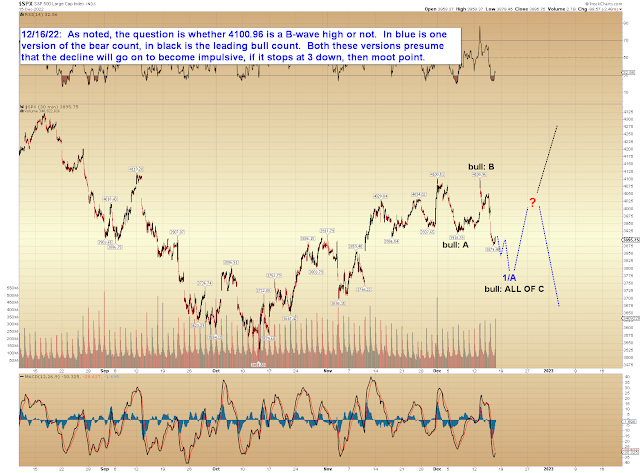

We can see on that chart where a simple 3-wave decline might end, but I'm somewhat presuming that this will go on to become an impulsive decline for maximum ambiguity. I've drawn up the most straightforward bull and bear versions of this on the SPX chart below:

I've also noted this first near-term downside inflection on the SPX IT chart (presuming this does go on to become an impulsive decline, of course -- see INDU for the "3 down" option). Again, do note that this is simply the most straightforward version of this, not the "only option." If this decline does become impulsive, either as wave 1/A or as the C-wave of an expanded flat, it does not need to end in that inflection zone and is well within its rights to terminate on either side of it.

[NOTE: Typo in annotation; should read 3790-3811, not 3890-3811]

BKX might lean me slightly toward the more bearish option, as this chart does not look particularly good for bulls:

In conclusion, BKX looks a bit sickly, but the most recent tops in SPX and INDU are not ideal, leaving open the possibility of a B-wave high expanded flat pattern. Hopefully everything above helps readers to navigate this with a bit more understanding as it unfolds. Trade safe.

No comments:

Post a Comment