Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, October 6, 2023

Oil, SPX, NYA, COMPQ Updates

Wednesday, October 4, 2023

Where Do We Go from Here (Now That All of the Children Are Grown Up)?

America is getting progressively dumber at an alarming rate. This is happening both literally...

And anecdotally. Both of these next two items are screenshots from the U.S. Treasury official website. Item one:

These are only three examples of the types of news items you and I see every single day that cannot help but cause us to question what the hell this country is doing. It's as if there's a massive tsunami headed straight for us but, instead of making any effort to prepare or even acknowledge its existence, we're busy arguing about whether Coke is better than Pepsi. And we're getting REALLY HEATED about that argument. As if that's something that matters more than, say, the fact that we're going to be crushed by interest payments on the debt, or the fact that banks are holding tons of questionable assets, or the fact that our actions on the world stage are uniting our worst enemies in common cause against us, at the exact same time that we're weakening ourselves both financially and militarily (some of our munitions stockpiles will take over a decade to replenish -- and that was as of January), and the fact that historians may well look back on this time in history as "the Start of World War III."

Along with a million other serious and, more importantly, real issues that we're completely ignoring.

Something to think about as they test the emergency cell phone alert system later today. (Meanwhile, Russia ran nationwide drills for nuclear war yesterday. I'm sure the timing of both of these things is purely coincidental. Don't give it another thought.)

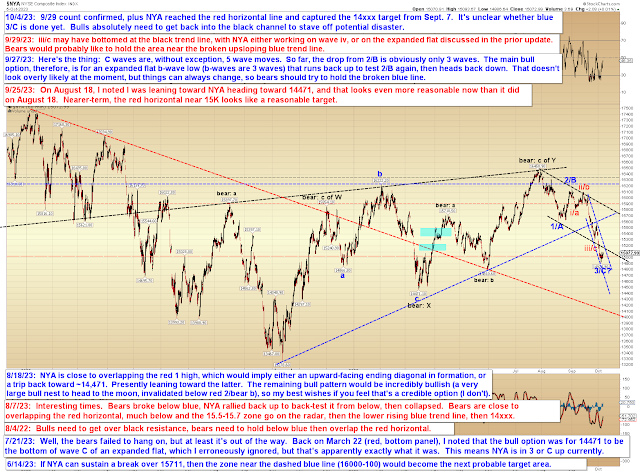

Anyway, NYA captured its target from two months ago (typo says "Sept. 7," but the target was from August 7):

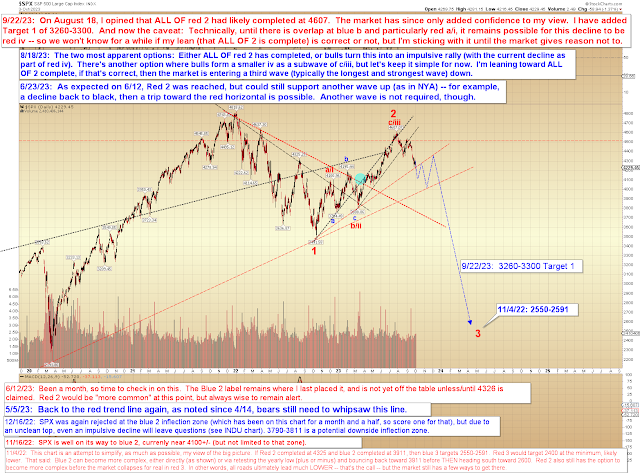

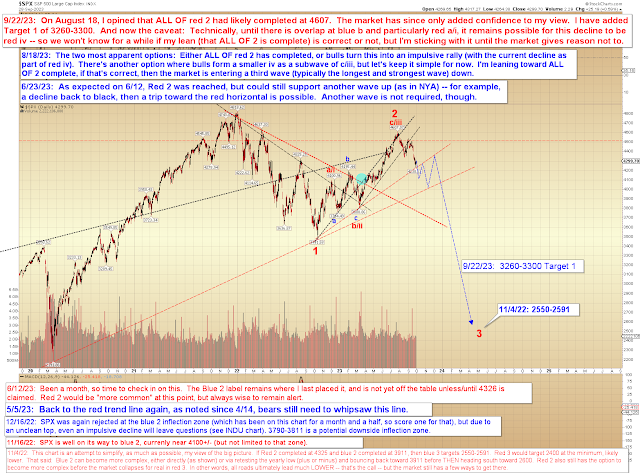

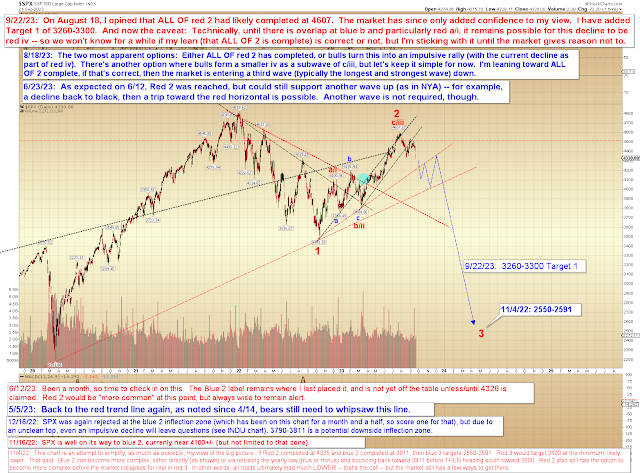

And SPX is tracking this "roadmap" chart (not updated since September 22) well so far:

