Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, March 8, 2021

SPX Update: One for da Bullz

Friday, March 5, 2021

SPX and Gold Updates: Been a Great Week for Bears

Last update noted that the rally could be over (for now) via a big WXY, and that count was confirmed with dramatic new lows yesterday.

There are multiple potential counts in this position, so we're going to focus on "keeping it simple" via trendlines today. We'll start with the near-term SPX chart:

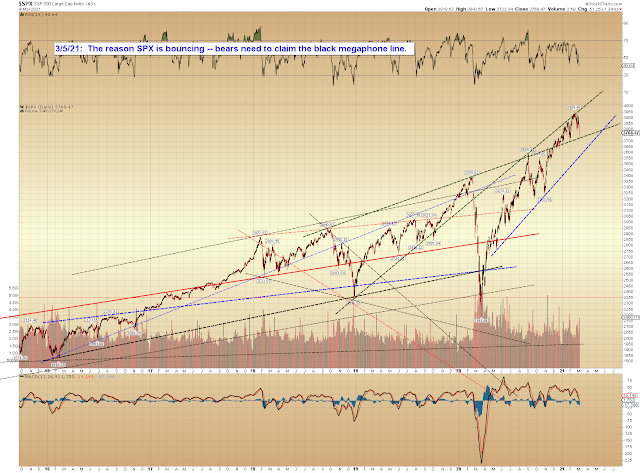

Bigger picture, it's easy to see why SPX is bouncing from yesterday's low:

Also realized there was a typo on the gold chart, so wanted to update that. Gold reached its minimum downside target yesterday, with its test of the blue/black confluence (but, as noted on 2/28, may still have farther to run):

In conclusion, on Friday, I published "Is the Party Over?" and so far the market is doing everything in its power to agree that the party may indeed be over. Sure, bears still don't have long-term confirmation... but as I intimated in that piece, the nature of the market is such that by the time there's "confirmation," pretty much everyone is on board. That said: On the flip side of my own sentiment (which is "bearish"), SPX did test an important zone yesterday, and bears do need to claim that zone for early confirmation. Especially if the Fed steps in with more QE. Trade safe.

Wednesday, March 3, 2021

SPX Update

Monday, March 1, 2021

SPX and NYA: First Downside Inflection

Friday, February 26, 2021

SPX, Gold, TRAN, INDU: Is the Party Over?

Walkin' with a dead man over my shoulder...

Waiting for an invitation to arrive,

Goin' to a party where no one's still alive...

It's a dead man's party, who could ask for more?

-- Dead Man's Party, Danny Elfman/Oingo Boingo

We've been anticipating this as a potential "final fifth wave rally" for a while, but some interesting things have happened since last update. In the prior update, I noted that SPX could still make a higher high, and while it didn't, many other markets did -- including INDU, TRAN, NYA, among others. Let's start off with INDU's long-term chart, where many past projections have played out very well across time. The past few times we've discussed this chart, I felt that INDU probably needed to head at least a little bit higher. It has now done that:

TRAN is another market that made a new high yesterday, and its long-term chart is interesting:

NYA made a new high -- and here's where we might note that from a long-term perspective, there's still work for bears to do before they begin to get anything approaching "confirmation" -- so we are front-running with any speculations that the bull market is over (or nearly over). A fifth wave extension is still possible:

SPX is one of the markets that failed to make a new high -- and it stalled just shy of the first key overlap, which made for as low-risk an exit/entry point as it gets.

Finally, I want to briefly touch on gold, because this chart looks like potential trouble for gold bulls at the moment. Gold bulls could reset this look (at least a little; it wouldn't put them entirely out of the woods) with trade over the noted level:

So... what does all this mean? Are we there yet? Is this the end of the road for the bulls? On the one hand, there are enough waves up for that to be the case. On the other hand, we have nothing approaching "confirmation" from the market yet (but, of course, the nature of the game is to try to be a bit ahead of it), so it's a bit early to say with much conviction.

Thus, in conclusion: As I've noted a few times in recent past updates, we were approaching the zone where five waves could complete -- and yesterday, INDU, NYA, et al, rallied enough to complete those patterns. At least potentially -- since it's very early, we still can't rule out a continued fifth wave extension; but bulls now need to prove that is their intention by rallying back over the all-time high. If they can't, then the market could be in real trouble. Trade safe.

Wednesday, February 24, 2021

SPX, INDU, TLT: Easy Trade, Complex Pattern

Monday, February 22, 2021

SPX Update: In More Detail

In the prior update, we discussed that the pattern wasn't quite as clean as I'd like and that this meant the market was reserving a couple additional options. Let's review that, then look at this options in more detail:

But in cash, it's not quite so clean. As long as that low holds, we'll assume we're dealing with the gray path as originally shown... but because the structure isn't as clean as I'd like, the market is leaving open two interesting options: