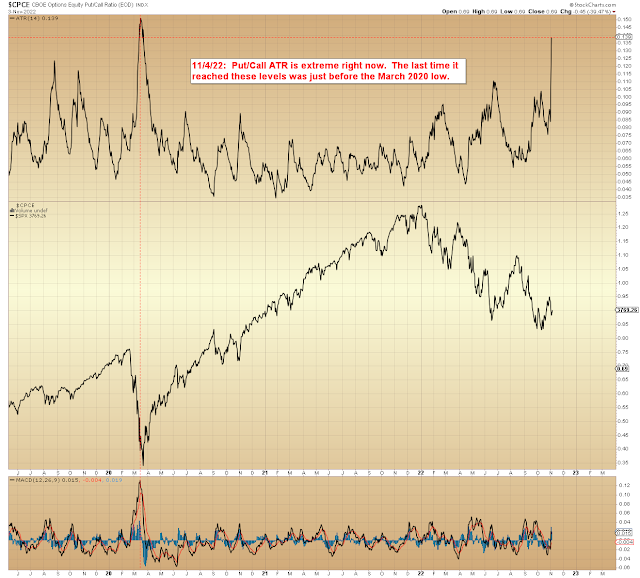

Now, with that out of the way... it's worth being aware that the market often likes to mess with the majority, and there are a lot of "newly-minted" bears after Powell's speech:

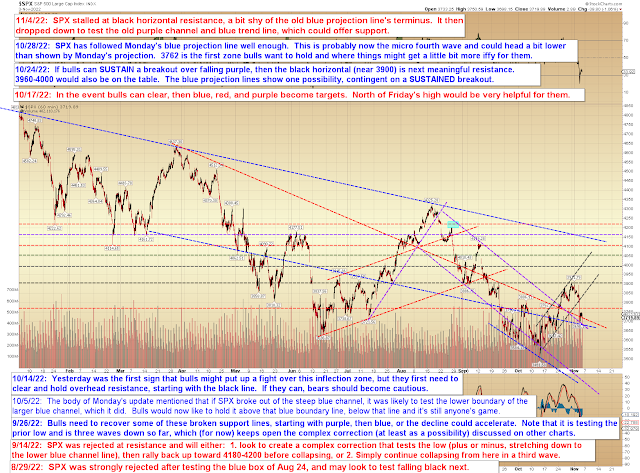

Big picture, I decided to try to simplify things as much as possible, for clarity:

Near-term, there may still be some value in the SPX trend line chart:

In conclusion, the big picture remains exceedingly bearish, but the market still has options near term, and blue 2 or red 2 (2nd chart) are still on the table and would be a lot of fun here, as it would really throw a lot of new bears off the trail. Also, I should add that in the event we are already in blue 3 of red 3, then, in that case, 3 of 3 is usually a crash wave, so be aware of that. Trade safe.

No comments:

Post a Comment