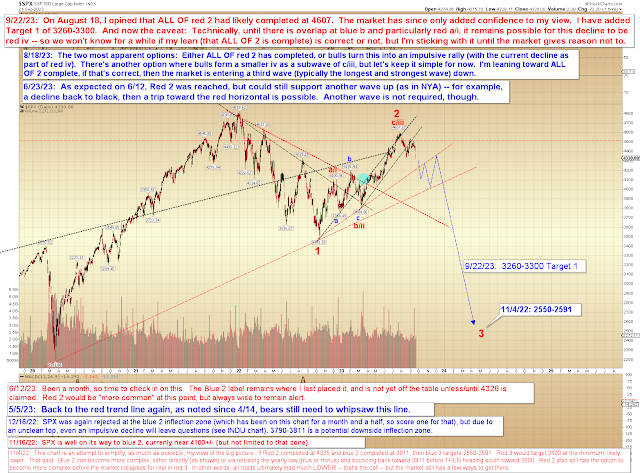

Bears finally broke the green trend line, but of course, have yet to hold that against whipsaws, so I don't want to imply that we should be complacent here, as the "complex intermezzo correction" is still on the table (if seemingly less likely):

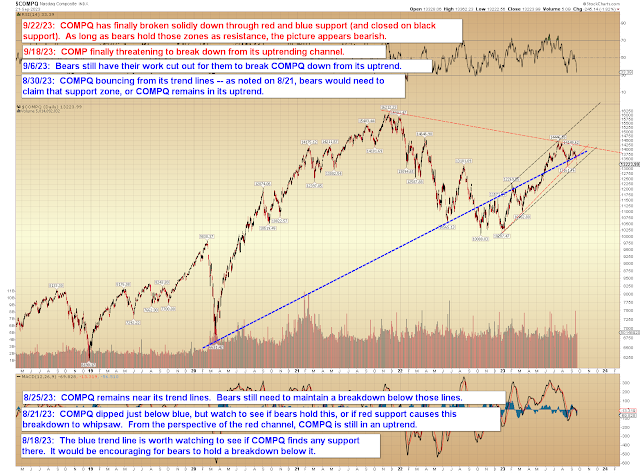

Finally, COMPQ broke red and blue support, but closed the session right at its next support zone, so a bounce isn't unreasonable here, and bears do need to claim that (which I suspect they will) to add confidence:

In conclusion, SPX this month has captured two upside targets and two downside targets. The next targets are listed, while bulls' main hope for the foreseeable future seems to be, at best, for a complex correction. And while my lean on August 18 went against the grain at the time, it may not seem so outlandish now, and I continue to suspect we're in the very early stages of a massive third wave decline, to break the 2022 lows and beyond. Trade safe.

No comments:

Post a Comment