Yesterday's market blew through the downside projections, much like the rally did on the upside earlier this year. It comes to mind that the prior rally became historically over-extended, so there are a lot of folks ready to jam the exit doors, and it shouldn't be surprising to see the same types of extensions happen on the downside... if the trend has indeed changed -- which I continue to believe it has.

I believe we are in the very early phase of a major trend change. While there is an alternate count that allows for another wave up, I view that as less-likely by the day. The market looks very weak right now... but we will continue to be on alert for the alternate until it drops below 25% probability, especially since SPX has not broken through 1340 yet.

Many indicators have reached oversold readings, and there are divergences on the smaller time frames, so some type of relief rally may be in order here. The shape of this rally will tell us a lot about what's to follow.

Below is the short term SPX chart, which shows the conservative labeling, and corresponding bounce targets, for this decline.

That's the conservative, "everything's oversold -- be cautious" chart, and there are good reasons for bear caution. As an indicator of just how oversold, below is the McClellan Oscillator, which is generally one of the more reliable indicators out there.

RSI and MACD are arguing that the bounce can be sold. There are divergences in the short time frames, but not in the larger time frames. The larger time frames have "confirmed" the low -- meaning the indicators reached new lows along with price. The majority of the time, this means that lower lows are still coming.

The charts above show the conservative arguments as to why a bottom is near (likely after the next low). But when I step back and examine this decline from an aesthetic perspective, I see the more aggressive pattern below as a distinct potential. I'm not advocating throwing caution to the wind, by any means. Examined technically, the odds are against this more bearish pattern. The pattern below is more of an aesthetic thing -- and sometimes that works, sometimes it doesn't.

If the bounce overlaps 1378.24, then we can take this count off the table and focus on the first chart.

Next is a non-Elliott look at the potential broadening top/megaphone that's formed in NYA. It also shows that NYA has now overlapped the October highs, and broken the March lows. Both of these developments are intermediate-term bearish.

Next is an update on CVX, which has reached its 101 +/- target, which always means time to take some profits, and time to start watching for a bounce. This trade was an out-and-out winner, and I hope some readers were able to profit from my sell recommendation when CVX was trading at 110/111.

It appears probable that there's some more downside still in store, but of course there's no guarantee.

In conclusion, the odds favor the next bounce as being a good sell opportunity. How solid the bounce is will give us some indications of how far the decline may have yet to run, if indeed it does. Trade safe.

Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, April 11, 2012

Tuesday, April 10, 2012

SPX Update: A (Bearish) Look Out Across Several Markets

On Sunday, we played devil's advocate a bit and tried to tear down the preferred count. We'll continue watching the alternate possibility presented there, but we're going to focus on the preferred count until the market suggests we shouldn't.

The preferred count continues to believe that the market is in the early stages of an important trend change, and I've assembled some additional supporting evidence in favor of this view. The first chart I'd like to present is the London FTSE, which has now overlapped its potential first wave. While this doesn't rule out higher prices in the future, it does substantially lower the odds on any long-term bull counts.

Next is the German DAX, which also looks bearish. It appears that the preferred count for DAX, presented a couple times over the past month, did a good job anticipating the turn in that index.

Silver appears to be breaking down from its uptrend.

Next a look at several indices on the same chart. NYA, WLSH, TRAN, and INDU have now all whipsawed their recent key breakouts.

Let's take a quick look at the preferred count in the big picture view. Keep in mind that the next bottom (blue target box) could mark ALL OF wave (i), or only mark the bottom of wave 3.

The same count, shown on the 5-minute chart below. Trade above 1392.92 would eliminate the 4th wave interpretation and indicate that a correction at higher degree was unfolding.

Finally, a look at the alternate count at next highest degree. The first target under the terms of this count was reached yesterday. The 2nd target below might line up with the black count shown in the chart above -- however, the market is reaching into territory where bears need to be very cautious of a larger rally developing. If the first target below is exceeded, and the second target missed, that might argue a bit in favor of the preferred count.

In conclusion, there are even more bearish signals appearing across markets, adding some degree of confidence to the preferred count. Unless bulls can pull a major stick save here (wouldn't be the first time), it appears that a larger trend change is beginning. Trade safe.

The preferred count continues to believe that the market is in the early stages of an important trend change, and I've assembled some additional supporting evidence in favor of this view. The first chart I'd like to present is the London FTSE, which has now overlapped its potential first wave. While this doesn't rule out higher prices in the future, it does substantially lower the odds on any long-term bull counts.

Next is the German DAX, which also looks bearish. It appears that the preferred count for DAX, presented a couple times over the past month, did a good job anticipating the turn in that index.

Silver appears to be breaking down from its uptrend.

Next a look at several indices on the same chart. NYA, WLSH, TRAN, and INDU have now all whipsawed their recent key breakouts.

Let's take a quick look at the preferred count in the big picture view. Keep in mind that the next bottom (blue target box) could mark ALL OF wave (i), or only mark the bottom of wave 3.

The same count, shown on the 5-minute chart below. Trade above 1392.92 would eliminate the 4th wave interpretation and indicate that a correction at higher degree was unfolding.

Finally, a look at the alternate count at next highest degree. The first target under the terms of this count was reached yesterday. The 2nd target below might line up with the black count shown in the chart above -- however, the market is reaching into territory where bears need to be very cautious of a larger rally developing. If the first target below is exceeded, and the second target missed, that might argue a bit in favor of the preferred count.

In conclusion, there are even more bearish signals appearing across markets, adding some degree of confidence to the preferred count. Unless bulls can pull a major stick save here (wouldn't be the first time), it appears that a larger trend change is beginning. Trade safe.

Sunday, April 8, 2012

SPX, RUT, CVX, WLSH Updates: Last Update Was the Bear View; Now Let's Poke Holes in It

In Thursday's update, I built up the bear case; for today's update, we're going to try to poke some holes in it -- and within all that, we'll look at some targets which fit both.

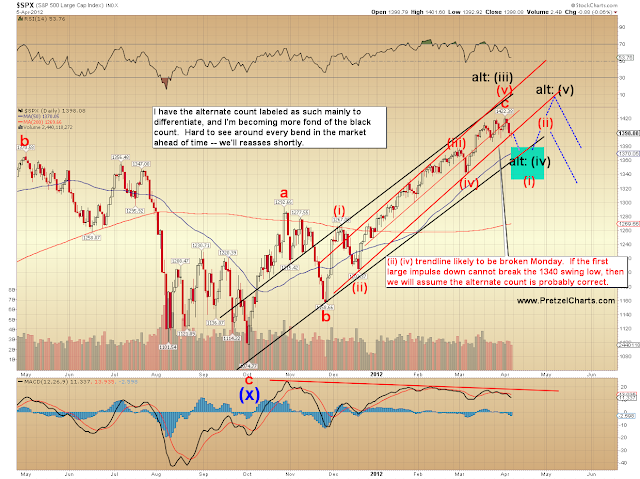

Since I covered the bear case in quite a bit of detail on Thursday, today I'm going to spend the majority of the article focussing on the alternate count and the merits therein.

