Having cleared its prior swing high, NYA's most straightforward option would be for the current rally to be a C/3 wave. There are still other options, but this is the most "straightforward." On the opposite end of the spectrum, the absolute least straightforward option would be for NYA to form a b-wave high and drop back toward the blue 2/B. Until we have signals for that (such as an impulsive decline), we'll just keep it in the back of our minds, though.

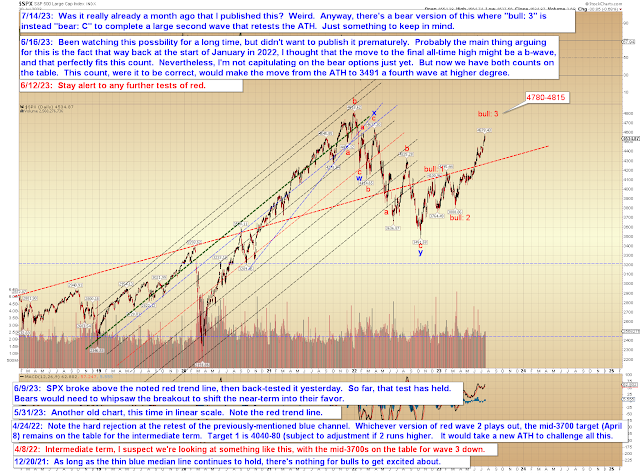

SPX, likewise, is apparently in a 3/C wave rally.

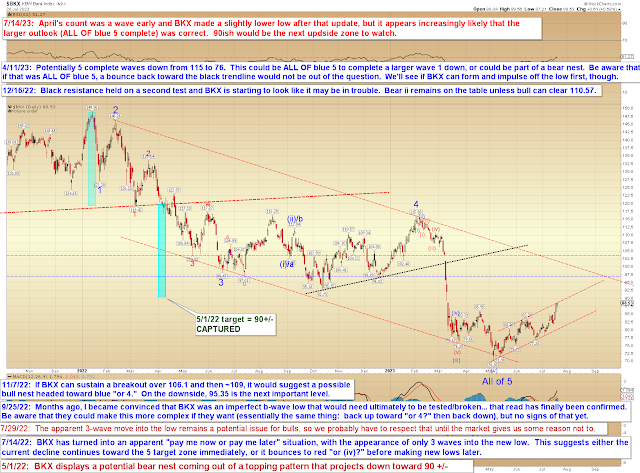

BKX is an interesting chart in this context: If it's correct that BKX formed a large impulsive decline off its 2022 high, then it's currently in a large second wave bounce -- which, although unlikely to end immediately, will eventually end and lead to another big wave down. This is very much worth keeping an eye on, as the rest of the market would inevitably be dragged down by a major disruption in the banking sector.

From a fundamental standpoint, the simplification of the bull case is something like: "Due to the lessons learned during Covid and concerns about future supply chain disruptions, private industry is in the process of revitalizing the American manufacturing base, which will lead to an era of meaningful prosperity."

The simplification of the fundamental bear case is something along the lines of: "Yeah, but inflation often comes in waves (see the 1970s, when inflation rose, then dropped down to 'normal' for a few months before spiking even higher in the next round) and we've only finished the first wave. The Fed isn't out of the woods yet. Plus we still have the worldwide debt bubble to contend with, and the economy hasn't meaningfully contracted in order to burn off its prior significant excesses. We're still carrying too many zombies to start a new era of prosperity."

In the coming updates, we'll take a closer look at each of those arguments (plus some others). For now, we'll presume bulls have the ball in a C/3 wave up either way. Trade safe.

No comments:

Post a Comment