Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, March 12, 2021

Forum Issues -- RESOLVED

SPX Update

Yesterday, SPX made a new ATH, which means the market did indeed form the most rare pattern at this degree -- the ultra-rare triple-three (WXYXZ). I don't think I've seen more than a dozen triple threes in the past two decades, and certainly not at this degree.

This also means that my original read of Feb. 17 of a b-wave at the high was correct -- but due to the rarity of the subsequent pattern, the market sure made me second guess that first read.

So where are we now? There are two possibilities:

1. Yesterday's new high was/is part of a fifth wave (standard or extended; bulls would need to keep making new ATHs for this iteration of an extended fifth to stay on the table, obviously).

2. Yesterday's high was wave C of a complex flat (discussed previously).

In conclusion, it's enough to be aware of the options at this stage; we'll need a bit more from the market to parse them. Trade safe.

Wednesday, March 10, 2021

SPX Update

Monday, March 8, 2021

SPX Update: One for da Bullz

Friday, March 5, 2021

SPX and Gold Updates: Been a Great Week for Bears

Last update noted that the rally could be over (for now) via a big WXY, and that count was confirmed with dramatic new lows yesterday.

There are multiple potential counts in this position, so we're going to focus on "keeping it simple" via trendlines today. We'll start with the near-term SPX chart:

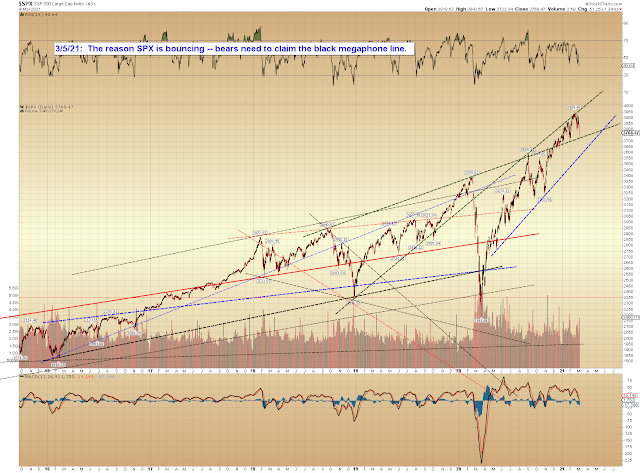

Bigger picture, it's easy to see why SPX is bouncing from yesterday's low:

Also realized there was a typo on the gold chart, so wanted to update that. Gold reached its minimum downside target yesterday, with its test of the blue/black confluence (but, as noted on 2/28, may still have farther to run):

In conclusion, on Friday, I published "Is the Party Over?" and so far the market is doing everything in its power to agree that the party may indeed be over. Sure, bears still don't have long-term confirmation... but as I intimated in that piece, the nature of the market is such that by the time there's "confirmation," pretty much everyone is on board. That said: On the flip side of my own sentiment (which is "bearish"), SPX did test an important zone yesterday, and bears do need to claim that zone for early confirmation. Especially if the Fed steps in with more QE. Trade safe.