It is simply not possible to see out around every bend in the market ahead of time, so the approach I take is to try to anticipate potential patterns before they occur, and then see how the market responds to validate or invalidate those potentials. This alternate count is one of those attempts, and I think it's a very viable possibility.

The first key to remember is that tops are not supposed to be recognizable until after they've passed. They are supposed to trap a lot of buyers on the wrong side, and they're supposed to blow out a lot of bears in the process (by whipsawing them) -- so that there's fuel for the first round of selling. Some level of ambiguity is to be expected here.

I've personally always found important bottoms to be relatively easy to call, at least the majority of the time -- but major tops are usually confusing places where the market becomes a bit schizophrenic and throws off a lot of false signals in both directions. As we examine the charts today, we can see some of those signals present.

I'm going to lead with the Wilshire 5000 chart to illustrate what I'm talking about. Long-time readers will immediately notice that this count looks a bit weird. It considers the option that wave 1 of (iii) was the extended wave, and the annotations explain the merits of this interpretation. I really like how it lines up all the 2-4 trendlines present throughout the first wave.

This chart took a long time, with liberal usage of the "delete" key, but it still remains the alternate count for now.

Let's continue running with the alternate count for a moment and look at some of the targets for SPX under the terms of that count. The middle target of a 2.618 extension currently appears the most probable, but we'll have to re-examine as the wave unfolds.

Here's what the alternate count would look like for the bigger picture. I like that it would create a better-looking major top pattern and blow out all the bears who join the fray too late. Note that the alternate count is not long-term bullish, it simply suggests a new high to complete the pattern.

RUT is giving similar targets for the alternate count. RUT has also cracked its major uptrend line, which isn't bullish -- but it's not unusual for one to see this happen a few times as an early warning signal before the final top hits.

Let's throw this next chart into the mix, where my somewhat recently-discovered red cycle predicts a low near April 23, plus or minus a few days. This could fit the terms of either count quite well.

So those are some of the things I'm watching here. The final top may be in, but there are still an appropriate number of question marks surrounding that conclusion. Next, let's look at the preferred count in more detail.

The first chart is a simple analog, and shows that RUT may be building a similar fractal to its last major top.

The next chart shows the SPX short-term targets, which work under the terms of either count. It's possible that Monday's decline will mark the fifth wave of the total decline (black), but I view it as quite a bit more probable that it is actually wave (3) of 3 (blue). 1380 is the first target under the blue count, 1360 is the second. The chart talks about watching momentum for confirmation.

The target of 1350 shown earlier as the alternate count 2.618 extension would work quite well with the short-term interpretation, which is reading this as a nest of 1's and 2's. Because there were no violations of the previous 1 and 2, an extended fifth wave is also valid. The final target for an extended fifth would be 1342-1345.

Finally, an update on CVX. There are two ways to look at CVX here -- there's the hard math conservative way, which says a bottom is close. Then there's the gut instinct way (my approach), based on experience. I'm going to show both views here, but conservative traders may want to opt for the conservative approach and take profits more quickly. Until I see the market open, there's literally nothing backing my read but my gut.

CVX has been a big hit overall, and the trade is already about 6% in profit since I first called attention to it on March 18 -- so there's no need to get overly greedy... but at the same time, one never wants to leave a bunch of money on the table. I haven't called a bottom in CVX yet because I haven't seen one.

If CVX opens Monday down significantly and momentum confirms, then it's likely that my "gut instinct" view is correct and the question becomes whether to take profits near 101 or simply move stops and push for the lower target. If CVX is showing divergences in momentum on the open, then one may wish to opt for the very conservative "wave 5 almost over" approach and take profits quicker.

There is also an even more bearish interpretation which says that 3 and 4 are another 1 and 2. We'll reassess this chart as needed.

In conclusion, referring back to the larger view of the market, there are two main possibilities, both quite viable. There are bearish signals across other markets, which may indicate the market made a long-term top -- but there is enough ambiguity to give me quite a bit of pause, and I feel it's prudent to let the market dictate further before trying to draw definite conclusions.

As I expressed heading into Thursday's close, both short-term patterns expect lower prices directly. The 1350 +/- zone currently seems to be a pretty good final target for both counts, but traders should definitely exercise good trade management until the pattern unfolds a bit further and allows more accurate targeting. We'll reassess all this as the move develops. Trade safe.

Since I covered the bear case in quite a bit of detail on Thursday, today I'm going to spend the majority of the article focussing on the alternate count and the merits therein.

It is simply not possible to see out around every bend in the market ahead of time, so the approach I take is to try to anticipate potential patterns before they occur, and then see how the market responds to validate or invalidate those potentials. This alternate count is one of those attempts, and I think it's a very viable possibility.

The first key to remember is that tops are not supposed to be recognizable until after they've passed. They are supposed to trap a lot of buyers on the wrong side, and they're supposed to blow out a lot of bears in the process (by whipsawing them) -- so that there's fuel for the first round of selling. Some level of ambiguity is to be expected here.

I've personally always found important bottoms to be relatively easy to call, at least the majority of the time -- but major tops are usually confusing places where the market becomes a bit schizophrenic and throws off a lot of false signals in both directions. As we examine the charts today, we can see some of those signals present.

I'm going to lead with the Wilshire 5000 chart to illustrate what I'm talking about. Long-time readers will immediately notice that this count looks a bit weird. It considers the option that wave 1 of (iii) was the extended wave, and the annotations explain the merits of this interpretation. I really like how it lines up all the 2-4 trendlines present throughout the first wave.

This chart took a long time, with liberal usage of the "delete" key, but it still remains the alternate count for now.

Let's continue running with the alternate count for a moment and look at some of the targets for SPX under the terms of that count. The middle target of a 2.618 extension currently appears the most probable, but we'll have to re-examine as the wave unfolds.

Here's what the alternate count would look like for the bigger picture. I like that it would create a better-looking major top pattern and blow out all the bears who join the fray too late. Note that the alternate count is not long-term bullish, it simply suggests a new high to complete the pattern.

RUT is giving similar targets for the alternate count. RUT has also cracked its major uptrend line, which isn't bullish -- but it's not unusual for one to see this happen a few times as an early warning signal before the final top hits.

Let's throw this next chart into the mix, where my somewhat recently-discovered red cycle predicts a low near April 23, plus or minus a few days. This could fit the terms of either count quite well.

So those are some of the things I'm watching here. The final top may be in, but there are still an appropriate number of question marks surrounding that conclusion. Next, let's look at the preferred count in more detail.

The first chart is a simple analog, and shows that RUT may be building a similar fractal to its last major top.

The next chart shows the SPX short-term targets, which work under the terms of either count. It's possible that Monday's decline will mark the fifth wave of the total decline (black), but I view it as quite a bit more probable that it is actually wave (3) of 3 (blue). 1380 is the first target under the blue count, 1360 is the second. The chart talks about watching momentum for confirmation.

