Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, December 16, 2022

SPX, INDU, BKX: To B or Not to B

Wednesday, December 14, 2022

SPX, INDU, and TLT Updates

Monday, December 12, 2022

INDU and SPX: A Little More Detail

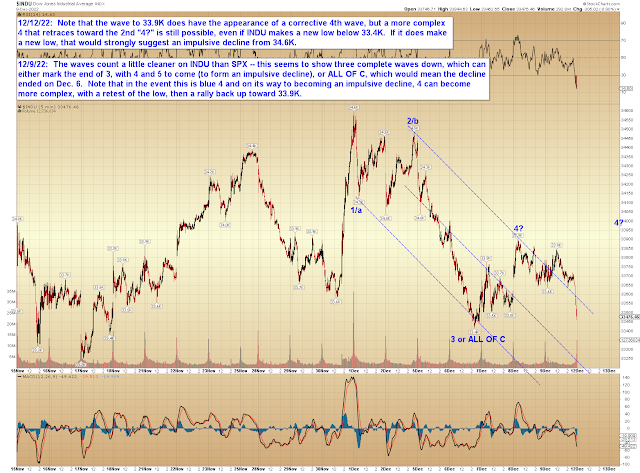

Since last update, while the market has technically done nothing, INDU has continued its rejection from the first blue 4 inflection:

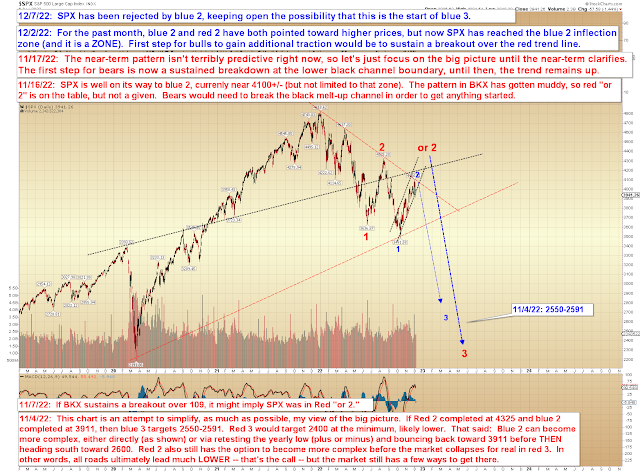

I added some detail to the SPX chart, since I don't want the straight line pointing downward to be taken as an actual nuanced projected path. SPX does not need to follow the exact path shown below and probably won't, but this is more reasonably representative of the type of path SPX could take if we have already seen the start of blue 3:

In conclusion, no change from last update, and we remain on the cusp of an impulse. Trade safe.

Friday, December 9, 2022

SPX, INDU, COMPQ: On the Cusp of an Impulse

Wednesday, December 7, 2022

SPX Update: Rejected at Blue 2 Inflection

For the past few updates, I shifted from my previous near-term bullish stance to a more cautious stance, and on December 5, I wrote:

What we do have now, though, is a case where the "more upside" of the past couple updates has been achieved, the 4100 target from October has been captured, and the month-long standing blue 2 on the chart above has been reached. Thus, this is a neutral zone; people tend to finally "get it" and become bullish or bearish once targets are captured, but that's the wrong time. Once targets are captured, the market is at last truly free to go either way again.

Monday, December 5, 2022

SPX, BKX, NYA Updates

Friday, December 2, 2022

SPX Update: Call My Attorneys -- 4100 Target Captured

The last two updates said the exact same thing:

[I]f SPX rolls over here, the first zone to watch is 3865-98 (which would be one area a complex fourth wave could bottom), but it is into a zone where I can no longer promise continued upside. I think it would probably look a bit better with more upside, but it doesn't appear to be "guaranteed" the way it did over the recent past -- thus we'll be watching closely in the event it forms an impulsive decline.

Since those updates, SPX has indeed found more upside, so score one for wave aesthetics and "looking a bit better."

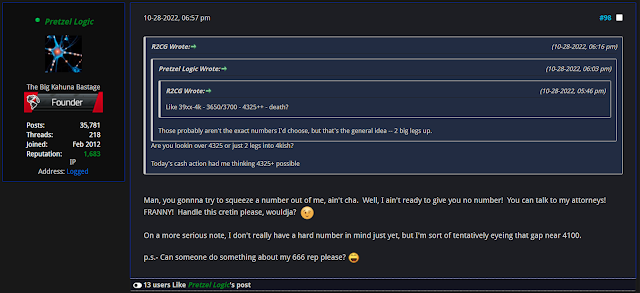

It's also worth noting that way back on October 28, on our forums, one of our regular active members (R2CG) pressed me for a number as to where I thought the rally was headed, and the number I gave was 4100 -- which is exactly the price SPX tagged yesterday:

4100 is also where I've had blue 2 sitting on the chart below for a month:

So here we are, finally. Does that mean the rally needs to end immediately? It could, but of course it doesn't "need" to, and it's entirely possible it continues on either a little (blue 2 is a zone, not a hard number) or a lot (in the event it decides to become red 2). Thus, as I've written in the past couple updates, I'm still awaiting an impulsive decline before getting too aggressive on the bearish side.

What we do have now, though, is a case where the "more upside" of the past couple updates has been achieved, the 4100 target from October has been captured, and the month-long standing blue 2 on the chart above has been reached. Thus, this is a neutral zone; people tend to finally "get it" and become bullish or bearish once targets are captured, but that's the wrong time. Once targets are captured, the market is at last truly free to go either way again. In the current case: It's not bearish until we see an impulsive decline, but neither is it a zone where one would want to initiate new long positions. Trade safe.