Other than mentioning the target captures (targets often act as support/resistance, so this could lead to a near-term bounce), there's no change from recent updates. Trade safe.

Monday, October 2, 2023

SPX, NYA, GOLD: This is a Little Weird

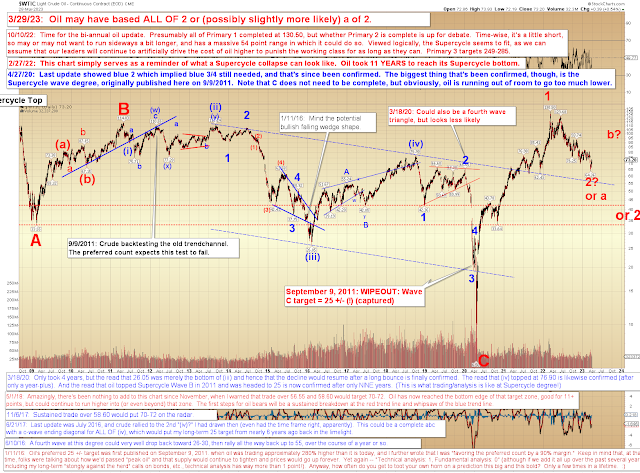

Friday, September 29, 2023

SPX, NYA, TLT: SPX Captures Target 1; TLT Confirms Long-Standing Count

Wednesday, September 27, 2023

SPX and NYA: You Might Think

Monday, September 25, 2023

SPX, NYA, COMPQ: Don't Change for You, Don't Change a Thing for Me

Those of you with internet access may have noticed that today's title continues the long-running tradition (two days) of referencing classic 80s songs. Not sure if I'll try this again on Wednesday, but I Just Can't Get Enough, so I will be Right Here Waiting to see If This Is It or not.

As the title implies, no change from last update, but I did want to bring forward the NYA chart, which I haven't updated in a while, because it's right at rising support. If bulls can't manage any kind of reactionary bounce, then a sustained breakdown here quite likely takes NYA down toward blue 3/C:

SPX is unchanged:

No change to the targets:

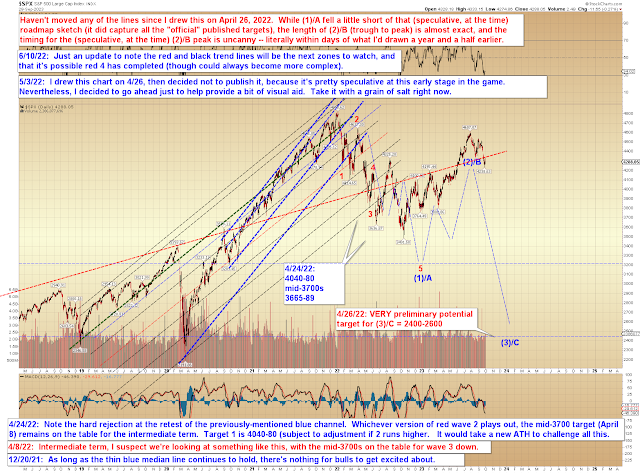

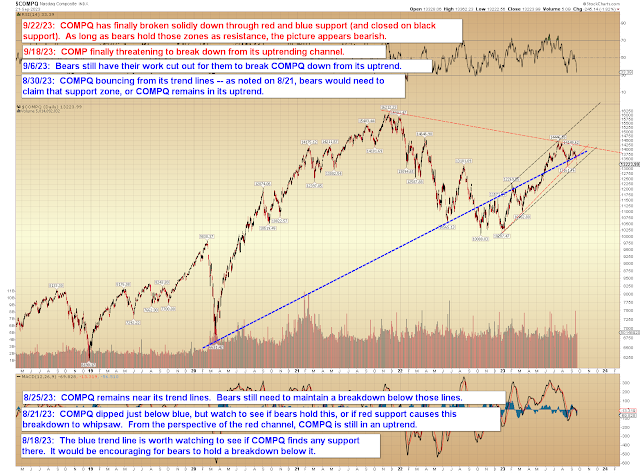

COMPQ still flirting with next support:

In conclusion, no real change to anything. Several market are still sitting at or near theoretical support zones -- if bulls can't manage any kind of reactionary bounce, then that tells us something about the strength (or lack thereof) of the market. Trade safe.