Next, let me reprint something from a couple weeks ago, because it remains relevant:

This lag suggests two diametrically opposed possibilities: Either SPX only has a little more upside, and the rest of the market will drag it back down -- or SPX is headed toward at least Red 2 and that will drag the rest of the market up. NYA may become particularly germane here -- IF it can break above the red c/3 high, as it would then need to go on to form 5 waves from the 15055 low. Right now, because of the divergences across markets, it's a bit early to determine how significant SPX's breakout may or may not be, so how these markets collectively behave during the upcoming sessions will be important toward drawing firmer conclusions one way or the other about the larger time frames.

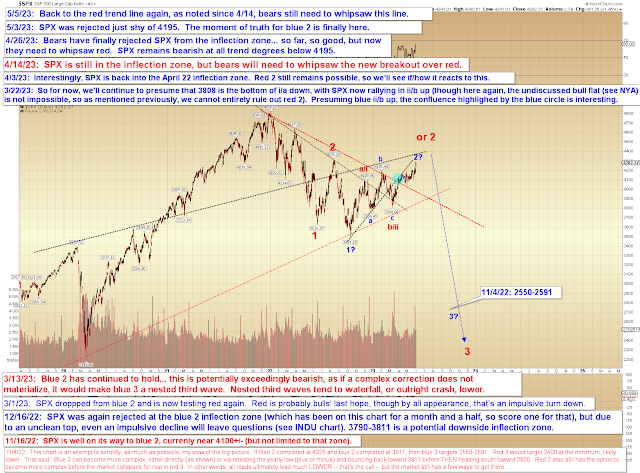

Finally, the big picture chart again, to put it all into perspective: Above 4326 and Blue 2 would finally be off the table, leaving Red 2 as the main bear option:

In conclusion, Friday's move has finally put bears into a "do or die" with blue 2, given the proximity to 4326. The second chart already hints at Red 2 as a distinct possibility, but let's see if bears have anything up their sleeves at horizontal resistance. Trade safe.

No comments:

Post a Comment