The target of 1350 shown earlier as the alternate count 2.618 extension would work quite well with the short-term interpretation, which is reading this as a nest of 1's and 2's. Because there were no violations of the previous 1 and 2, an extended fifth wave is also valid. The final target for an extended fifth would be 1342-1345.

Finally, an update on CVX. There are two ways to look at CVX here -- there's the hard math conservative way, which says a bottom is close. Then there's the gut instinct way (my approach), based on experience. I'm going to show both views here, but conservative traders may want to opt for the conservative approach and take profits more quickly. Until I see the market open, there's literally nothing backing my read but my gut.

CVX has been a big hit overall, and the trade is already about 6% in profit since I first called attention to it on March 18 -- so there's no need to get overly greedy... but at the same time, one never wants to leave a bunch of money on the table. I haven't called a bottom in CVX yet because I haven't seen one.

If CVX opens Monday down significantly and momentum confirms, then it's likely that my "gut instinct" view is correct and the question becomes whether to take profits near 101 or simply move stops and push for the lower target. If CVX is showing divergences in momentum on the open, then one may wish to opt for the very conservative "wave 5 almost over" approach and take profits quicker.

There is also an even more bearish interpretation which says that 3 and 4 are another 1 and 2. We'll reassess this chart as needed.

In conclusion, referring back to the larger view of the market, there are two main possibilities, both quite viable. There are bearish signals across other markets, which may indicate the market made a long-term top -- but there is enough ambiguity to give me quite a bit of pause, and I feel it's prudent to let the market dictate further before trying to draw definite conclusions.

As I expressed heading into Thursday's close, both short-term patterns expect lower prices directly. The 1350 +/- zone currently seems to be a pretty good final target for both counts, but traders should definitely exercise good trade management until the pattern unfolds a bit further and allows more accurate targeting. We'll reassess all this as the move develops. Trade safe.

Thursday, April 5, 2012

SPX and Oil Update: The Market Appears to Have Finally Reached the Tipping Point

Who remembers Sniglets from HBO's series, Not Necessarily the News? Sniglets are words that should be in the dictionary, but aren't. One that sticks with me from my youth, and which comes to mind now, is:

Pielibrium - n. The point at which the crust on a wedge of pie outweighs the filling and tips it over.

I believe this historically over-bought market has finally reached the point of pielibrium, and I'll elaborate on some of the reasons for this belief in a moment.

First, a quick update on silver, sans chart, for anyone who missed the chart yesterday: I personally closed all silver longs yesterday shortly after the open, with the cross of price back beneath the 30.72 pivot. (This level was called out on yesterday's premarket chart.) Silver appears to have new lows on the horizon. This was also one of the "hints" the market was giving yesterday, warning of further equity weakness.

Those of you who follow along in the intraday comments section know that right at the close yesterday, I called for a gap down open today. I'm going to share my short term chart, show you what my read of that chart is/was, and why I made that call (below).

Next, a wider view, and the projected target range if this is wave 5 of (i). The more aggressively bearish view would have this as a nest of 1's and 2's.

It is important to note that 1386.87 is still the first confirmation level for bears, and it has not been broken yet. So I'm a bit ahead of the market with this update, since this update is decidedly bearish. There are still bullish potentials out there, but I am ignoring them at the moment. I think the time has finally come.

Perhaps a bit aggressive, since I'm projecting a major trend change is about to unfold. Oh well... if it blows up, it wouldn't be the first time I've had to eat crow. ;)

Readers should be aware that projecting trend-changes before confirmation is very high risk.

Next a wider view, showing the key trendlines, which appear ripe to fall on Thursday. It will be interesting to see if the market closes inside or outside the (ii) (iv) trendline. The sketched-in portion is simply a rough idea at this point, not a projection.

Next, I want to put up the big picture chart. A few readers have asked about this lately, and it is still my long-term projection that the 2009 lows will ultimately be broken. I do wish to stress that there is nothing even approaching confirmation yet; and a lot can happen between now and the bottom to stretch out the B wave even further. The chart below assumes the most immediately bearish outcome -- and while that outcome is certainly quite possible, I am not yet assuming this to be the case.

I also want to revisit an oil chart I posted back in February. Oil has now whipsawed back beneath its breakout level and has broken its intermediate uptrend. The chart appears quite bearish at the moment. This weakness is being echoed by many other commodities, including gold and silver.

Now for a quick discussion regarding my thinking behind the psychology of all this.

The pattern had two main options heading into Thanksgiving of 2011. One option was an immediate bearish resolution (which appeared to be unfolding according to plan), and the other was to turn the 2011 decline into an (x) wave. Ben and friends stepped up at just the right moment to blow-up the bearish pattern, and the market has been running with it ever since.

We've reached another inflection point. While it currently appears unlikely, there could still be a bit more upside here -- that would be okay for the bear view. But one way or another, it does appear that the market is at an inflection point of intermediate proportions. While it's been a tough turn to nail, one can't help but find it interesting that the waves counted out just about perfectly to line up with the market's recent Fed-motivated Moment of Recognition that no new stimulus appears to be forthcoming.

Elliott Wave is largely based around psychology, and it does appear that psychology is now shifting/about to shift. The stock market is an unusual mechanism. I'm going to use Apple as an example here, but really you could use almost any stock.

Why does anyone buy 1 share of Apple stock for $600? Before you give the quick and easy answer, think about it for a moment. You don't need it; it's not going to keep you alive. I can see paying $600 for an apple, if you were completely out of food, starving, and stuck crossing the desert -- but $600 for a piece of paper?

It isn't the newly-announced dividend, because it would take about 60 years just to break even -- certainly not a wise exchange. If I asked you to lend me $600, and told you I'd pay you back $10 a year for the next 60 years, would you do it? Doubtful.

And yes, if you owned enough of these pieces of paper, you could exchange them for a stake in the company, but you're not going to do that, and neither am I. (By the way, if you're rich enough to buy a controlling stake in Apple, I expect some serious donations pouring in today!)

No, the only reason you buy Apple for $600 is because you think that, later on, you can sell it to someone else for $700. Or $1,001. Or whatever -- but you think you can sell it for more. There is no other genuine reason to buy stock.

Want to test this theory? Try this simple mental exercise. If you had a crystal ball and knew with certainty that a year from now Apple would be selling for $300, would you still buy it for $600 today? Of course not. Conversely, if you knew that the new TV or laptop you desperately wanted to buy today would be worth half what you paid for it in a year (which is probably the actual case), you would still buy it. Because a TV, or a laptop -- or anything tangible -- has value which is granted through its use. Stock does not.

Wall Street has convinced people that it's "investing" but it's more speculation than anything. So you are buying it on the speculation that someone else will pay more for it down the line.

This is why stocks move as they do, in buying and selling panics.

"This stock's going up, oh my gosh, I'd better buy it before Andy does, so I can sell mine to Andy for more!"

