So, this is a do-or-die moment for bulls and bears. If bulls could turn it back up over this week's high, then they could have a bull nest underway and launch a strong rally. If bears can keep pushing lower and break 4953, then they will be getting into the ballpark of a possible impulsive decline, which could signal a larger trend change. The upcoming sessions could thus be important for setting the intermediate tone of the market.

Pretzel Logic's Market Charts and Analysis

Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, May 3, 2024

SPX Update: Right Said Fed

Wednesday, May 1, 2024

SPX Update: But Who's Counting

Since last update, SPX rallied up into its first target/inflection zone, then the inflection zone did its job and SPX topped right at the "bear: c" label that I'd placed on the chart on April 26. I didn't even need to move it for today's update:

So, this is a do-or-die moment for bulls and bears. If bulls could turn it back up over this week's high, then they could have a bull nest underway and launch a strong rally. If bears can keep pushing lower and break 4953, then they will be getting into the ballpark of a possible impulsive decline, which could signal a larger trend change. The upcoming sessions could thus be important for setting the intermediate tone of the market. Trade safe.

Monday, April 29, 2024

SPX Update: Second Verse, Same as the First

Friday, April 26, 2024

SPX Update: One Chart to Rule Them All

In conclusion, bulls have so far turned the market back up where it was expected and where they needed to. Bigger picture, bulls probably continue to have the advantage unless bears can reverse this and form at least one more new low, to give the decline a more impulsive appearance.

And there's really nothing else to add since then, other than to note that we'll probably enter the ABC inflection zone either today or Monday. Again, though, as I also wrote last update, "bears should be ready in the event the market elects to disappoint them." Trade safe.

Wednesday, April 24, 2024

SPX, COMPQ, and...

The last couple updates suggested that a larger bounce could occur any time in SPX, and here we are. The chart below further elucidates the landscape for both bulls and bears:

Now, we can't rule out bears making a stand sometime soon and turning things lower in order to create an impulsive decline. But right now, all we have in actuality is three waves down, so there's nothing "deterministic" about this pattern and bears should be ready in the event the market elects to disappoint them.

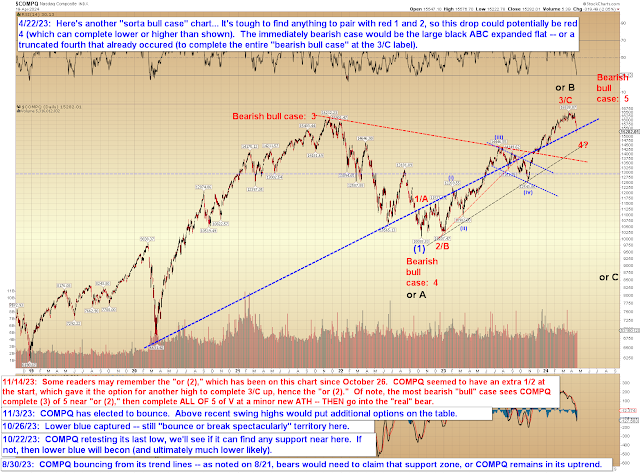

COMPQ is in a similar position, but (more clearly than SPX) seems like it probably "needs" another wave up to new highs, either immediately or a bit down the road. [Note: Please ignore the blue "(1)" on this chart.]

On another, unrelated, note, a few days ago, a friend sent me a link to an interview with the CEO of Redfin, regarding the current real estate market; quoted in part below:

Usually when sales decline, prices drop too, and then sales increase later—that’s the cycle, he said. Homes become affordable again, and sales pick up because of it. This situation is very different. Interest rates are up, and sales volume has fallen through the floor, as he put it, but home prices haven’t followed. “Some of that is just this artifact of 30-year mortgages,” he said. Everything the Federal Reserve is doing has no real effect on homeowners, apart from keeping them where they are. “It actually has the perverse effect of keeping home prices high,” Kelman explained.

Just over two years ago (on April 18, 2022), I went completely against the "everyone knows rising rates will crash housing! Common knowledge!" and instead predicted the following:

Rising rates do, of course, have an impact on future affordability -- but they have no impact on families already in a home (presuming these families have a fixed-rate mortgage, which, as we already covered, the vast majority do). If anything, rising rates might tend to inspire people to hang on to their homes longer instead of putting them up for sale, which would have a tightening effect on inventory. After all, if you're in a mortgage at ~3%, what possible incentive do you have to ever exit that loan with inflation running above or near 8%?As I mentioned earlier, inflation should provide a tailwind for housing -- in more ways than one. If my reasoning above is in the right ballpark, then rising rates may, perhaps counterintuitively, provide impetus for inventory to ultimately balance. Houses might spend more days on market due to fewer buyers, but if fewer homes are being brought to market in the first place because families are incentivized to stay put (or to turn their old 3% mortgage home into a long-term rental), those seemingly-opposed forces could tend to counteract each other.

While I took some flak for that prediction in the Spring of 2022, as it turns out, that's exactly what has come to pass in the years since.

In conclusion, bulls have so far turned the market back up where it was expected and where they needed to. Bigger picture, bulls probably continue to have the advantage unless bears can reverse this and form at least one more new low, to give the decline a more impulsive appearance. Trade safe.

Monday, April 22, 2024

SPX, COMPQ, BKX: As Far as the Eye Can See -- for Now

Last update ended with (in part):

In conclusion, SPX captured Target 2, good for around 200 points of profit for readers. It would look a little better if it were to head at least a bit deeper into the 4970-5005 zone, but that's not required and if that's ALL OF 3/C down, a big bounce is possible any time.

SPX did indeed head a bit deeper into the target zone, and even exceeded it slightly. That's about as far as I can get us for the moment and I now have something approaching a neutral stance, at least from an analytical standpoint. A big bounce is indeed possible from here, though I have no strong opinion yet on whether it will materialize directly or if further lows are pending. I can't see around every corner, and sometimes it's best not to attempt to.

COMPQ discusses one "bullish" option -- and because we don't yet have a larger impulsive turn, bullish options remain very much alive and well for now:

Finally, BKX bounced almost immediately after I posted the red "1?" label:

In conclusion, unless/until we see a larger impulsive turn, it's worth remembering that SPX and COMPQ are still very much in the running for new highs, and there are now enough waves down for that to happen from this general area. If they do, instead, go on to form larger impulsive turns, then bears will have more leverage than they do now. Trade safe.

Friday, April 19, 2024

SPX and BKX: SPX Captures Target 2

As we can see on the chart above, to complete C/3 down, bears would need another new low, which I'm currently inclined to suspect they'll get after a bounce. That would complete red v, which would complete THREE waves down [4/19 Note: We are here now, at three waves down.], so from there, a rally to new ATHs would not be off the table. For bears to demonstrate more control, they would then need a bounce in a larger 4th wave, followed by another new low, at which point, we could conceivably label the entire wave off the ATH as an impulse.