On Wednesday, Chairman Pao(well) announced that financial conditions had tightened significantly (even though, by most objective measures, they have not) and that the "disinflationary process has started," hence that the Fed was probably just going to call it a day soon and get back to golfing and loan sharking, or whatever it is the Fed does when it's not creating new bubbles while actively dropping money from helicopters. The market responded, shockingly, by rallying.

Chairman Pao also cautioned that it would be "premature to declare victory" against inflation, and that inflation was "still running very hot" -- but most traders were too busy screaming "buy!" to hear that part. Interesting to note that, while goods are experiencing some disinflation, commodities and services are still accelerating.

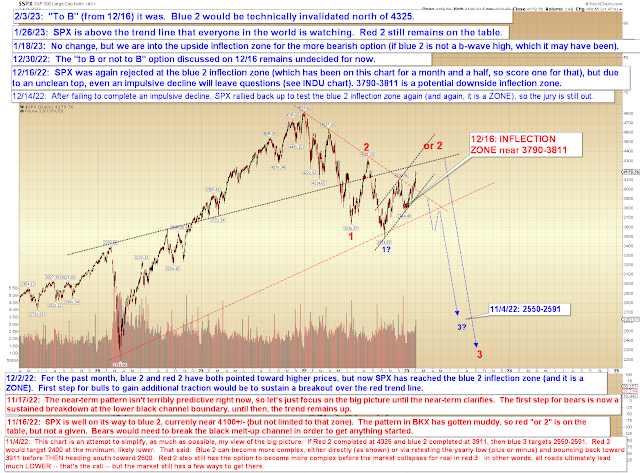

Chart-wise, the "to B or Not to B" question from way back on December 16 (which revolved around the suspicion that 4100 may have been a corrective B-wave high and thus ultimately fated to be broken) has finally been answered in the affirmative. That of itself does not invalidate the potential of blue 2 (blue 2 would be technically invalidated north of 4325).

Near-term, SPX broke above the next trend line:

Finally, NYA has come very close to its "textbook" upside target:

No comments:

Post a Comment