Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, January 27, 2017

SPX, RUT, BKX: Back to Back Rare Patterns

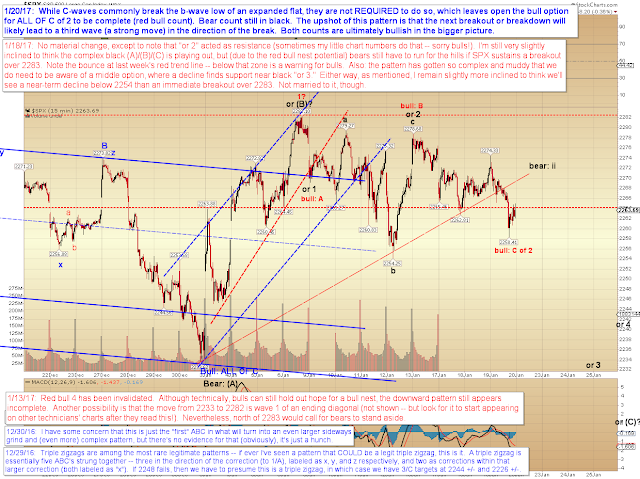

Every now and then the market throws in a pattern that is just so rare and unpredictable that all you can do is shake your head. The recent chop zone featured not one, but two such patterns. We discussed the first one (an ultra-rare triple zigzag) back in December. The more recent rare pattern is charted below. These are the types of patterns that are so unusual that many novice Elliotticians can't figure them out even AFTER they've played out. And virtually none of us can anticipate them in real time, because nobody in their right mind anticipates the "1 in a 10,000 odds" pattern.

Bigger picture, there's no change:

Last update's triangle fake-out warning was timely, and the upside breakout target was captured:

(continued, next page)

Monday, January 23, 2017

SPX Update: Day 217... Deep within the Chop Zone

We're now three weeks into a chop zone within a still-larger chop zone... and I haven't had this much fun in a market since that time way back in high school when my then-buddy Dan got chased through the Quakertown Farmer's Market by an angry vendor. (Dan, if you're out there: You deserved it!)

Seriously, this chop zone is more fun than a barrel of rabid fire monkeys with functional chainsaws. (Are "fire monkeys" even a real thing? Well, they should be! Err... maybe not. The world has enough problems.)

Anyway, there's been no real change since December, which is when I first came up with the black (C)-wave count, primarily based on instinct, which has made it hard to have too much conviction about it, especially since I do ultimately expect we're still in a bull market, and the aforementioned C-wave would simply be a bull market correction (if it materializes, of course). Yes, that was one single run-on sentence. At least now it doesn't constitute the entire paragraph.

On the plus side, we may finally be getting close to an actual move.

Below is a more simplistic chart, along with a couple targets:

In conclusion, at this point deep within a chop zone, it just gets tough to keep these updates interesting, and to come up with anything that I haven't already said five times before. The bottom line is that I'm still ever-so-slightly favoring the black C-wave count, but since that's always been just a gut-instinct, I'm not married to it. I do ultimately expect we're still in a bull market, so with or without that black C-wave, higher prices are still expected in the bigger picture. Trade safe.

Friday, January 20, 2017

SPX Update: Next Break Could Finally Be Significant

Ran a bit short on time tonight, but the charts have all the info, so I'll let them do all the talking.

In conclusion, nothing to add beyond the annotations on the charts -- except a quick reminder that everything moves in cycles, including personal wealth advancement. Allow yourself room to breathe within those cycles -- try to slow down when your personal cycle is on a downswing, and run with it when it's on an upswing. And trade safe.

Wednesday, January 18, 2017

SPX and BKX Updates: Obama Signs Last-Minute Pardon for the Algos

My title has nothing to do with anything, I'm just tired of writing titles that basically say: "Still a Chop Zone, Huzzah!" Which is what has led to titles such as last week's: "How Much Wood Could a Woodchuck Chuck if a Woodchuck Could Chuck Norris?" And so on.

Last update expected the market would open higher and then reverse, and that's what happened. BKX in particular did so in a rather dramatic fashion, likely trapping many unsuspecting bulls into a loss:

SPX didn't reverse quite as suddenly and dramatically, but reverse it did:

Bigger picture, we're still stuck in the same spot we've been in since last year:

In conclusion, the market is keeping its near-term options open, but I'm still slightly leaning toward a continuation of the complex correction. Bigger picture, the trend remains up, and even if we get the more bearish (C) wave, I expect that will then be bought up to new highs. So, bottom line, no matter what happens from here, I am anticipating a continued rally, the only question is how we get there. Trade safe.

