Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, June 28, 2023

SPX and NYA Updates

Monday, June 26, 2023

SPX and NYA: Big Picture and Near-term Counts for this Major Inflection Zone

Last update I outlined some of the reasons I'm still betting on the bears for the bigger picture, so today we'll do a deeper dive into the near term.

Before we do that, though, let's look again at where we seem to be at the intermediate level, starting with NYA (no change from recent updates):

SPX:

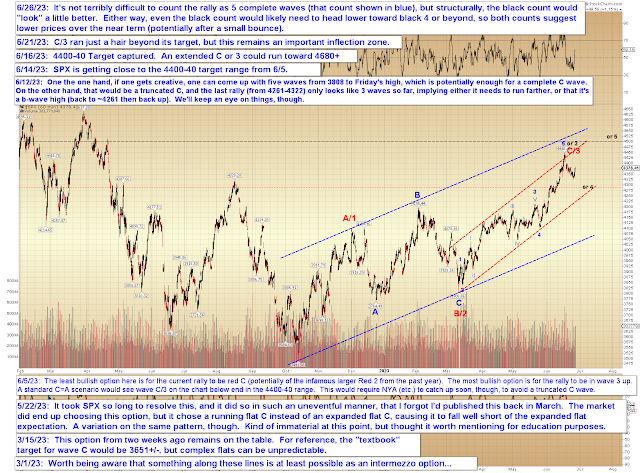

And now, the near term. It doesn't require any creative counting to come up with five complete waves, but the overall structure would "look" a bit better with one more high:

In conclusion, SPX and NYA have both stalled at the lower edges of their respective inflection zones -- and again, these are not minor inflection zones, these are major inflections with significant downside potential if they generate a turn (which I am currently presuming they will). Both markets appear to need at least a bit more downside (potentially after a bounce in 2/B up), so we'll be watching that closely to see if it exceeds what might be expected for a fourth wave (black 4 on the final chart). If this is a fourth wave, then the market has some wiggle room to head a little higher afterwards, back into the higher edges of the inflection zone. If no fourth wave materializes, then the bear market may be gearing up to resume in the near future. Trade safe.

Friday, June 23, 2023

SPX and NYA: Still Betting on the Bears

Wednesday, June 21, 2023

SPX and NYA: Important Inflection Zone

A week ago, I wrote:

I'm very close to publishing [the alternate intermediate bull count] now (eighty percent of the time, "finally" publishing a bull count is the best way to create a bear move, so we'll see if the threat of publication is enough to cause the market to reverse, or if I actually need to publish the bull count to really force the market's hand).

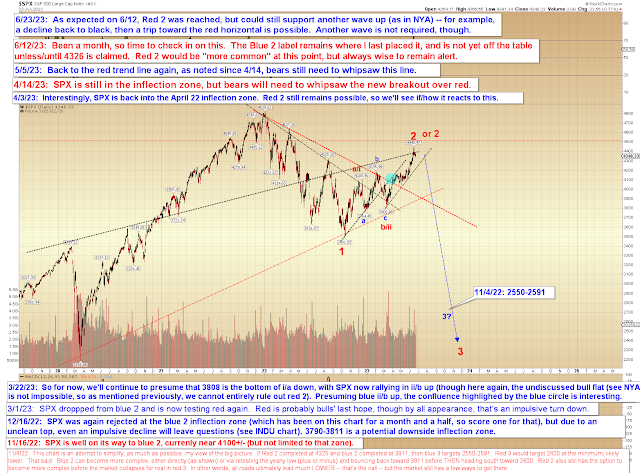

I then published that count on Friday, and lo and behold, after exceeding the SPX target/inflection zone by a hair, the market reversed that very session. Interestingly, NYA fell a hair short of its target/inflection, but also reversed. Let's start there:

As we can see, NYA could support one more smallish wave up, but if we are indeed on the cusp of a bear move, it would not be uncommon for such a wave to fail to materialize.

SPX is in a similar position:

As yet, we don't quite have a small impulse down, but a couple sets of slightly lower lows today might accomplish that.

In conclusion, this is -- quietly, for the masses -- a major inflection zone. The market does have a little leeway to run a little bit higher if it wants (and still remain in the inflection zone), but if there's a bear move to come, such moves often attempt to take "everyone" by surprise. Trade safe.

