Way back in March of 2022, I wrote a bit more about the Supercycle collapse (which I believed/believe had/has already begun) in order to help get people thinking about the types of things that could happen, and to hopefully inspire them to prepare:

Bigger picture, the bear case hasn't changed, though I have included some ballpark numbers on the chart below. The question I always ask myself in parallel with such numbers is, "What would have to happen to take SPX to [for example] 2200? What is going on in the world as the market falls?" Because we have to remember, especially when dealing with Supercycles, that these things do not occur in a vacuum. If the market crashes, there are things going on outside the market that will be "causing" the crash.

And when it comes to Supercycles, those events can be truly dramatic, as I've often discussed in the forum. During a Supercycle crash, the door is open to events such as major natural disasters ("big one" earthquakes, Cascasdia Subduction Zone tsunamis, etc.), world wars (or even something at a smaller scale but still massively devastating, such as a "backpack nuke" brought up through our less-than-secure borders and detonated downtown in a major US city), comet impacts -- things of that nature. Things that we tend to blindly assume can't happen in modern times, but most assuredly still do.

Those types of events can, and usually do, run in close proximity to Supercycle crashes.

Anyway, I don't mean to sound melodramatic, but when we start asking ourselves the question ("What could be happening in the world to cause the market to react so negatively?"), we probably won't like the possible answers. As I've always said: Charts lead the news.

Outside of that brief mention of "world wars" above, I don't think I've written about war much on the blog, but on the forums, I've discussed many times that wars are to be expected during Supercycle collapses. Implicit in the idea of a Supercycle collapse is a shakeup of the world power dynamic -- especially when the collapse is occurring in the global superpower (the United States). As America continues to weaken financially, economically, militarily, and morally, the Pax Americana naturally comes under fire as other powers look to capitalize on our weakness.

I have repeatedly warned that Supercycles take years, sometimes even decades, to unfold completely and that this bear market would not be like the other bear markets of living memory. It's now been almost two years since the all-time high in SPX, and there's still a lot more to come, in my view.

During the first week of January (2023), I published the following thoughts:

I still remain of the opinion that this is the start of a Supercycle collapse, meaning that the worst is yet to come. Despite how some investors are undoubtedly feeling, in my view, things haven't even begun to get "bad" yet. We're still in the stage where bears are having fun (!). We'll know we're getting closer to the bottom when even bears are hoping and praying for good news and rallies, because everything will be teetering on the brink of complete destruction -- and not even bears want to see that.

I likewise remain of the opinion that the current collapse is not solely a financial event.

We are more able to see the seeds starting to sprout a bit now, but we are still nowhere near the point where "everything [is] teetering on the brink of destruction." We can speculate on what that might look like, but just remember that nothing is off the table for us during a Supercycle collapse. Things that would have seemed impossible a few short years ago, such as a nuclear conflict, are no longer impossible.

Supercycle declines are not just financial, they are cultural, and they are geopolitical.

To avoid negative consequences, we have to tread far more carefully than our leaders are currently doing -- but then, if they weren't arrogant and complacent, we might not have entered this Supercycle in the first place. So, Catch 22. Worth remembering that Rome grew so arrogant and complacent that its leaders refused to believe barbarians were capable of conquering them even after entire cities had fallen. If our leaders were in touch with the times, they'd have a far more protectionist attitude about our finances and resources, instead of borrowing as if interest rates were still zero and lunging about clumsily as if the world was still stable and as if we were still in a position to do anything about the growing instability.

Things have changed, but our leaders' attitudes have not.

Anyway, my point is not to be fatalistic, but simply to remind everyone that we're still in the early stages and things can get a lot worse than they currently are, so it's not a bad idea to prepare. Don't be among the complacent. Because we're nowhere near the bottom yet, in my opinion. Whatever it is that you think can't happen, won't happen, would never happen here -- it absolutely can. Plan as if it might. Worst case (or best case?), you're overprepared and everything ends up fine. No real harm done.

Let's move on to the charts.

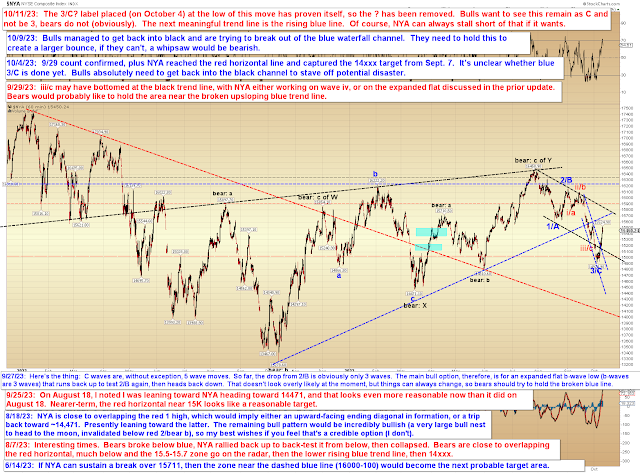

NYA:

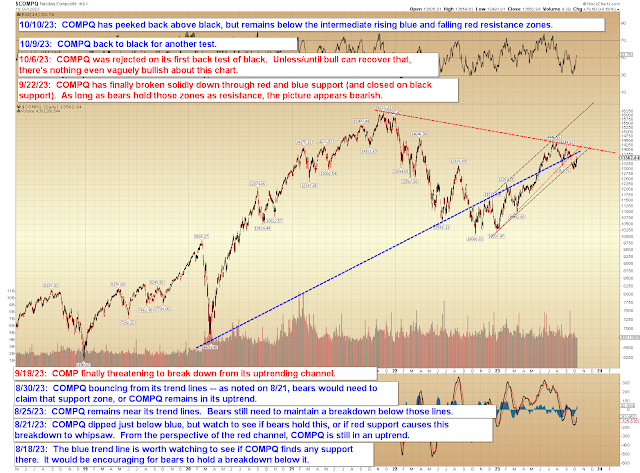

COMPQ:

And what currently appears to be the "most bullish" option for SPX (4 can run even higher than shown):

Of course, there are other options for the shape of blue 4 above, including the option to end immediately. There are, of course, larger, intermediate bull options, but as promised, I'm not giving much airtime to them until the market gives better reason to. Trade safe.