Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, March 3, 2023

SPX Update

Wednesday, March 1, 2023

SPX Update

Monday, February 27, 2023

SPX Update: "Easy" Part is Over for Now

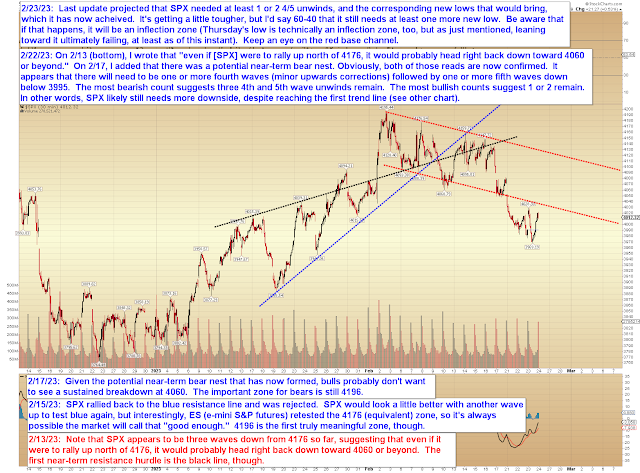

In Friday's update (which was published when the S&P futures were trading just off of Thursday's high), I wrote that I suspected that SPX needed another new low, which it reached at the open. As I also wrote, that low would be an inflection point. I wrote this because that low is potentially three complete waves down in SPX from 4195, which means we shouldn't entirely discount the possibility that bulls could regain near-term (or larger) control from here.

What bears would like to see now is a bounce in a larger fourth wave (which could take a week or longer to unfold), then another new low in a fifth wave.

SPX came up a hair short of the red trend line, but was in the ballpark:

In conclusion, the "easy" part is over for now, and I can no longer promise more new lows -- we'll just have to see how it develops for a bit, to determine if the market wants to form a potential impulse down, or if that whole decline was merely a correction. Trade safe.

Thursday, February 23, 2023

SPX Update: New Lows Confirmed -- Now What?

Wednesday, February 22, 2023

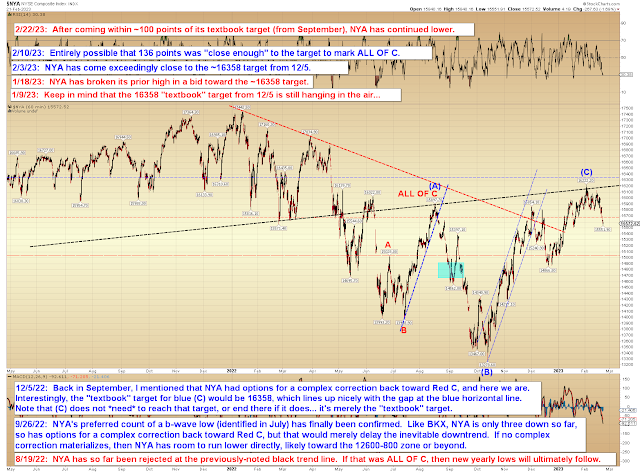

NYA and SPX: Confirmed

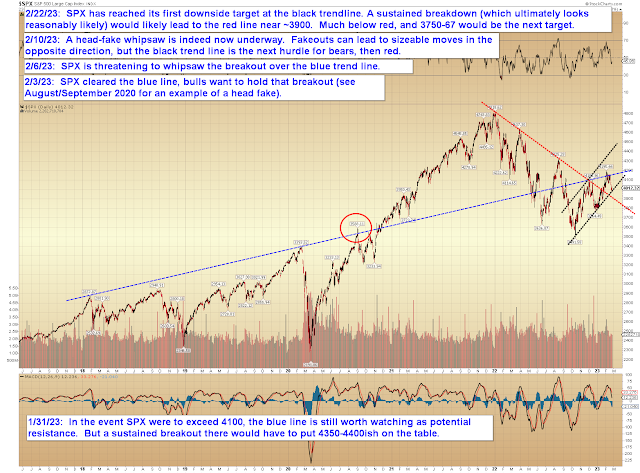

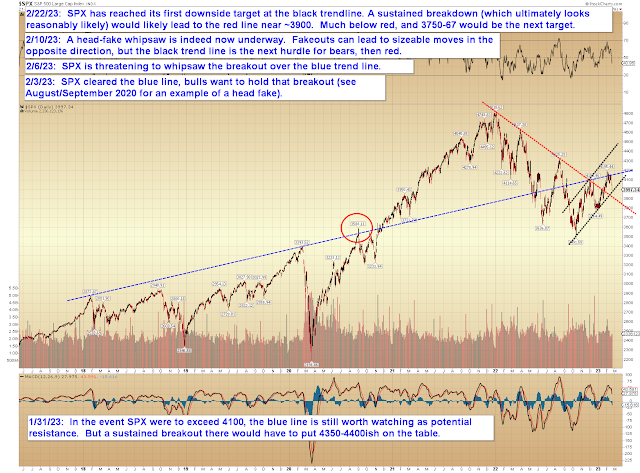

On February 10, I wrote:

[B]ears are still very much in the near-term game here, and normally one would expect some downside follow-through to the pattern so far (though worth being aware that it's three waves down from 4176 so far, which, 9 out of 10 times, means it either needs to become five down, or it will turn into an expanded flat that runs back toward 4176 before heading lower later; 1 out of 10 times it's something weird like a double three).