"Uh oh, the stock's going down now, I'd better sell it while people are still willing to buy the damn thing!"

Stocks move as they do as a result of the fact that, deep down, every "investor" knows that the value of stocks is largely arbitrary. When it begins to be perceived that "greater fool" buyers are in shorter supply, the smart money starts dumping. This starts to drive prices down, but the average "investor" keeps buying these dips, thinking there are still "greater fools" out there... and not realizing that they themselves are the greater fool. It reminds me of the quote immortalized in the movie Rounders, regarding poker: "If you can't spot the sucker in your first half hour at the table, then you are the sucker."

Eventually, the average investor realizes that the market is in a down trend, and then they start dumping -- and when that happens, you get a bear market.

We've had an ongoing buying panic because of the perception that, essentially, the Fed would be the ultimate greater fool. And to a big degree, that has been true. Stocks don't rise and fall based on the economy, they rise and fall based solely on liquidity. While it's true that a good economy often means a liquid market and vice-versa -- that liquidity is only a by-product of the economy. In other words, stocks can be driven indirectly by the economy, but not directly; the economy by itself is not the causation. Many traders miss this key point.

So what we've had is an ongoing liquidity flood, which has in turn backed the psychology of speculation, which has in turn led to the Rally from Hell. But now it is suddenly being perceived that this liquidity will go away. Whether that will actually be the case, or whether Ben will pull another rabbit out of his butt remains to be seen. Obviously, we can only play the hand we're dealt right now; we can't see the future.

My contention is that without the Fed, this market will not hold up. Especially right now, when it's as over-bought as a market can be, at long-term resistance, and loaded with negative divergences. This means that if there are no more "greater fools," the exit doors should get jammed quickly. Couple that with the fact that the wave patterns have reached a probable completion point, and you get the potential for a serious decline. Given the pattern right now, an intermediate decline is the high probability outcome.

It is important to recall that Ben could step in a month from now and change the pattern again. He could add another (x) wave, or numerous other things. We'll deal with that if and when we come to it.

It does seem, though, that at some point imbalances ultimately need to be reconciled. Much like the housing market collapse; bubbles can only stay inflated for so long. Eventually the forces of nature, or inevitable human error, bring the imbalances back to the mean. And right now, I think it's likely that this massive rebalancing is on the verge of beginning. Trade safe.

Pielibrium - n. The point at which the crust on a wedge of pie outweighs the filling and tips it over.

I believe this historically over-bought market has finally reached the point of pielibrium, and I'll elaborate on some of the reasons for this belief in a moment.

First, a quick update on silver, sans chart, for anyone who missed the chart yesterday: I personally closed all silver longs yesterday shortly after the open, with the cross of price back beneath the 30.72 pivot. (This level was called out on yesterday's premarket chart.) Silver appears to have new lows on the horizon. This was also one of the "hints" the market was giving yesterday, warning of further equity weakness.

Those of you who follow along in the intraday comments section know that right at the close yesterday, I called for a gap down open today. I'm going to share my short term chart, show you what my read of that chart is/was, and why I made that call (below).

Next, a wider view, and the projected target range if this is wave 5 of (i). The more aggressively bearish view would have this as a nest of 1's and 2's.

It is important to note that 1386.87 is still the first confirmation level for bears, and it has not been broken yet. So I'm a bit ahead of the market with this update, since this update is decidedly bearish. There are still bullish potentials out there, but I am ignoring them at the moment. I think the time has finally come.

Perhaps a bit aggressive, since I'm projecting a major trend change is about to unfold. Oh well... if it blows up, it wouldn't be the first time I've had to eat crow. ;)

Readers should be aware that projecting trend-changes before confirmation is very high risk.

Next a wider view, showing the key trendlines, which appear ripe to fall on Thursday. It will be interesting to see if the market closes inside or outside the (ii) (iv) trendline. The sketched-in portion is simply a rough idea at this point, not a projection.

Next, I want to put up the big picture chart. A few readers have asked about this lately, and it is still my long-term projection that the 2009 lows will ultimately be broken. I do wish to stress that there is nothing even approaching confirmation yet; and a lot can happen between now and the bottom to stretch out the B wave even further. The chart below assumes the most immediately bearish outcome -- and while that outcome is certainly quite possible, I am not yet assuming this to be the case.

I also want to revisit an oil chart I posted back in February. Oil has now whipsawed back beneath its breakout level and has broken its intermediate uptrend. The chart appears quite bearish at the moment. This weakness is being echoed by many other commodities, including gold and silver.

Now for a quick discussion regarding my thinking behind the psychology of all this.

The pattern had two main options heading into Thanksgiving of 2011. One option was an immediate bearish resolution (which appeared to be unfolding according to plan), and the other was to turn the 2011 decline into an (x) wave. Ben and friends stepped up at just the right moment to blow-up the bearish pattern, and the market has been running with it ever since.

We've reached another inflection point. While it currently appears unlikely, there could still be a bit more upside here -- that would be okay for the bear view. But one way or another, it does appear that the market is at an inflection point of intermediate proportions. While it's been a tough turn to nail, one can't help but find it interesting that the waves counted out just about perfectly to line up with the market's recent Fed-motivated Moment of Recognition that no new stimulus appears to be forthcoming.

Elliott Wave is largely based around psychology, and it does appear that psychology is now shifting/about to shift. The stock market is an unusual mechanism. I'm going to use Apple as an example here, but really you could use almost any stock.

Why does anyone buy 1 share of Apple stock for $600? Before you give the quick and easy answer, think about it for a moment. You don't need it; it's not going to keep you alive. I can see paying $600 for an apple, if you were completely out of food, starving, and stuck crossing the desert -- but $600 for a piece of paper?

It isn't the newly-announced dividend, because it would take about 60 years just to break even -- certainly not a wise exchange. If I asked you to lend me $600, and told you I'd pay you back $10 a year for the next 60 years, would you do it? Doubtful.

And yes, if you owned enough of these pieces of paper, you could exchange them for a stake in the company, but you're not going to do that, and neither am I. (By the way, if you're rich enough to buy a controlling stake in Apple, I expect some serious donations pouring in today!)

No, the only reason you buy Apple for $600 is because you think that, later on, you can sell it to someone else for $700. Or $1,001. Or whatever -- but you think you can sell it for more. There is no other genuine reason to buy stock.

Want to test this theory? Try this simple mental exercise. If you had a crystal ball and knew with certainty that a year from now Apple would be selling for $300, would you still buy it for $600 today? Of course not. Conversely, if you knew that the new TV or laptop you desperately wanted to buy today would be worth half what you paid for it in a year (which is probably the actual case), you would still buy it. Because a TV, or a laptop -- or anything tangible -- has value which is granted through its use. Stock does not.

Wall Street has convinced people that it's "investing" but it's more speculation than anything. So you are buying it on the speculation that someone else will pay more for it down the line.