Friday, January 13, 2017

SPX and BKX Update: What Will Friday the 13th Bring for the Market?

Today is Friday the 13th, so you're probably expecting I'll make bad jokes about good luck, or good jokes about bad luck, or something. But you'll be sorely disappointed. My only Friday the 13th joke goes like this:

- Knock, knock.

Who's there?

- Friday the 13th.

Friday the 13th who?

And that's it, there's no punchline. That's the whole joke, and it makes no sense whatsoever. I think I first read it on the back of a cereal box, during an unusually vivid dream I had -- so you can rest assured I won't be telling that joke today!

Anyway, the market has continued to chop everyone up and spit them out while laughing hysterically. The last breakout whipsawed, and the recent breakdowns have done the same. For what it's worth, the pattern doesn't appear complete to the downside, so most of the time we'd expect another low here -- which hints that the black (C) wave might be playing out. Here's a near-term chart in detail:

The slightly bigger picture chart below shows that red 4 has been invalidated:

BKX seems to confirm the idea that the decline is difficult to count as complete:

In conclusion, in most markets I'd be fairly confident of another new low -- in this market of the past couple months, it's hard to be fairly confident of much of anything. At this point, I'd say the near-term onus is on bulls to prove this is something other than a near-term bearish pattern. Again, from a bigger picture standpoint, I do expect the black wave (C) bottom (presuming that pattern is actually underway) to be a buy op. Trade safe.

Wednesday, January 11, 2017

SPX Update: If a Woodchuck Could Chuck Norris

*Preventative Note in Case Chuck Norris is Reading: The title is not meant to imply that a woodchuck COULD Chuck Norris. Only Chuck Norris can Chuck Norris. Nor is the title asking: "How much wood could Chuck Norris chuck if Chuck Norris could chuck wood?" Everyone knows Chuck Norris can chuck ALL the wood, if he wants. Along with all the woodchucks, for that matter. Please don't hurt me.

I can't recall the last time I've written "No material change," "nothing to add," "no real change," and "please don't hurt me, Chuck Norris" as often as I have over the past month or so. That's largely because this market has remained slightly less exciting than flossing your cat's teeth would be, presuming you have a cat, and presuming that cat does not wear feline dentures. This has gone on for what seems like an eternity (the trading range, not your cat's much-needed teeth flossing), especially after the rocket-launch rally that came before this extended chop zone.

So, with that said, there's only a little tiny bit to add since last update. Basically, the complex (B) and (C) waves still look pretty viable. If 2263 fails, then traders should be on high alert for a decline back below 2233 -- and if 2233 goes, then even the 2200ish zone isn't out of the question.

Note that SPX dipped below the blue trend channel as of yesterday's close. Bulls want to see that channel reclaimed. Bigger picture, there's also no change, and it is still presently assumed that the black (C) bottom would be a buy op for an eventual trip toward 2400 SPX.

In conclusion, the complex black ABC that I first warned about on December 30 continues to look like a viable possibility. To negate that option, bulls need to clear this chop zone with a little more energy than they mustered (mustard?) on January 6. Trade safe.

Monday, January 9, 2017

SPX Update: The Cheese Stands Alone

On Friday, SPX finally broke back above 2277, thereby validating 2233 as the bottom of ALL OF C (and validating my belief that this was all just a correction and not the start of anything bearish) -- but not yet eliminating the possibility that that first ABC merely marked a larger (A) wave.

One of the blessings and curses of B-waves is that they can exceed the prior relevant high or low, which makes them the wave that bulls hate to see on a breakout, and the wave that bears hate to see on a breakdown. The "blessing" part of B-waves is that they offer high odds that the market will ultimately turn back around and reclaim their peaks/troughs. But they do require patience, because the nasty C-wave that follows a B-wave can and will shake most people who attempt an early knife catch.

(Note that I'm not saying the (B)-wave is what's going on here, I'm simply expanding on the commentary about B-waves in general.)

In any case, the next couple sessions should give us clues as to whether we're dealing with a simple fourth wave (red 4), or the more complex nastiness of the larger black (A)/(B)/(C). If we see a larger impulsive down move develop, or if SPX sustains a breakdown at 2263, then the complex (A)/(B)/(C) gains some favor.

Bigger picture, there's still no change unless and until the market says there is:

In conclusion, as Market Watch would say: "The Dow Jones Industrial Average Ordinary Mediocre Almost Barely Nearly Possibly Sort of Reached Really Super-Duper WOW OMG OMG Close to 20,000 on Friday and... Like, What Were We Talking About Again?"

Trade safe.

Subscribe to:

Comments (Atom)