Friday, June 16, 2023

SPX Update: Time for a Rant -- and the Promised Bull Count

Imagine you have two friends, who are the polar opposites of each other:

Friend A, we'll call him "Joe," believes that the point of life is to find happiness, and that the key to happiness lies in doing whatever he wants, whenever he wants. Consequently, he lives a life of hedonism, partying late into the night and engaging in risky behavior (heavy drug use, sexual promiscuity, etc.). Hard work being, well, hard, is not something that's exactly at the forefront of his consciousness -- to the contrary, he believes that hard work is a "lie of the system" and that people are entitled to receive equal outcomes regardless of the amount of effort they expend. Joe believes that most people are victims, not of the challenges inherent in life itself, but of this "system," and that success or failure is purely a matter of luck and not effort.

Ideologically, his "morality" is a hodgepodge of seemingly arbitrary standards, some of which are self-contradictory, none of which (of course) require much effort from him, and all of which serve to bolster his core belief that "whatever I want whenever I want!" is the goal of life. In other words, his "morality" is purely self-serving. It's self-serving because if others would adopt it, which Joe preaches at every opportunity, it would (in his view) make his life a lot easier and less guilt-ridden.

While he doesn't consciously see the connection, he believes the most egregious sin anyone can engage in is to judge the behavior of others (including judging his behavior, obviously -- in his case, this functions as another self-serving belief) and believes that every form of behavior should be treated as equally valid to all other behaviors. Since he views people as victims, he does not subscribe to personal accountability (of course, this, too, allows Joe to feel better about himself. After all, it's not his fault he can't hold a job due to repeatedly calling in hungover! It's the system, man!).

There is really no absolute "right and wrong" in Joe's world, because that would cause him too much grief -- his "morality" functions mainly as an expedience that allows him to justify his own behavior. And as a way for him to engage in performative displays showing off his version of "moral virtue" to the world (i.e.- while he believes it's wrong to condemn the behavior of others, he nonetheless loudly and vocally condemns those who condemn the behavior of others, giving him a sense of moral superiority). He not only fails to see the irony in this but views his zero-effort acts of condemnation as making him somehow magically superior to those he condemns, despite the fact that he is engaging in the exact same behavior (condemnation) that he's condemning!

Others who have adopted Joe's ideas of morality praise him for his "brave" words of condemnation against those who have stricter moralities, even though his words contain no substance, and thus do exactly zero to make the world a better place in any practical sense. In essence, Joe's vision of morality requires no effort or sacrifice on his part, but does generate him plenty of "likes" on social media.

Friend B, we'll call her "Sally," has a much different view of the world from Joe. Sally believes that hard work is the key to success, and that almost anyone who puts in the effort can succeed -- especially given the popularity of Joe's view (meaning that it doesn't take much effort to rise above the crowd, which has become stunningly mediocre). Sally believes strongly in personal accountability and believes that humans have an innate responsibility to the people around them. (Sometimes this means warning people away from things that are harmful, which Joe views as "the sin of condemnation" on Sally's part.)

Sally also believes something that isn't even on Joe's radar: Sally views "happiness" as a side effect of success (success is more than material for Sally, so she takes pleasure in success in any aspect of her life, be it honoring her own principles, doing a quality job, being there for her family, etc.) and thus not as a goal in itself. Sally believes that if happiness becomes her primary end goal, then that could steer her behavior in directions that are solely self-serving and lead her away from higher, more meaningful goals.

Contrary to Joe, she doesn't believe that the key to life lies in indulging every whim or desire she has, but in making positive contributions to the world in which she lives. Sally's morality thus focuses on avoiding behavior that could cause needless suffering to others -- though she has a nuanced view on this: For contrast, she believes an example of "needed" suffering would be confronting Joe about his self-destructive behavior. Joe would view this as "Sally causing him suffering," but that suffering is not without purpose and has the potential to benefit Joe in the long run, if he learns from the confrontation.

Ultimately, Sally strives to be hardworking, honorable, and just and fair to others.

There is, of course, more to these two friends, but you get the general direction of their personalities. Now, ask yourself this: Which of those friends is more likely to succeed in life? Which of those friends would you rather have as a work partner? Or as a partner in any endeavor? Which of those two is more likely to be reliable, trustworthy, loyal?

Those questions are somewhat rhetorical -- but now the big question:

If you were trying to create a healthy, pleasant, safe, and productive society, which of those two examples would you want society to follow? Joe's? Or Sally's?

