Nothing approaching panic selling yet, and didn't even overshoot the trend line a little, just bottomed right there perfectly. This market is still complacent, regardless of most of the bear talk. As I said the other day, I think most people are "oh no, a correction" bearish, not "OMG a genuine bear market!" bearish. So far, anyway. Bear markets are terrifying, as anyone who traded 2008 and 2001 will attest. There's no fear in this market yet.

But I wouldn't be shocked if it takes some time. In 2008, after the first 20% decline, there was a multi-month bounce before the real selling started. Not sure if that will happen here (in this phase of bear markets, the key understanding that puts you ahead of the crowd isn't "exactly when will it go lower" but simply understanding that it is now a bear market, which the majority don't accept until the middle of the first big third wave down), but it's certainly within the realm of possibility:

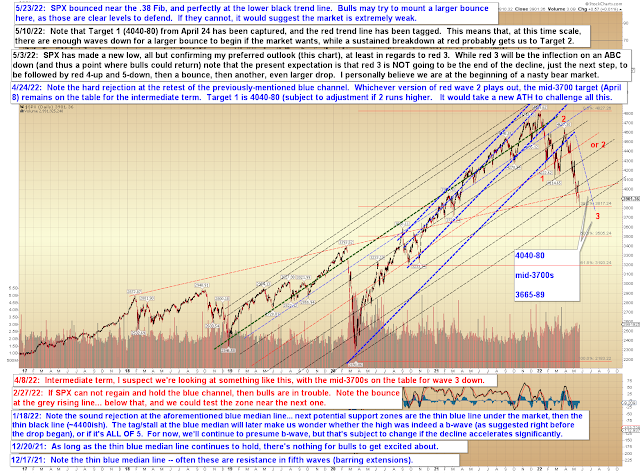

Near-term, the first zone bulls have to clear is noted below in blue:

In conclusion, bulls bounced right from an obvious support zone, so they may be able to muster a larger bounce from here. If they can clear resistance on the chart above, then we'll keep an eye on the expanded flat (Red ABC) shown on that chart as an option, and then take it from there. If they can't even clear the first inflection, then they may have bigger problems directly. Trade safe.

No comments:

Post a Comment