This is why stocks move as they do, in buying and selling panics.

"This stock's going up, oh my gosh, I'd better buy it before Andy does, so I can sell mine to Andy for more!"

"Uh oh, the stock's going down now, I'd better sell it while people are still willing to buy the damn thing!"

Stocks move as they do as a result of the fact that, deep down, every "investor" knows that the value of stocks is largely arbitrary. When it begins to be perceived that "greater fool" buyers are in shorter supply, the smart money starts dumping. This starts to drive prices down, but the average "investor" keeps buying these dips, thinking there are still "greater fools" out there... and not realizing that they themselves are the greater fool. It reminds me of the quote immortalized in the movie Rounders, regarding poker: "If you can't spot the sucker in your first half hour at the table, then you are the sucker."

Eventually, the average investor realizes that the market is in a down trend, and then they start dumping -- and when that happens, you get a bear market.

We've had an ongoing buying panic because of the perception that, essentially, the Fed would be the ultimate greater fool. And to a big degree, that has been true. Stocks don't rise and fall based on the economy, they rise and fall based solely on liquidity. While it's true that a good economy often means a liquid market and vice-versa -- that liquidity is only a by-product of the economy. In other words, stocks can be driven indirectly by the economy, but not directly; the economy by itself is not the causation. Many traders miss this key point.

So what we've had is an ongoing liquidity flood, which has in turn backed the psychology of speculation, which has in turn led to the Rally from Hell. But now it is suddenly being perceived that this liquidity will go away. Whether that will actually be the case, or whether Ben will pull another rabbit out of his butt remains to be seen. Obviously, we can only play the hand we're dealt right now; we can't see the future.

My contention is that without the Fed, this market will not hold up. Especially right now, when it's as over-bought as a market can be, at long-term resistance, and loaded with negative divergences. This means that if there are no more "greater fools," the exit doors should get jammed quickly. Couple that with the fact that the wave patterns have reached a probable completion point, and you get the potential for a serious decline. Given the pattern right now, an intermediate decline is the high probability outcome.

It is important to recall that Ben could step in a month from now and change the pattern again. He could add another (x) wave, or numerous other things. We'll deal with that if and when we come to it.

It does seem, though, that at some point imbalances ultimately need to be reconciled. Much like the housing market collapse; bubbles can only stay inflated for so long. Eventually the forces of nature, or inevitable human error, bring the imbalances back to the mean. And right now, I think it's likely that this massive rebalancing is on the verge of beginning. Trade safe.

Wednesday, April 4, 2012

SPX and SLV Update: We Were Ending Diagonal When Ending Diagonal Wasn't Cool...

Okay, so that's a stretch of a title. I'm trying to echo the famous Barbara Mandell song. The original song was of course titled I Was Ending Diagonal When Ending Diagonal Wasn't Cool -- my change to "we" definitely stretches it.

Anyway, that's not the point. I'm going to have to consult my notes now to figure out exactly what the point was... oh yes, the point was that we started watching this potential back on March 27, based on my read of one extra little wave -- and now everyone's looking for it. The market's sure doing it's best to "make it so," and the description on the chart of a frustrating whipsaw market describes the last week perfectly. My only concern is that too many people have caught onto it now, so the market may need to throw another curve ball.

Yesterday's SPX preferred short-term count was a whiff. Based on the most probable read of the pattern, it clearly looked like it needed another slightly higher high -- but it never came. This is one reason that chasing the last couple bucks of a move can be dangerous. On the other hand, yesterday's NDX expectation was a hit, so that's some consolation.

Yesterday, I warned that trade beneath 1409.61 would be dangerous for the bullish outlook, and after studying the charts tonight, I hope that readers heeded that warning.

Yesterday's overlap, while not perfectly conclusive, pretty well locked-in the three-wave form of the most recent rally leg. So now the question is if there's another leg up left to complete the diagonal, or if we need to shift all the labels over to the left, which would make the recent high "it." Either is possible, and there's little in the way of crystal-clarity.

To try and uncover some clues, I spent literally two hours breaking down about a day's worth of movement on the SPX one-minute chart, and it does appear that there are new lows coming either way. The decline counts best as an impulse, albeit an ugly one. So either the market formed a first wave down and ended the day in a second wave (which is likely complete at a 2.618 extension of wave-a in an expanded flat (see chart)), or it's an a-wave down, with the market ending the day in a b-wave. Either 3 or C down still to come.

Alternately, the market bottomed wave iv at yesterday's low -- but as I said, if two hours of short-term chart work mean anything, then that's unlikely.

The larger structure would look slightly better with another wave up, so it's possible that yesterday was waves a and b of wave iv of the diagonal -- but I like the idea of the recent high being "it" because it would make a great curveball and send the market plunging while all those johnny-come-lately ending diagonal watchers kept waiting for a new high.

As discussed over the past couple days, the risk level for longs definitely remains elevated. There's a couple key levels marked on the chart.

Anyway, that's not the point. I'm going to have to consult my notes now to figure out exactly what the point was... oh yes, the point was that we started watching this potential back on March 27, based on my read of one extra little wave -- and now everyone's looking for it. The market's sure doing it's best to "make it so," and the description on the chart of a frustrating whipsaw market describes the last week perfectly. My only concern is that too many people have caught onto it now, so the market may need to throw another curve ball.

Yesterday's SPX preferred short-term count was a whiff. Based on the most probable read of the pattern, it clearly looked like it needed another slightly higher high -- but it never came. This is one reason that chasing the last couple bucks of a move can be dangerous. On the other hand, yesterday's NDX expectation was a hit, so that's some consolation.

Yesterday, I warned that trade beneath 1409.61 would be dangerous for the bullish outlook, and after studying the charts tonight, I hope that readers heeded that warning.

Yesterday's overlap, while not perfectly conclusive, pretty well locked-in the three-wave form of the most recent rally leg. So now the question is if there's another leg up left to complete the diagonal, or if we need to shift all the labels over to the left, which would make the recent high "it." Either is possible, and there's little in the way of crystal-clarity.

To try and uncover some clues, I spent literally two hours breaking down about a day's worth of movement on the SPX one-minute chart, and it does appear that there are new lows coming either way. The decline counts best as an impulse, albeit an ugly one. So either the market formed a first wave down and ended the day in a second wave (which is likely complete at a 2.618 extension of wave-a in an expanded flat (see chart)), or it's an a-wave down, with the market ending the day in a b-wave. Either 3 or C down still to come.

Alternately, the market bottomed wave iv at yesterday's low -- but as I said, if two hours of short-term chart work mean anything, then that's unlikely.

The larger structure would look slightly better with another wave up, so it's possible that yesterday was waves a and b of wave iv of the diagonal -- but I like the idea of the recent high being "it" because it would make a great curveball and send the market plunging while all those johnny-come-lately ending diagonal watchers kept waiting for a new high.

As discussed over the past couple days, the risk level for longs definitely remains elevated. There's a couple key levels marked on the chart.

