Since "to QE3 or not to QE3" is once again the big question on investors minds, I'm going to share my thoughts on this before we get to the charts.

The Federal Reserve Board meets next week, and as has become something of a tradition over the past several months, there's been

even more QE3 talk lately. The Fed is starting to sound like the little shepherd boy in that old Aesop's Fable,

The Boy Who Cried QE3. How many more times will this Virtual QE talk work?

Several top economists (I realize this is a bit like saying "several of the world's tallest midgets") are now predicting that the Fed will launch QE3 in the very near future. Many seem to be predicting this based on the still-abysmal housing market, as recent statistics show that the ratio of homeowner equity to disposable income has fallen to an unprecedented low of 54%. How more QE would help the housing market is beyond me... if 30-year mortgage rates get any lower, the banks will have to start paying

us interest. Call me old-fashioned, but the housing market's woes seem to be caused by the archaic principle of supply and demand. Too much supply and too little demand are not going to be solved by the Fed firing up the printing presses again.

Perhaps the theory is to keep inflation going up, thereby driving housing prices up, thereby bringing current underwater homeowners back to even. But, my word, at what cost? If that's their thinking, we're in even worse trouble than we thought with this bunch. To achieve that level of inflation... homeowners wouldn't be underwater on their mortgages anymore, but gas would be $15 a gallon. So we'd cure the equity problem, but we'd have the slight new problem that homeowners wouldn't actually be able to afford to heat their homes. As Robert Heinlein said: "TANSTAAFL: there ain't no such thing as a free lunch." I'm hoping the Fed has figured this out.

In any case, I continue to believe that the Fed will not announce QE3 at this time, especially in light of the recent stock market rally. There are two main reasons I believe this. The first is: why launch QE3 when you can accomplish the same thing just by talking about it? I don't think it's coincidental that the Fed tries to make a very convincing case before each and every meeting about why they're going to launch QE3 any minute now. But then Ben comes out of the meeting saying, "Eh, not today. But we could! Don't tempt us!" and shakes his finger at the camera. These guys aren't idiots -- at least, not in regard to the PR department.

The second reason is that in observing the current board, this Fed does not strike me as a proactive body. Virtually every major action they've taken, including both prior QE's, has been a reaction to the stock market and/or other factors. There presently seems to be no blatant crisis to react to, since we all know that Europe is fixed for at least a few more minutes; the latest massaged economic numbers aren't horrible by any stretch; and everything has been coming up roses for the market lately -- potentially because institutions are front-running QE3. The irony is that maybe in front-running QE3, institutional investors are preventing the very situation that needs to occur for the Fed to feel mandated to announce QE3 in the first place. It may create something of a Catch 22... then again, maybe they just have more information than I do. We'll find out next week.

What really steams my boat about the whole thing is that the Fed created most of this mess in the first place -- and then completely failed to anticipate the backlash of their prior actions. People can blame subprime mortgages and sleazy lenders all they want, but the Fed created that situation. It's a bit like blaming the punk street dealers for your city's drug problem; the punks are just the pawns, and while they're far from innocent, in order to address the problem one really needs to blame the kingpin distributor. Now somehow the kingpin Fed is going to "fix everything" by doing what the government

always does when it attempts to fix the problems it's created: it throws even

more money at them. (I'm aware that, technically, the Federal Reserve is not part of the government. I'm also aware that back in 1995, technically, O.J. Simpson was innocent.)

In my view, the problems are not going to go away even if the Fed does print more money. This "hair of the dog" fix may continue to work temporarily, but it seems to me that digging the hole deeper isn't actually a solution. As Albert Einstein said, "We can't solve problems by using the same kind of thinking we used when we created them."

