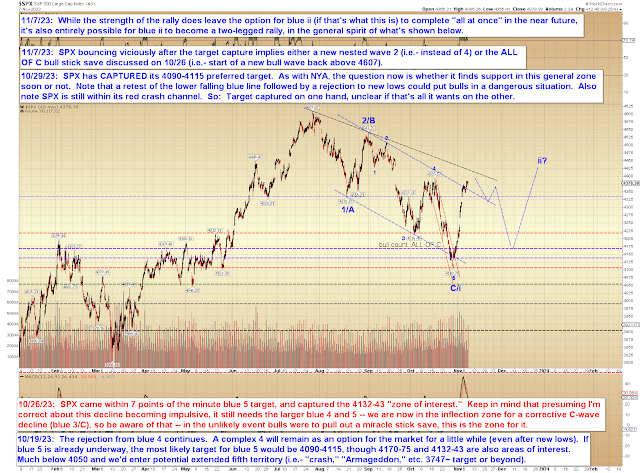

1. For bulls: ALL OF C completed at 4103 SPX and it's on to new highs (north of 4607).2. For bears: The recent decline was a nested first wave and the current bounce is a nested second wave. In full disclosure, the argument against this version of events is that the prior wave extended 1.618 times the A/1 wave, which is common behavior for C waves, not as common for nested first waves. The arguments in favor are more fundamental than technical.

The bull option is straightforward, so there's no need to discuss it further.

The bear option breaks down into a couple of suboptions, which I've attempted to roughly sketch (don't hold me to these, because where we are is not this predictable) on the following two charts.

Bear suboption 1 is simply "run it up as fast as we can, then run out of gas like an unsuccessful test rocket":

Bear suboption 2 is to drag things out for a while by forming a two-legged bounce:

So bears should keep in mind that even if everything goes their way, the market can always grind along for a while, and could even give bulls something akin to a false Santa Rally.

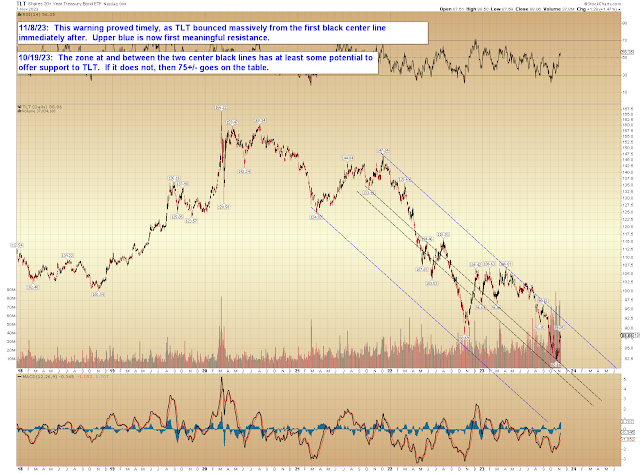

I also wanted to quickly update the TLT chart. My warning from October 23 proved quite timely:

In conclusion, there's no quick and easy roadmap in the current position, so we'll just have to watch for potential impulsive declines in real-time and take it from there. Waiting for impulsive turns can sometimes help bears stay out of trouble in the event the "straightfoward bull count" shows up, since that approach prevents one from shorting the entire ride up to new highs. It also gives one a clear stop (against the high where the (pending) first impulse down began), as opposed to the current situation, where the only crystal-clear level is way up at 4607. None of that is trading advice. Trade safe.

No comments:

Post a Comment