I've prepared a more zoomed-in chart to help readers have an idea of what to look for -- assuming my two hours was well-spent and new lows are actually coming tomorrow.

I want to also update the silver chart, because it's possible that silver may have formed an a-b-c and fallen short of the target for c. Personally, I'm moving my stops up to the most recent swing low at 30.72. I feel that risk below that level is high.

In conclusion, the market remains at a potentially dangerous tipping point. As I've mentioned several times, diagonals can be extremely tricky patterns, and that has certainly been the case over the last week. It remains so.

The larger pattern would "look" better with another new high, but I wouldn't bet the ranch on it. It sure feels like the trend has changed. And if we have seen a trend change with the recent high, then it is highly likely that the market is about to embark upon a decline of intermediate proportions.

I can't state often enough that diagonals are very tricky patterns, so it is simply not possible to know for sure one way or another whether this is still part of wave iv, or whether the diagonal has already completed -- but the market should answer this question over the next session or three. Trade safe.

Tuesday, April 3, 2012

SPX and NDX Updates: So Far, So Good...

Yesterday performed perfectly in accordance with the expectations of the preferred count, which needed the market to show some upwards momentum. That's exactly what we got, and it's always tempting to be lulled into a sense of complacency when the market performs as anticipated. The good thing about the complacency approach is that it saves a ton of time -- the problem with that approach is that the market usually eats complacent traders.

So I constantly re-evaluate the market and my expectations, and I never assume that the move will continue to perform as expected simply because it's done so up to this point.

Along those lines: the market rallied convincingly yesterday, but has so far only produced three waves in the upward direction. The preferred count does expect it to go on to form a fourth and fifth wave, but we can never assume the market to be completely "deterministic" -- so I've spent tonight actively looking for reasons why it might not perform as expected, and I'll present some of those counter-arguments, along with some levels to watch, in this article.

In examining the charts, let's start with the highest probability outcome. It appears that the market closed Monday within a small fourth wave correction (red iv, chart below), and it would not be unusual for this correction to last a bit longer into Tuesday, or even into Wednesday's session.

The chart below roughly depicts what to expect if the standard impulse plays out. Please note that my charts are almost never intended to be time accurate -- I simply work within the available space.

The two levels to watch which would provide warning that the impulse was going astray are noted on the chart: 1409 and 1401.

Next we'll take a look at the "still impossible to predict" potential diagonal. Even here, and even if the market is only in one of the c-waves up for the diagonal, it would be unusual for the upwards movement to be complete yet. Barring a break of the 1409 level, the waves seem to point to 1427-1431 at the minimum.

In looking for alternate possiblilities, the NDX caught my eye. It's failed to make a new high, and spent a good portion of yesterday bouncing along the underside of its most recent uptrend line. This behavior does leave open the possiblility of weakness in the near future. Levels to watch are noted on the chart.

Since SPX has only formed three-waves up, let's consider how it could play out if this is not part of an impulse up, but is instead still part of an ongoing corrective wave. That option is shown below in more detail.

It's important to note that both the impulse (first chart) and the correction shown above ultimately suggest that there should still be new highs -- the question is more which path the market will take to get there.

I'd like to use that thought as a segue to discuss one of the challenges in this business. Regular readers know that for roughly a week, I've been predicting that the SPX would make new highs, which it finally did yesterday.

You really have no idea how difficult these calls can be sometimes. Especially now -- with the market massively over-extended, sentiment at ridiculous extremes, and most markets flirting with long-term resistance. Additionally, I'm well-aware of the underlying fundamental weaknesses in the whole system.

As a result, sometimes it's actually painful for me to "have to" make calls like that, because deep down I know that if everything fell apart immediately, we'd all look back and say, "Well, duh. Obviously. What were you thinking suggesting higher prices?" At times it feels like I'm going against every ounce of common sense in my body, so it's a big relief when these types of calls play out as predicted.

It's one thing to be an oblivious perma-bull whose knee-jerk reaction is always "buy!" -- but I believe it's difficult for any thinking man to be bullish at this juncture. For some of the reasons I feel that way, please review the long-term resistance levels covered in yesterday's article.

The point being, I will continue to do my best to give an honest and objective read of the waves -- and if they seem to be pointing higher, then that's what I'll present. In that context, please do bear with me if it all suddenly falls apart five minutes from now... because while my best read of the short-term waves doesn't suggest that will happen -- and even suggests some out-and-out bullish potentials -- at the same time, because of the massive over-extention of this rally on so many levels, it wouldn't surprise me either. Trade safe.

So I constantly re-evaluate the market and my expectations, and I never assume that the move will continue to perform as expected simply because it's done so up to this point.

Along those lines: the market rallied convincingly yesterday, but has so far only produced three waves in the upward direction. The preferred count does expect it to go on to form a fourth and fifth wave, but we can never assume the market to be completely "deterministic" -- so I've spent tonight actively looking for reasons why it might not perform as expected, and I'll present some of those counter-arguments, along with some levels to watch, in this article.

In examining the charts, let's start with the highest probability outcome. It appears that the market closed Monday within a small fourth wave correction (red iv, chart below), and it would not be unusual for this correction to last a bit longer into Tuesday, or even into Wednesday's session.

The chart below roughly depicts what to expect if the standard impulse plays out. Please note that my charts are almost never intended to be time accurate -- I simply work within the available space.

The two levels to watch which would provide warning that the impulse was going astray are noted on the chart: 1409 and 1401.

Next we'll take a look at the "still impossible to predict" potential diagonal. Even here, and even if the market is only in one of the c-waves up for the diagonal, it would be unusual for the upwards movement to be complete yet. Barring a break of the 1409 level, the waves seem to point to 1427-1431 at the minimum.

In looking for alternate possiblilities, the NDX caught my eye. It's failed to make a new high, and spent a good portion of yesterday bouncing along the underside of its most recent uptrend line. This behavior does leave open the possiblility of weakness in the near future. Levels to watch are noted on the chart.

Since SPX has only formed three-waves up, let's consider how it could play out if this is not part of an impulse up, but is instead still part of an ongoing corrective wave. That option is shown below in more detail.

It's important to note that both the impulse (first chart) and the correction shown above ultimately suggest that there should still be new highs -- the question is more which path the market will take to get there.

I'd like to use that thought as a segue to discuss one of the challenges in this business. Regular readers know that for roughly a week, I've been predicting that the SPX would make new highs, which it finally did yesterday.

You really have no idea how difficult these calls can be sometimes. Especially now -- with the market massively over-extended, sentiment at ridiculous extremes, and most markets flirting with long-term resistance. Additionally, I'm well-aware of the underlying fundamental weaknesses in the whole system.

As a result, sometimes it's actually painful for me to "have to" make calls like that, because deep down I know that if everything fell apart immediately, we'd all look back and say, "Well, duh. Obviously. What were you thinking suggesting higher prices?" At times it feels like I'm going against every ounce of common sense in my body, so it's a big relief when these types of calls play out as predicted.

