Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, April 27, 2020

SPX, INDU, Oil: A Rare Look at Supercycle Degree

Before we get into the equities market, I want to briefly touch on oil, as it provides a rare study in what can happen during a correction at Supercycle wave degree.

As most who follow my work already know, Elliott Wave is based on the fractal nature of markets. Fractals display self-similarity across time-frames, so the same wave patterns thus recur across different time frames (the fractals on the daily charts are made of smaller similar patterns on the hourly charts are made of the same, smaller fractals on the 5 minute charts, etc.), referred to as "wave degrees."

The largest degree any human can (practically) be expected to observe during their lifetime is generally considered to be Supercycle degree. (There is also Grand Supercycle degree -- and certainly even larger degrees of cycle that haven't been named -- but things that occur over hundreds or thousands of years simply won't be observed from start to finish by your average human.)

Most are aware that there's been some pretty historic price action in oil recently. The truly historic nature of the times becomes quite apparent when viewed in context of the last 150 years:

That's pretty incredible when you think about it.

Back in 2011, I discussed my belief that oil was in the middle of a correction at Supercycle degree. At the time, fundamental analysts were telling us that we had passed "peak oil" (which, in my view, is a fundamentally flawed theory to begin with and based on incorrect presuppositions; but that's another discussion) and that oil would get more and more expensive and rare.

Of course, they were dead wrong.

But that was the context of 2011, when I predicted that oil would ultimately crash all the way down to 25. (Little did I know that my target was too conservative! It seemed outrageous enough at the time.) But here we are -- and I simply want to show this because it's important to understand the absolutely destructive nature of a correction at Supercycle degree -- few people alive can say they've ever witnessed such a wave.

Now we have.

In equities, the market is in the process of retesting its prior high (or will be at the open):

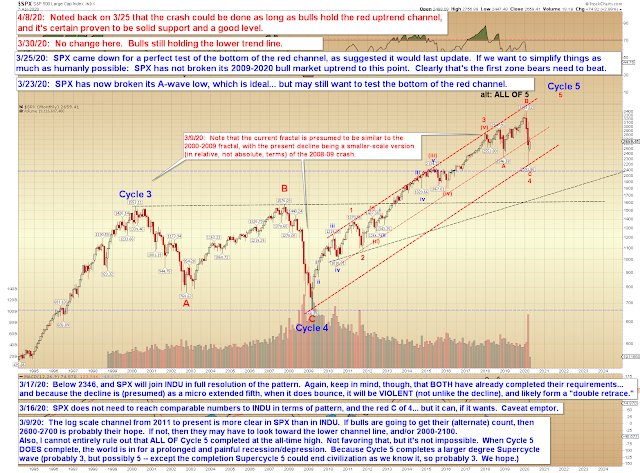

No change to the big picture -- and ideally, there won't be (but still open to the possibility):

In INDU/SPX can sustain breakouts over their prior highs, then a test of the blue line on this INDU chart and 2950-3000 SPX would be possible:

In conclusion, not much to add since last update. Trade safe.

Friday, April 24, 2020

SPX Update: The Next Key Levels

Last update, SPX had arrived at the inflection zone that arrives with three wave declines, and I noted that

While the market was heartily rejected at that resistance zone, as of yet, there is still no impulsive decline to add confidence to the bear view, though -- so we're watching to see if one develops.

and concluded with:

Ideally, bears can keep pushing a little further and form an impulsive decline.

The decline then stalled right at that inflection -- so, thus far, bears haven't been able to get it done, and the pattern got, and remains, stuck at three waves down. Today might therefore be critical.

The three wave structure is pretty clear on the 5-minute chart, but the rejection at red is worth noting:

No change at the higher wave degree:

In conclusion, today could be a pivotal day, in a "make or break" way for the near-term bear options. As noted, bears do need to sustain a break at 2727, but if they can, then that would clear them for a decent near-term run lower. On the flip side, if bulls were to sustain trade over 2882 resistance, then they could make a run toward 2950-3000 next. I'm still leaning slightly toward the bears (near-term) here, but the wave pattern has thus far refused to add confidence to my lean, so we'll simply have to stay nimble and see how it plays from here. Trade safe.

Wednesday, April 22, 2020

SPX Update: No Material Change

Short and sweet update today, as there's really not much to add. Last few updates anticipated that SPX might find resistance in the 2850-2882 zone, and it found resistance at 2879.

While the market was heartily rejected at that resistance zone, as of yet, there is still no impulsive decline to add confidence to the bear view, though -- so we're watching to see if one develops:

Near-term, it would not be uncommon to see a back-test of broken support (black/blue/red). The green line is the first meaningful downtrend line... whether bears can hold that basic zone or not may be revealing:

In conclusion, no material change from last update. Ideally, bears can keep pushing a little further and form an impulsive decline. (Although, with this particular pattern that won't be the end-all, due to the potential of a B-wave high, it would be a good start.) Much below yesterday's low, and 2640-50 could come into play (not a hard target, but quite possible). Trade safe.

Monday, April 20, 2020

SPX Update: Can Bears Capitalize on This Opportunity?

A week ago, I noted that SPX was approaching resistance, which stretched from about 2850 to 2882ish. The market has since tested that zone a few times, and on Friday, it reached as high as 2879 (note that even though we knew Friday was going to open higher, I declined to turn bullish, and instead reiterated that "ideally, bears will make a stand somewhere in the discussed zone"). SPX has (thus far) been unable to break through the noted zone, and futures today are indicating that it's going to open lower.

