My apologies for that error.

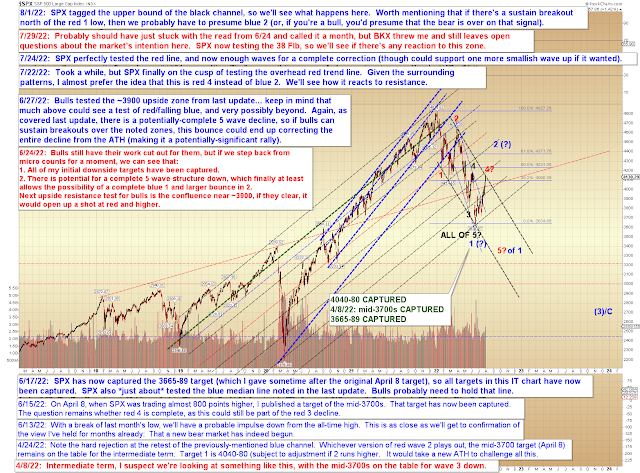

So is this a fourth wave or a second wave? I genuinely don't know. As of this moment, it could still be either; the chart explains the dividing line:

BKX is still a pain for all involved, and no change here:

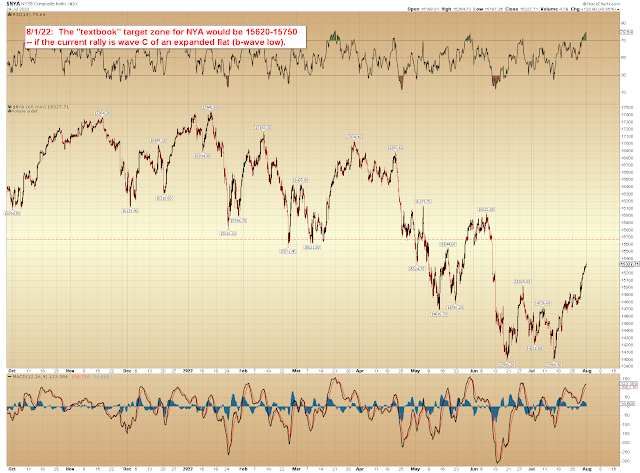

I noted back on July 22 that in the event the current wave were to extend, then SPX 4200-35 would be a target. Given BKX, I thought that unlikely at the time, but now -- who knows. NYA says that it's at least possible:

So, with the wave counts up in the air, I often like to return to basics. Below is a simple trend line/channel chart:

The irony is that as I write this, futures are down 26 points, so maybe there will be a significant reaction to the black trend line on the chart above, and we'll all have a good laugh about this later.

In conclusion, SPX is in a sort of no-man's-land right now, where a fourth wave or second wave are both still on the table. All I can do from here is try to take it as it comes. Trade safe.

No comments:

Post a Comment