It's one thing to be an oblivious perma-bull whose knee-jerk reaction is always "buy!" -- but I believe it's difficult for any thinking man to be bullish at this juncture. For some of the reasons I feel that way, please review the long-term resistance levels covered in yesterday's article.

The point being, I will continue to do my best to give an honest and objective read of the waves -- and if they seem to be pointing higher, then that's what I'll present. In that context, please do bear with me if it all suddenly falls apart five minutes from now... because while my best read of the short-term waves doesn't suggest that will happen -- and even suggests some out-and-out bullish potentials -- at the same time, because of the massive over-extention of this rally on so many levels, it wouldn't surprise me either. Trade safe.

Sunday, April 1, 2012

Almost "Everything" Update: Short to Long-Term Outlooks Across Markets -- and a Striking Analog

Early last week, the structure of the waves suddenly looked quite bullish -- however the market has, so far, failed to follow through, which is causing me to re-examine this outlook.

Normally, one can determine the next higher degree of trend by determining which structures are impulsive, and which structures are corrective. The challenge right now is that the last 3 waves, both up and down, all appear reasonably impulsive. This could be indicitive of an undecided market.

I can't tell you how many hours I've spent charting during this weekend, but it seems like four or five hundred. Even though the market yutzed around a bit on Friday, it still seems to me that unless the bears can push through and take out the prior swing lows, the bulls have an excellent shot at sling-shotting the market to new highs. Let's examine the evidence together.

Short-term Outlook

The conventional impulse count would view this as a nest of 1's and 2's, which means that it's just about time for the bulls to run with the ball here, early this week. If they don't, then it will be prudent to give more serious consideration to other potentials.

I want to start off with the short term Dow chart, because it shows the relevent conundrum of how the last three waves all appear basically impulsive. Despite that, in just looking at the very short-term charts of Dow and SPX, I'm inclined to continue to give the edge to the bulls. One of the reasons is mentioned on the chart.

There are some bigger picture factors which we'll discuss in more detail further along.

Next, the SPX preferred count.

The hypothetical ending diagonal is next. We'll continue to watch this as a potential.

Based on the big picture discussed further along in the article, I continue to believe this is an excellent and viable option.

I also wanted to provide an update on Chevron (CVX). It is unclear whether Chevron has completed 5 waves down in a fifth wave failure, or whether this bounce is still part of a flat 4th wave correction. I'm leaning toward the 4th wave correction interpretation.

Next, an update on silver, now that I'm able to project some more exact potential short-term targets.

A quick big picture glance at silver below. Silver bulls will note the potential of a much larger inverted head and shoulders pattern, going back to October.

Next the RUT, which is in a similar position to everything else. This still appears to be the wind-up for a move higher. If this is a nest of 1's and 2's, then the next wave higher should show some solid momentum. If the move doesn't show this, then we'll give more consideration to the alternates.

Short term NYA chart below -- pretty much the same deal there. This chart isn't labeled with the ending diagonal count, but that count is currently my first alternate. I consider the more bearish alternate count show below (in black) as less likely.

When to Get Bearish

Most of the above charts are labeled with invalidation levels, but below are a few more things to watch. If the bears did break these key levels, then things could get ugly fast.

Below is a short-term SPX chart which shows the more immediately bearish potentials. I'm not favoring the ultra-bearish view, due to the "extra" leg up shown early last week -- which in my mind, continues to ultimately point the way higher one way or another. As mentioned, though, if bears can take out some of those key lows, then that would open the way to this type of resolution.

This chart also shows an interesting potential for the ending diagonal count -- in green. I do tend to believe that if the diagonal is playing out, it will probably follow a path closer to that discussed on the diagonal chart shown earlier, but the option below is still viable.

If the diagonal's playing out, then they are super-difficult to predict early in the pattern.

The big picture overview continues to show that the bulls are maintaining the recent key breakout levels. Right click and "open in new window" for the full-size chart. Until those breakouts are negated, it seems unwise to get overly bearish.

It generally pays for bears to remember the three-t's: Tops Take Time (TTT). Not always, of course -- but usually. Take a look at 2000, 2007, and 2011 on the chart below for examples.

The Very Big Picture

Short term, I remain moderately bullish, for reasons discussed above. The big picture, however, suggests that equities bulls have their work cut out for them.

(The possible exception to this thought is the dollar, discussed further below.)

Several markets are approaching, or have reached, very long-term resistance levels. We'll start with SPX.

Nasdaq also faces resistance, in the form of the 50% retrace off the all-time-high. Worth noting, the Nasdaq 100 (NDX -- not shown) has now had 13 straight higher closes at the weekly level. The record is 14.

RUT has also reached long-term resistance, and a potential triple-top zone.

NYA also faces what should be a solid long-term resistance level.

The next NYA and INDU charts (below) don't really fit into the "very big picture" section, but I'm not sure where else to put 'em, so they go here.

Below is an interesting INDU pattern comparison. If history repeats, it suggests higher prices over the short-term. Some key levels are marked.

The US Dollar is currently in a position that's actually somewhat encouraging to equities bulls. It remains beneath long-term support/resistance.

Based on my wave analysis, I continue to believe the dollar put in a long-term bottom with the 2008 print low -- but this chart bears watching.

Unless equities bulls can take out these levels, which seems unlikely this late in the rally, then it seems that upside is probably limited here.

Okay, deep breath... do I still have more charts? Lemme check...

Ah yes, saving the best for last.

Speculative

The first chart is interesting, because it shows that Apple has potentially completed a five-wave rally. It's a bit tricky, due to the lack of clarity regarding the correct labeling for the last correction (wave 4).

But the potential definitely exists for Apple's top to be in, or very close. This would, of course, mean the rest of the market would struggle, as also suggested by the big picture charts above.

I've recently started referring to Apple as The Economy, since it single-handedly accounted for more than half of the 4th quarter profit growth of the entire S&P 500 (as outlined in this article by Matt Nesto).

Conclusion

Over the short-term, I still believe there are likely some marginal new highs to be made, but the pattern leaves a bit to interpretation, and the market does feel like it's topping at some degree. The next few sessions should help illuminate the short-term path with more clarity.

The bevy of long-term resistance levels suggest upside is probably limited at best, and I think the longer-term outlook for this market is ultimately bearish. If bulls can somehow break out convincingly here, then that would certainly call that view into question.

Something that fits into both outlooks is a trip into the 1430's-1440's -- so as of yet, this is still what I'm currently favoring. Obviously, the flip side of things is that if the bears can stage a convincing breakdown of some key levels, then all bullish bets would be off. One thing that can be stated with certainty is that the rally is well above the relevant MA's and very long in the tooth; and sentiment has been extreme for a long time now.

For these reasons, I remain somewhat partial to the ending diagonal, which was proposed last week as a hypothetical. This would allow a choppy upwards grind to slowly frustrate and wipe out everyone -- and would be quite fitting as a larger topping pattern. Trade safe.