Exactly. We all know the answer here, because we all have similar experiences of life in this regard. We know what we can achieve when we work hard, and we know we achieve virtually nothing when we don't. We know that chasing quick and easy dopamine hits isn't good for us in the long run, and we know that taking an "anything goes" approach with our own behavior almost always ends badly. We likewise know that if we don't hold ourselves accountable for such things, we enter a self-perpetuating downwards spiral that continues until such time as we do take responsibility.

So why are we, as a society, not only embracing Joe's ideology, but encouraging everyone around us to do the same? Worse, why are we condemning the Sallys of our nation and celebrating the Joes?

Are we stupid? Or are we just self-destructive? Or both? We need to look further than the ends of our noses; ideas have far-reaching consequences that branch out beyond the emotions of the next 5 minutes and into infinity, so we'd better start finding the courage to speak up, even when it may result in temporarily hurt feelings. It helps to remember that sometimes negative emotions are the most positive thing a person can possibly experience -- just like touching a hot stove, emotional pain can act as a warning that something in our behavior or our mentality is harming us.

On our current trajectory, we're going to rapidly find ourselves in "a nation of Joes." And where do we suppose that nation ends up, besides the scrap heap of history?

I mentioned all that because, ultimately, it's one of the reasons I view America as a nation in decline, regardless of whether we can drum up enough money for any more market hurrahs. A society, just like an individual, can and will only perform poorly on ideologies that prioritize "anything goes feel good behavior" and that condemn and silence everything else.

The bull case is that the rest of the world is in such incredibly bad shape that our blazing mediocrity will allow us to stay on top economically, in spite of ourselves -- but that doesn't help us become a better nation. We need to start allowing each other the space for tougher conversations if we truly want to reverse the slide.

Rant over.

***

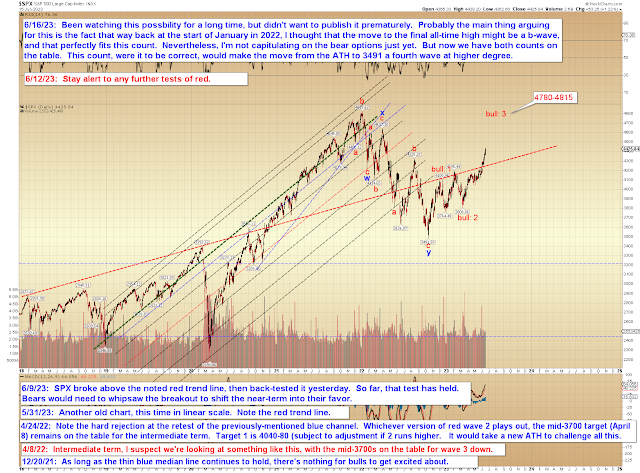

Moving to the charts, first up, the C/3 target from June 5 was captured yesterday. In fact, SPX ran right to the label:

Next, NYA implies at least a bit more upside is still needed:

Finally, the promised long-term bull count. The main thing that's bothered me for this option is that back in January of 2022, while I though the bull market was going to end directly, nailing down the exact end was tricky in real-time and I wrote several times that I thought the all-time high might be a b-wave. In fact, going back and rereading the update of January 3, 2022, apparently, I even went so far as to say I "liked the idea of a b-wave." Ugh.

In conclusion, now the bull count is officially out and published, which is often the best way to end a rally... so if the market is going to reverse, then it needs to finish off the rally (see NYA again) and do so relatively soon. Frankly, if NYA clears the blue (C), then we'll probably have to start taking the bulls a lot more seriously, despite the fact that they're clearly insane (just kidding, bulls). Trade safe.

Wednesday, June 14, 2023

SPX and NYA Updates: Closing in on Upside Targets

Last Friday, I wrote that SPX appeared to be on track to break resistance, which it has since done. It's now closing in on its next upside target zone:

NYA is now right up against resistance -- if it sustains a breakout there, then the next probable resistance zone is represented by the blue line:

Finally, for the past few months, I've gone back and forth on whether to publish the potential longer term bullish count, but have been restraining myself. I'm very close to publishing it now (eighty percent of the time, "finally" publishing a bull count is the best way to create a bear move, so we'll see if the threat of publication is enough to cause the market to reverse, or if I actually need to publish the bull count to really force the market's hand), but have decided to hold off just a little longer. Trade safe.