Accordingly, this at least has the potential to be a pivotal day, and if bears can break through (and hold below) support, they may finally get a larger decline going.

Let's look at near-term support first:

Bigger picture, the blue path is still my "best guess," but there's really nothing so far to add confidence to that. The first step for bears is to form an impulsive decline, and/or break though support.

In conclusion, back on April 13, I noted the 2850-2882 zone as resistance, and the market is (again) reacting to it, which gives bears a shot to get in the game. We'll see how it plays from here. Trade safe.

Accordingly, this at least has the potential to be a pivotal day, and if bears can break through (and hold below) support, they may finally get a larger decline going.

Let's look at near-term support first:

Bigger picture, the blue path is still my "best guess," but there's really nothing so far to add confidence to that. The first step for bears is to form an impulsive decline, and/or break though support.

In conclusion, back on April 13, I noted the 2850-2882 zone as resistance, and the market is (again) reacting to it, which gives bears a shot to get in the game. We'll see how it plays from here. Trade safe.

Friday, April 17, 2020

SPX Update: Second Verse, Same as the First

Last update noted that the market had tagged, and reacted to, resistance, and that it would be ideal to see a larger correction begin, but also noted that:

Until bears break down the above support zones, we can't entirely rule out the possibility of higher prices (especially since I can't rule out a b-wave high instead of a diagonal).

Bears then failed to break the noted key support zones, so we're back up into testing the resistance zone again today.

Beyond this, there really isn't very much to add. Ideally, bears will make a stand somewhere in the discussed ballpark. If for some reason they can't, then we'll burn that bridge in Monday's update. Trade safe.

Wednesday, April 15, 2020

SPX Update: Market Tags the Resistance Zone

Last update noted that SPX was approaching a resistance zone, in the form of the red trend line on the chart below:

I drew the beginning of the blue projection line with a slight overthrow of the red line (the zone I've noted on the forum repeatedly for the last week or so was 2850, so I began it there) -- and yesterday, SPX tagged 2851. Today, it's going to gap lower. So it's acknowledging the resistance zone, which is also an inflection zone.

The chart below shows the first potential near-term support zones:

Beyond that, not much to add. Until bears break down the above support zones, we can't entirely rule out the possibility of higher prices (especially since I can't rule out a b-wave high instead of a diagonal) -- but ideally, I'd like to see a larger correction (or a run to new lows) begin now. We'll see how it develops from here. Trade safe.

I drew the beginning of the blue projection line with a slight overthrow of the red line (the zone I've noted on the forum repeatedly for the last week or so was 2850, so I began it there) -- and yesterday, SPX tagged 2851. Today, it's going to gap lower. So it's acknowledging the resistance zone, which is also an inflection zone.

The chart below shows the first potential near-term support zones:

Beyond that, not much to add. Until bears break down the above support zones, we can't entirely rule out the possibility of higher prices (especially since I can't rule out a b-wave high instead of a diagonal) -- but ideally, I'd like to see a larger correction (or a run to new lows) begin now. We'll see how it develops from here. Trade safe.

Monday, April 13, 2020

SPX Update: Market Near Big Picture Resistance

Ended up spending a late evening with family last night for Easter, so short and sweet update this morning (3:00 a.m. here!)

Big picture, the last noted back-test held, causing SPX to rally toward next resistance:

Near-term, still some trend lines to watch:

It's worth mentioning that on March 25, I published a piece titled "All Downside Targets Captured," in which I noted that I (finally) had no more lower targets... and that final downside target has not only continued to hold ever since, but that call has led to a massive bounce:

In conclusion, SPX is near a potential resistance zone, so we'll see how it reacts to that. First chart contains my current "best guess," but that is still subject to revision at this phase. Final chart remains the preferred outlook, with new all-time-highs expected to follow the recent Covid crash, and the peak potentially arriving in late 2021 (+/-), which could then complete the entire bull market. Trade safe.

Wednesday, April 8, 2020

SPX Update: Preferred Count Confirmed

First off, it's worth a quick mention that the preferred count, as originally published (here) last Wednesday (last Tuesday on the forums), came through with flying colors, as the market not only bottomed at the preferred red "C?" label, but then went on to make new highs (by a lot, actually), thus confirming the read of a B-wave high:

Yesterday's rally was almost entirely accomplished in the overnight futures, with cash selling off quickly after the market opened:

There are some interesting things going on in the bigger picture, starting with this:

Finally:

In conclusion, yesterday's futures low (around 2630 cash, plus/minus) is probably the first near-term inflection zone on the downside. On the upside, the green channel (currently near yesterday's high) and the black channel (both on the 2nd chart) may be the next zones to watch. While I'd love to see a decline from here back toward 2447, bears do first need to claim the noted big picture back-test to get anything going, and it's at least possible the wave will require a new high to complete. At the moment, the market is in near-term limbo, which is not uncommon after a big winning trade like we just had. Trade safe.

Yesterday's rally was almost entirely accomplished in the overnight futures, with cash selling off quickly after the market opened:

There are some interesting things going on in the bigger picture, starting with this:

Finally:

In conclusion, yesterday's futures low (around 2630 cash, plus/minus) is probably the first near-term inflection zone on the downside. On the upside, the green channel (currently near yesterday's high) and the black channel (both on the 2nd chart) may be the next zones to watch. While I'd love to see a decline from here back toward 2447, bears do first need to claim the noted big picture back-test to get anything going, and it's at least possible the wave will require a new high to complete. At the moment, the market is in near-term limbo, which is not uncommon after a big winning trade like we just had. Trade safe.

Subscribe to:

Posts (Atom)