Normally, one can determine the next higher degree of trend by determining which structures are impulsive, and which structures are corrective. The challenge right now is that the last 3 waves, both up and down, all appear reasonably impulsive. This could be indicitive of an undecided market.

I can't tell you how many hours I've spent charting during this weekend, but it seems like four or five hundred. Even though the market yutzed around a bit on Friday, it still seems to me that unless the bears can push through and take out the prior swing lows, the bulls have an excellent shot at sling-shotting the market to new highs. Let's examine the evidence together.

Short-term Outlook

The conventional impulse count would view this as a nest of 1's and 2's, which means that it's just about time for the bulls to run with the ball here, early this week. If they don't, then it will be prudent to give more serious consideration to other potentials.

I want to start off with the short term Dow chart, because it shows the relevent conundrum of how the last three waves all appear basically impulsive. Despite that, in just looking at the very short-term charts of Dow and SPX, I'm inclined to continue to give the edge to the bulls. One of the reasons is mentioned on the chart.

There are some bigger picture factors which we'll discuss in more detail further along.

Next, the SPX preferred count.

The hypothetical ending diagonal is next. We'll continue to watch this as a potential.

Based on the big picture discussed further along in the article, I continue to believe this is an excellent and viable option.

I also wanted to provide an update on Chevron (CVX). It is unclear whether Chevron has completed 5 waves down in a fifth wave failure, or whether this bounce is still part of a flat 4th wave correction. I'm leaning toward the 4th wave correction interpretation.

Next, an update on silver, now that I'm able to project some more exact potential short-term targets.

A quick big picture glance at silver below. Silver bulls will note the potential of a much larger inverted head and shoulders pattern, going back to October.

Next the RUT, which is in a similar position to everything else. This still appears to be the wind-up for a move higher. If this is a nest of 1's and 2's, then the next wave higher should show some solid momentum. If the move doesn't show this, then we'll give more consideration to the alternates.

Short term NYA chart below -- pretty much the same deal there. This chart isn't labeled with the ending diagonal count, but that count is currently my first alternate. I consider the more bearish alternate count show below (in black) as less likely.

When to Get Bearish

Most of the above charts are labeled with invalidation levels, but below are a few more things to watch. If the bears did break these key levels, then things could get ugly fast.

Below is a short-term SPX chart which shows the more immediately bearish potentials. I'm not favoring the ultra-bearish view, due to the "extra" leg up shown early last week -- which in my mind, continues to ultimately point the way higher one way or another. As mentioned, though, if bears can take out some of those key lows, then that would open the way to this type of resolution.

This chart also shows an interesting potential for the ending diagonal count -- in green. I do tend to believe that if the diagonal is playing out, it will probably follow a path closer to that discussed on the diagonal chart shown earlier, but the option below is still viable.

If the diagonal's playing out, then they are super-difficult to predict early in the pattern.

The big picture overview continues to show that the bulls are maintaining the recent key breakout levels. Right click and "open in new window" for the full-size chart. Until those breakouts are negated, it seems unwise to get overly bearish.

It generally pays for bears to remember the three-t's: Tops Take Time (TTT). Not always, of course -- but usually. Take a look at 2000, 2007, and 2011 on the chart below for examples.

The Very Big Picture

Short term, I remain moderately bullish, for reasons discussed above. The big picture, however, suggests that equities bulls have their work cut out for them.

(The possible exception to this thought is the dollar, discussed further below.)

Several markets are approaching, or have reached, very long-term resistance levels. We'll start with SPX.

Nasdaq also faces resistance, in the form of the 50% retrace off the all-time-high. Worth noting, the Nasdaq 100 (NDX -- not shown) has now had 13 straight higher closes at the weekly level. The record is 14.

RUT has also reached long-term resistance, and a potential triple-top zone.

NYA also faces what should be a solid long-term resistance level.

The next NYA and INDU charts (below) don't really fit into the "very big picture" section, but I'm not sure where else to put 'em, so they go here.

Below is an interesting INDU pattern comparison. If history repeats, it suggests higher prices over the short-term. Some key levels are marked.

The US Dollar is currently in a position that's actually somewhat encouraging to equities bulls. It remains beneath long-term support/resistance.

Based on my wave analysis, I continue to believe the dollar put in a long-term bottom with the 2008 print low -- but this chart bears watching.

Unless equities bulls can take out these levels, which seems unlikely this late in the rally, then it seems that upside is probably limited here.

Okay, deep breath... do I still have more charts? Lemme check...

Ah yes, saving the best for last.

Speculative

The first chart is interesting, because it shows that Apple has potentially completed a five-wave rally. It's a bit tricky, due to the lack of clarity regarding the correct labeling for the last correction (wave 4).

But the potential definitely exists for Apple's top to be in, or very close. This would, of course, mean the rest of the market would struggle, as also suggested by the big picture charts above.

I've recently started referring to Apple as The Economy, since it single-handedly accounted for more than half of the 4th quarter profit growth of the entire S&P 500 (as outlined in this article by Matt Nesto).

And finally, my piece de resistance (French -- literally: "really cool chart") for this article.

As I was studying the Nasdaq and the US Dollar this weekend, I couldn't help but notice some striking similarities present within the two monthly charts. Below is an overlay of the current Nasdaq (going back to the crash) with the dollar after its (government-orchestrated) crash in the 80's.

After its crash, the dollar spent some time basing, and then retraced right to the 50% level in a convincing rally. From there, it spent some time topping and then resumed its march to new lows. The Nasdaq has behaved similarly regarding the basing action, and has also now reached its 50% retrace (as shown earlier).

I haven't seen this analog discussed anywhere else yet, probably because the two markets just recently "lined up" historically and nobody else has noticed -- but I think it's pretty uncanny. Of course, the $64,000 question is: going forward, will the Nasdaq follow the same path the dollar did after it hit its 50% retrace?

Conclusion

Over the short-term, I still believe there are likely some marginal new highs to be made, but the pattern leaves a bit to interpretation, and the market does feel like it's topping at some degree. The next few sessions should help illuminate the short-term path with more clarity.

The bevy of long-term resistance levels suggest upside is probably limited at best, and I think the longer-term outlook for this market is ultimately bearish. If bulls can somehow break out convincingly here, then that would certainly call that view into question.

Something that fits into both outlooks is a trip into the 1430's-1440's -- so as of yet, this is still what I'm currently favoring. Obviously, the flip side of things is that if the bears can stage a convincing breakdown of some key levels, then all bullish bets would be off. One thing that can be stated with certainty is that the rally is well above the relevant MA's and very long in the tooth; and sentiment has been extreme for a long time now.

For these reasons, I remain somewhat partial to the ending diagonal, which was proposed last week as a hypothetical. This would allow a choppy upwards grind to slowly frustrate and wipe out everyone -- and would be quite fitting as a larger topping pattern. Trade safe.

Subscribe to:

Comments (Atom)