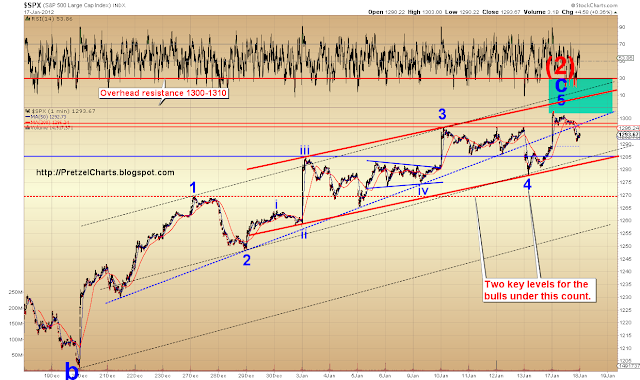

Alright, off my soapbox and onto the charts. The market broke through the key resistance level of 1300-1310, and the bears now need to reverse this move quickly, or risk an accelerating melt-up. The 1300-1310 level hasn't truly been back-tested yet, but if it holds as support, the market could make a fast run to 1350. Conversely, if it fails as support, the bears have a potentially powerful whipsaw to run with. While there are numerous indications that the market is overbought, prior melt-ups have sometimes occurred from such levels.

Today is options expiration, and as I mentioned last weekend, January's OpEx Friday has been solidly negative in 10 of the prior 13 years -- so maybe the bears will get some help there. A good reversal back under some key levels would make the breakout a whipsaw, and whipsaws usually lead to strong moves in the opposite direction of the prior trend.

If this is indeed Minor Wave (2), it is allowed to retrace up to 100% of the prior wave without violating any structural rules. However, this weekend I intend on revisiting the long-term charts in depth and doing my best to determine if that scenario still appears to be the most likely (usually this type of decision on my part is a signal for the market to decline immediately).

Sentiment still seems to indicate that a decline is probable -- since bullish sentiment as measured by the latest surveys is quite elevated, and the put/call ratio is reaching unusual extremes. There are a lot of investors looking for more rally here, which means there's a big chunk of money

already committed to that rally, which means there are less buyers to actually drive that rally. It would be unusual for a melt-up rally to start with investors as bullish as they are, because the market rarely rewards a crowded trade -- but past performance doesn't guarantee future results and all that.

The short term charts depict essentially the same counts as yesterday. Both counts were expecting some further upside, which the market provided. This wave remains one of the more difficult structures I've faced in the past few months. The challenge is that the entire wave leaves a great deal to interpretation and there has been little in the way of clarity. The blue wave 1 (below) could conceivably be 1-2, i-ii (see second chart). The entire third wave is a mess of structures that look more like a-b-c's than impulse waves. As a result, I have simply felt unable to nail down the short-term with much confidence.

The first chart shows that there are enough squiggles to count this as a complete 5-wave move, although the one-minute chart suggests 1320-25 could still be in the cards for this wave. 1315 could possibly be the top -- but

if this wave were behaving normally, I would be more inclined to think 1320ish. Not surprisingly, it's very unclear. Below 1302, and I would no longer consider 1320 probable over the very short term.

The second chart is the more bullish interpretation. The count below suggests that the rally is moving into an acceleration upwards. I have a hard time wrapping my head around this possibility, because of the ridiculously bullish sentiment and all the bearish secondary evidence. But I'm trying not to let that evidence blind me to other possibilities, because as I said yesterday, price action always rules.

I think there's a dangerous tendency bears have to look at a rising market and say, "Are these people clueless as to what's actually going on in the world?" Maybe. Maybe not. The market doesn't generally do a very good job of pricing reality into the equation, otherwise there would never be crashes in the first place. For example, the problems of 2008 (and beyond) were

all written on the wall in 2007 and earlier -- but the market kept going up anyway, because the majority was simply oblivious.

To draw another example, the housing market was quite obviously in a bubble for years, but prices kept going up anyway. It usually takes the majority a long time to catch on, and while you did well to sell your house and walk away in 2005, had you somehow been able to "short" houses and started doing so in early 2005, you would probably have been hurting by the time the housing crash actually got rolling.

Conversely, the problem with ignoring reality is that the masses tend to catch on all at the same time, and the exits suddenly get crowded fast. Traders have to walk a fine line in both regards.

Objectively, the action yesterday was bullish. Price broke out of the bearish "three drives to a top" type pattern that the market was in, and MACD also broke out to the upside. Bears really need this to be a blow-off head fake, because the market was signaling strength yesterday.

In conclusion, the bottom line is that bears need a quick whipsaw to stay in the game over the short term. Based on all the evidence, I'm inclined to think the bears will pull out an upset soon. If indeed institutions are front-running QE3, and no QE3 comes, perhaps that will be the catalyst bears need. In any case, theories, sentiment, and indicators aside, the current price charts have to be respected. Trade safe.