Our country was founded on solid principles. Those principles led to our success. They predated it; they created it. As we grew in stature, we began to forget the underlying principles, but we continued to live in the systems those principles created, so we continued to grow stronger: We were embodying the core principles, whether we understood them or not.

But over generations, we've drifted further and further from those principles. Few in the modern world seem to even understand those principles -- and we certainly won't value what we don't understand. And... some are actively rooting for destruction though they do not and cannot realize that's what they're rooting for; they bear destruction in the name of "progress" (because they truly believe in what they're doing).We have, in essence, discarded the very principles that brought us success in the first place.Since we, as a nation, are (as with all entities) merely the sum total of our ideas, this deterioration of our core principles cannot and will not continue without consequence. The center cannot hold. This, I suspect, is the last thing we see as a Supercycle Peak approaches.

What principles am I talking about? Too many things to list, but to name just a few: Principles such as personal and institutional integrity, equal justice for all under the law, free speech without censorship, honest open debate of "consensus" science, personal freedom and the accordant personal accountability burden that must be borne along with freedom (though it's worth noting that freedom/accountability intertwine and the consequences of diminishing either run in both directions: remove the burden of accountability from people and you have removed their agency; someone presumed to be without agency, by definition, cannot be free -- thus removing accountability does not free people, it enslaves them), and basic goodwill for our fellow humans taking precedence in our hearts and minds over our political "tribes."

Again, to name just a few of the areas where I believe America is losing, or has lost, its way.

I keep trying to drive home the idea that the near-term just doesn't matter much here. As I mentioned elsewhere, it's probably not wise to get too hung up picking up pennies on the track when a freight train is bearing down on you at full speed. So once again, as clearly as I can state this: Since December 2021, I have been, and remain, bearish until proven otherwise.

On April 8, in a piece written with very bearish undertones, I published the following intermediate projection:

That mid-3700s target was later captured.

I originally started this piece mainly wanting to look at the predictions from April's magnum opus, but realized some context was needed, which I think we've gotten through now -- so let's look at the predictions from April's Are Stocks Headed Toward a Generational Bear Market? in the order they appeared, starting with Treasury yields/interest rates.

In this regard, I published several charts highlighting a major trend line and wrote:

This trend line has contained yields for 40 years. 40 financially-prosperous years for the United States, we might add, in a largely low-inflationary environment. A sustained breakout might thus signal a sea change from those conditions

That "sea change" line was at ~2.8%. Given the spike in rates/yields since then, I think we can all agree this prediction was a major hit.

Heading forward, I believe the longer-term trend for Treasuries remains down (meaning higher interest rates). If the right conditions were met, my view can, of course, change, but so far bulls have not done anything to change it.

I then discussed inflation, citing what I originally wrote back in July of 2021:

This means that, regardless of what they tell us, inflation is likely here to stay (for as long as market forces will allow, anyway)

Speaking of, I went to the grocery store yesterday and saw that, in the course of only one week, the price of one of the items on my list had risen from $3.50 the week prior to $5.39 now! So yeah, I think we can call that a hit.

Then we talked about oil, and I wrote:

When the Fed says they need to control inflation, in one sense, what they're really saying is that they need to bring down the price of oil. At face value, oil prices impact the cost of shipping, which bleeds over into everything that has to get from one place to another (in other words: everything), including most of our food. And of course, it impacts the cost of electricity, which again impacts the cost of everything, including the refrigeration needed to preserve our food.

[Insert long discussion about the flaws in current domestic oil policy, culminating with:]

And it is by this road that it has now fallen to the Federal Reserve to attempt to bring down the price of oil, and thus to quell inflation, by tightening monetary policy. This is the wrong tool for the job, akin to using a hammer to fix a leak. You might be able to pound the leak closed, but you're going to do a great deal of collateral damage in the process.

Sounds about right. While I didn't give any immediate projections for oil prices, my long-term view is that oil based a massive Supercycle decline in 2020 (incidentally, back in 2011, I predicted that oil was headed to 25 and didn't waver from that until we hit bottom in March 2020), which means that after the current correction is over, oil is going to trend higher for the long-term.

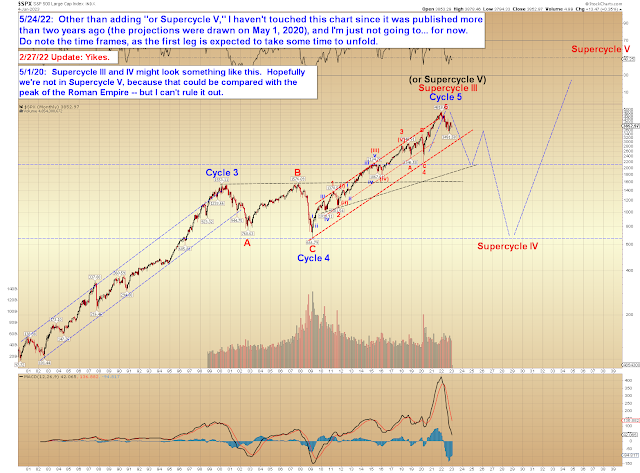

After oil, I discussed the stock market and presented long-term charts projecting a major bear market, and wrote:

I'm bearish because of what I see in the charts, but I'm also bearish because of what I have seen developing in our nation itself, and in our leaders. This has been a long time coming.

Obviously can't say with complete certainty that it's been a hit regarding the "Supercycle bear" yet, but I think we can say unequivocally that my bearish stance on equities has been the correct one.

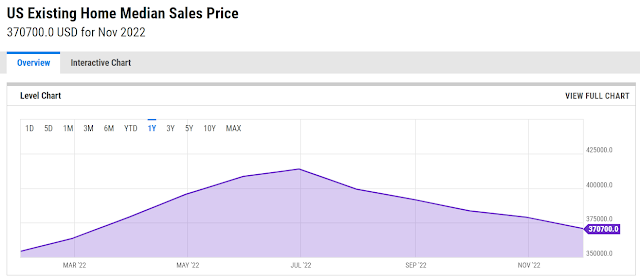

Finally, I discussed Real Estate, where I think I surprised some readers, as I was not yet bearish on the housing market. There, I wrote:

I wouldn't be surprised to see housing prices ultimately start falling in certain local markets (housing is, in the end, always "local") -- but I'm going to go out on a limb here and state that I suspect overall, real estate will hold up fairly well for the foreseeable future.

Bottom line: It wouldn't surprise me if prices level off somewhat as mortgage rates rise, with potentially some corrections along the way, but I don't believe we're in a bona fide housing bubble the way we were 15 years ago, so I don't believe we'll see a real estate "crash" from current valuations.

So as of December, I'm a major equities bear, but I think real estate will not suffer the same fate yet (this analysis of real estate is not intended as a super-long-term prognostication, only "the foreseeable future" as things will likely change somewhere down the road, of course. For example, if unemployment hits 26% in 2025, obviously that would become a new input in the equation).

Below is the current chart of home sales prices:

From the time I published in April, prices continued to rise until July, then declined, making prices roughly a wash from April until present. Thus I think it's not unreasonable to say my April analysis that "real estate will hold up fairly well for the foreseeable future" has borne out, and certainly my prediction that housing would not crash the instant rates rose has held up.

On this market, I haven't done the legwork to analyze where we are now (I don't track real estate developments on a daily basis the way I do with equities -- April 2021's update was the result of several weeks of detailed analysis). So, I don't have a strong opinion where we go now in real estate, but perhaps I'll look into it in more detail and do a larger piece on it if people are interested.

Trade safe.

No comments:

Post a Comment